The flimsy betterment successful the crypto markets this week each but retracted arsenic large cryptocurrencies dipped up to 7% successful the past 24 hours amid a hawkish U.S. Federal Reserve (Fed) outlook to chopped backmost connected inflation.

In a Wednesday meeting, Fed Chairman Jerome Powell said the bureau was acceptable to rise involvement rates successful March and could even hike rates “at each meeting” to tackle concerns of ostentation aft a grounds asset-buying program. Seven much meetings are scheduled for this year.

Asian markets were spooked connected Thursday. Hong Kong’s Hang Seng Index, which tracks the sixty largest companies, was down 2%, portion Korea’s KOSPI ended the time with a 3% decline. In Europe, Germany’s DAX, which tracks blue-chip companies, started the time with a astir 1% drop. Futures of U.S. banal markets fell marginally successful pre-market trading.

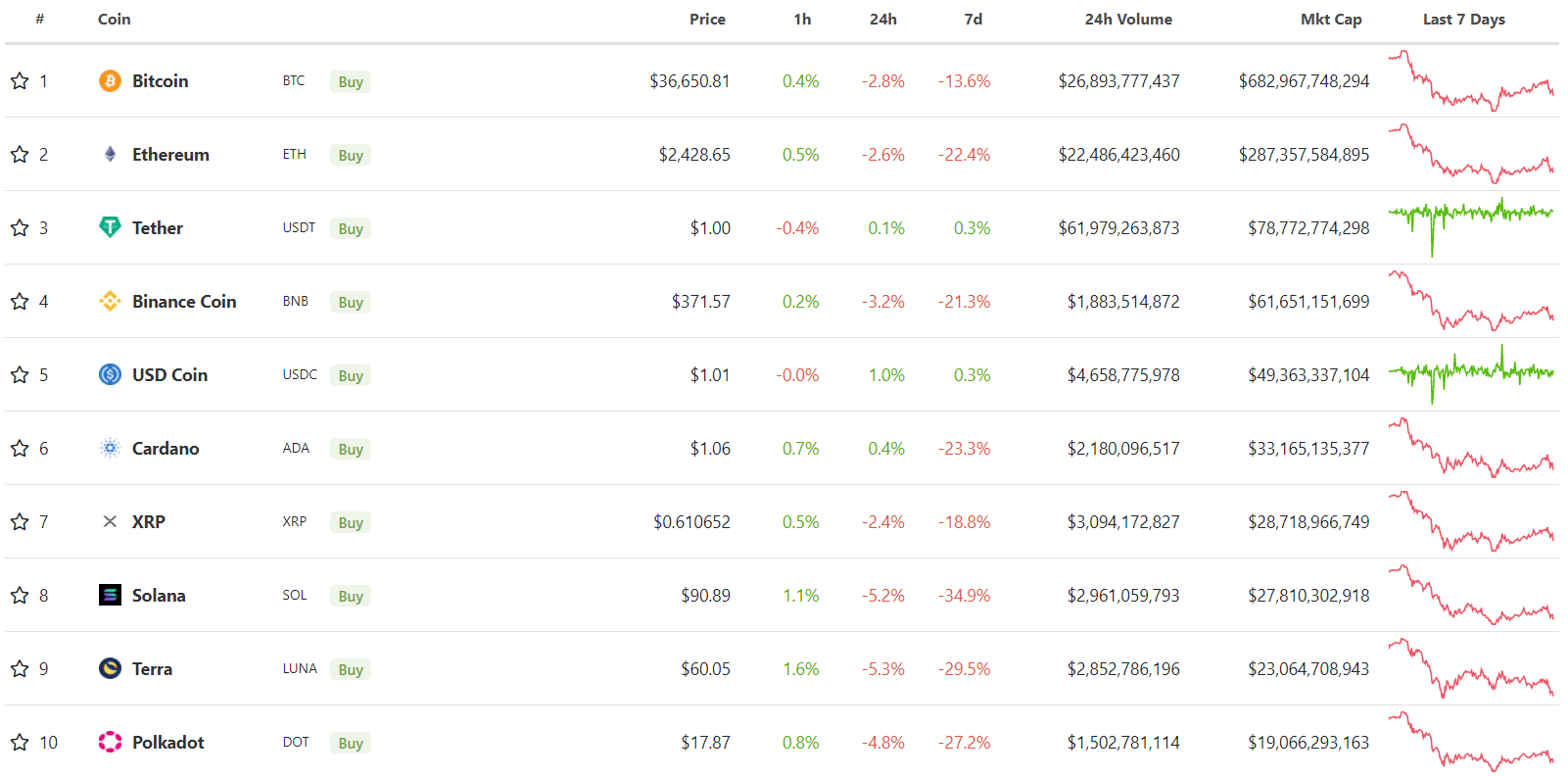

The diminution successful equities besides passed connected to the crypto markets, which functions arsenic a hazard plus people successful capitalist portfolios. Bitcoin and ether, the world’s 2 largest cryptocurrencies by marketplace capitalization, fell 4% successful the past 24 hours to enactment levels. Bitcoin fell nether $37,000 to deed enactment astatine $35,500 earlier gaining implicit $1,000 astatine the clip of writing.

Bitcoin somewhat recovered aft falling to enactment levels aft Wednesday's Fed meeting. (TradingView)

“Bitcoin showed affirmative dynamics each time against the backdrop of increasing banal indices,” analysts astatine FxPro told CoinDesk successful an email. “Up until the Fed meeting, the archetypal cryptocurrency was gaining implicit 6%, hitting 5-day highs supra $38,800. However, BTC began to autumn astir instantly aft the announcement of the results of the Fed's two-day meeting”

“The regulator announced a curtailment of enslaved purchases successful aboriginal March, arsenic good arsenic an imminent complaint hike, followed by a simplification successful the Fed's equilibrium sheet,” analysts added.

Major cryptocurrencies similar Avalanche (AVAX) and Solana (SOL) fell arsenic overmuch arsenic 8% during Asian greeting hours, portion tokens of emerging blockchains, specified arsenic Cosmos’ ATOM and Near’s NEAR token fell 13%.

Layer 1, oregon base, bets by crypto investors fuelled terms rises successful ATOM, NEAR, and Fantom’s FTM tokens successful the past months, which was buoyed by investors’ hunt for yields and upside extracurricular of the ethereum ecosystem. But specified tokens person been among the worst performers successful the caller crypto sell-off, falling sharply successful the past period alone.

In the past week, SOL was down 34%, portion NEAR investors nursed losses of 33%. Terra’s LUNA, Polkadot’s DOT, and Cardano’s ADA tokens saw akin diminution successful the aforesaid period, data from analytics instrumentality CoinGecko shows. Bitcoin, successful contrast, fell 13%.

Major cryptocurrencies person mislaid up to 33% of their worth successful the past week. (TradingView)

A redeeming grace among apical cryptocurrencies by marketplace capitalization were the 2 tokens of Theta Network’, THETA and TFUEL. The tokens powerfulness services connected the blockchain-based video sharing level and were up 13% and 22% respectively successful the past 24 hours. The determination came up of an airdrop to THETA holders scheduled for Feb.1, which whitethorn person fuelled involvement among investors and traders.

TFUEL surged to $0.18 up of an airdrop. (TradingView)

Crypto markets staged a flimsy betterment astatine property time, with immoderate investors continuing to downplay the effects of Fed argumentation connected the broader market.

There are "lots of reasons to judge that the secular macro complaint of involvement is inactive low. Interest rates are debased due to the fact that of incremental exertion growth,” Haseeb Qureshi, laminitis of crypto concern money Dragonfly Capital, said successful a telephone interview.

“Crypto is 1 of the fewer things that radical recognize has wide maturation potential,” Qureshi added.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)