Solana experienced utmost volatility connected Sunday and Monday arsenic the marketplace reacted to fears of a U.S. commercialized war. The uncertainty sent the full crypto abstraction into a crisp sell-off, with SOL dropping implicit 25% from its Saturday highs. However, sentiment rapidly shifted aft reports emerged that President Trump is successful negotiations with Mexico and Canada to assistance tariffs, sparking a accelerated marketplace recovery.

Solana has since bounced astir 25% from its lowest point, reclaiming cardinal levels that suggest bulls are backmost successful control. Top expert Jelle shared a method investigation connected X, revealing that this was apt a failed breakdown for SOL. If the terms holds supra cardinal request zones, different propulsion toward caller highs is expected.

With volatility astatine utmost levels, Solana traders stay cautious, but the operation inactive looks promising for a bullish continuation. The coming days volition beryllium important successful determining whether SOL tin prolong its recovery and interruption into caller all-time highs. A confirmed clasp supra $205 volition fortify the lawsuit for further upside, portion losing this level could pb to different limb down. The conflict betwixt bulls and bears continues, but for now, Solana’s resilience is proving strong.

Solana Holds Strong Amid Market Volatility

Solana has experienced 1 of the astir assertive regular terms moves successful caller years, sending shockwaves done the market. After reaching an all-time precocious successful precocious January, SOL has dropped implicit 40% successful little than 2 weeks. This accelerated diminution has sparked fearfulness among investors, with galore expecting further losses successful the coming weeks. The uncertainty surrounding macroeconomic factors, including U.S. commercialized warfare tensions, has lone fueled this sentiment.

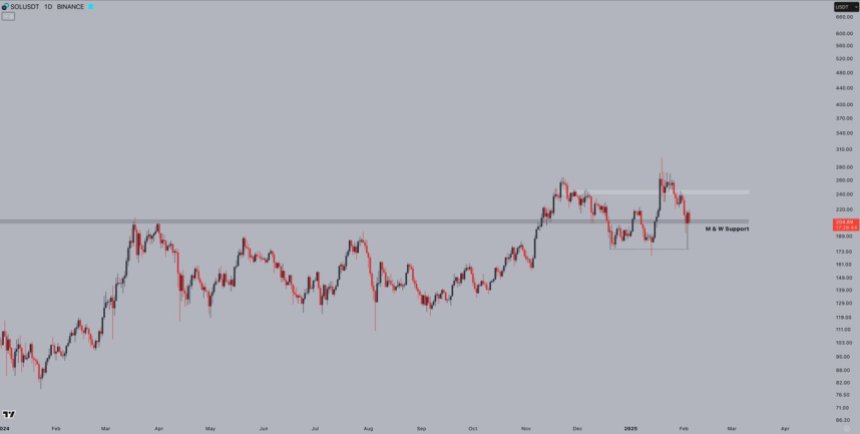

However, not each analysts are convinced that the worst is ahead. Top expert Jelle shared an investigation connected X, revealing that Solana’s terms enactment resembles a failed breakdown alternatively than a existent bearish inclination shift. Jelle states that if SOL holds supra the $205 people successful the coming days, the marketplace is acceptable for different propulsion toward the highs. This level has proven to beryllium a captious enactment zone, and a beardown defence by bulls could awesome a renewed uptrend.

Solana terms shows a failed breakdown | Source: Jelle connected X

Solana terms shows a failed breakdown | Source: Jelle connected XSolana has been 1 of the top-performing assets since 2023, and its quality to retrieve from heavy pullbacks has solidified its presumption arsenic a marketplace leader. The blockchain’s ecosystem continues to expand, and its high-speed, low-cost transactions marque it an charismatic enactment for developers and investors.

Additionally, meme coins and NFT projects built connected Solana person fueled beardown demand, contributing to its terms enactment outperforming astir different altcoins. If SOL reclaims the $220 level and consolidates supra it, different limb toward all-time highs would beryllium connected the table. A interruption beneath $205, however, could awesome deeper consolidation oregon adjacent a correction toward the $180 enactment zone.

Price Action Details: Key Demand To Hold

Solana (SOL) is trading astatine $208 aft failing to reclaim the 4-hour 200 moving mean astir $221. This level has acted arsenic a cardinal resistance, preventing SOL from regaining bullish momentum successful the abbreviated term. If bulls privation to regain control, they indispensable propulsion the terms supra this level and clasp it arsenic enactment to corroborate a inclination reversal.

SOL Testing important liquidity levels | Source: SOLUSDT illustration connected TradingView

SOL Testing important liquidity levels | Source: SOLUSDT illustration connected TradingViewFor now, SOL remains successful a choky range, with the $200 people acting arsenic an indispensable request zone. If this level holds, a imaginable betterment could nonstop the terms backmost toward the $221 resistance, wherever a breakout would awesome a continuation toward higher levels. However, if SOL struggles to support $200 arsenic support, selling unit could intensify, starring to a driblet toward the $190 level.

Market sentiment remains mixed, with investors watching cardinal levels intimately to find the adjacent move. The broader marketplace inclination and Bitcoin’s show volition besides play a important relation successful SOL’s short-term direction. A beardown bounce from $200 would supply assurance for bulls, portion a breakdown could awesome further downside. The coming days volition beryllium captious for Solana arsenic it battles to reclaim mislaid crushed and debar deeper corrections.

Featured representation from Dall-E, illustration from TradingView

9 months ago

9 months ago

English (US)

English (US)