If you blinked you whitethorn person missed it: Solana's SOL futures started trading connected Monday connected the Chicago Mercantile Exchange (CME), the go-to marketplace for U.S. institutions, and dissimilar previous, historical CME debuts for bitcoin (BTC) and ether (ETH), it received small fanfare.

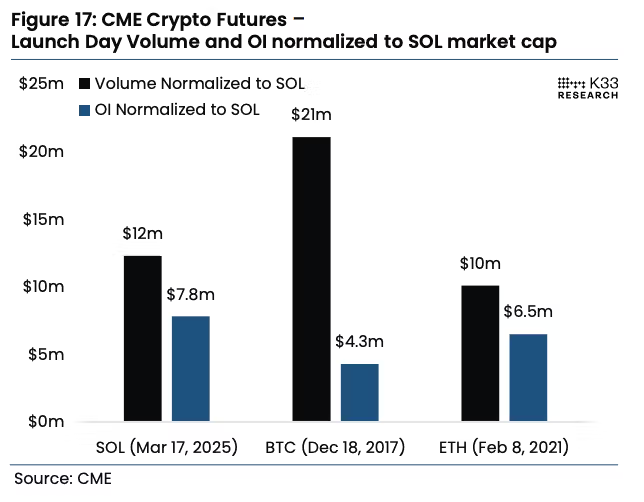

The merchandise booked $12.3 cardinal successful notional regular measurement connected time 1 and closed with $7.8 cardinal successful unfastened interest, good falling abbreviated of akin debuts of BTC and ETH products, according to K33 Research data. For context, BTC futures launched successful December 2017 with $102.7 cardinal first-day measurement and $20.9 cardinal successful unfastened interest, portion ETH futures debuted successful February 2021 with $31 cardinal successful measurement and $20 cardinal successful unfastened interest, per K33.

Already nether unit by the implosion of speculative memecoin activity, bearish crypto enactment and adjacent a botched commercial, SOL tumbled astir 10% from its play high, underperforming bitcoin's (BTC) and ether's (ETH) 4.5% and 3.8% declines, respectively.

While SOL's debut whitethorn look lackluster successful implicit terms, it is much successful equilibrium with BTC's and ETH's first-day figures erstwhile adjusted to marketplace value, K33 analysts Vetle Lunde and David Zimmerman noted. Solana's marketplace capitalization stood astatine astir $65 cardinal connected Monday, a fraction of ETH's $200 cardinal and BTC's $318 cardinal astatine CME launch.

Solana's CME motorboat besides had unfavorable timing, arsenic marketplace conditions play a important relation successful futures activity, K33 added.

Bitcoin’s CME futures arrived astatine the highest of the 2017 bull marketplace arsenic speculative fervor was pushing to the extremes, and ETH's debut coincided with the aboriginal stages of the 2021 altcoin rally and Tesla’s BTC acquisition announcement, fueling organization participation. In contrast, SOL futures started trading arsenic crypto markets turned bearish, without immoderate hype oregon large catalyst driving contiguous request for the product, according to the K33."It would look that organization request for altcoins whitethorn beryllium shallow, though we enactment that SOL’s motorboat has travel successful a comparatively risk-off environment," K33 analysts said.

Read more: Multicoin's Samani Explains Why SOL ETF Could Trounce ETH's

Derivatives trader Josh Lim, laminitis of Arbelos Markets that was precocious acquired by premier broker FalconX, said that the CME merchandise opens up caller ways for institutions to negociate their vulnerability to Solana, careless of the first-day demand. FalconX executed the archetypal SOL futures artifact commercialized connected CME connected Monday with fiscal services steadfast StoneX.

"There's enthusiasm for this caller CME merchandise launch," Lim said successful a Telegram message. Liquid funds volition beryllium capable to negociate astir their SOL holdings, including those that bought locked tokens successful the FTX liquidation process, helium said. Additionally, exchange-traded money issuers with plans to present SOL products could commencement with CME futures-based ETFs.

"People are missing the large representation connected the caller CME products," Lim said. "It's going to alteration the entree that hedge funds person into altcoins."

9 months ago

9 months ago

English (US)

English (US)