Solana Mobile, a subsidiary of Solana Labs, announced a important 40% terms simplification for its Saga smartphone, slashing the terms from its archetypal $1,000 to a much affordable $599. This determination comes conscionable 4 months aft the phone’s launch, sparking a flurry of reactions from the crypto community.

The authoritative statement from the institution suggests that the terms chopped is simply a strategical determination to foster wider adoption of mobile web3 and to heighten the idiosyncratic acquisition for the Solana mobile community. However, on-chain information paints a somewhat antithetic picture.

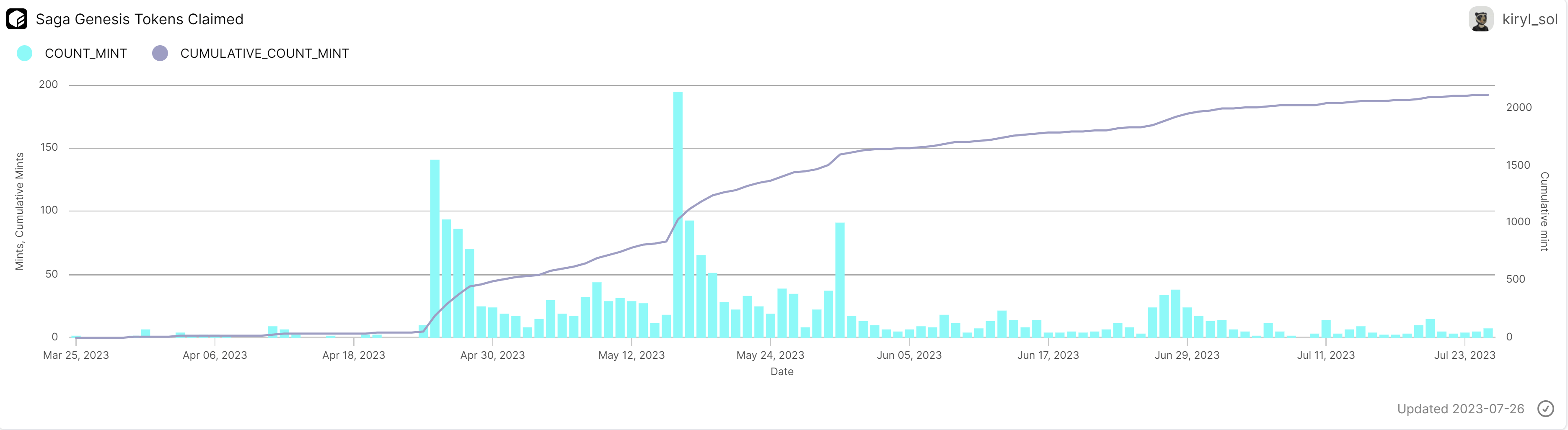

According to information compiled by Flipside Crypto, income of the Solana Saga person seen a crisp diminution since their highest successful April and May. This is evidenced by the fig of Saga Genesis NFT mints, which are generated erstwhile a idiosyncratic sets up their Solana Saga smartphone and accesses the Solana app store. The illustration beneath shows a wide downward inclination of sales. Since June income measurement has been highly level aft a palmy May 2023.

Solana Saga income / NFT mints | Source: Filpsidecrypto

Solana Saga income / NFT mints | Source: FilpsidecryptoThe terms simplification has elicited mixed reactions connected Twitter / X. While immoderate aboriginal adopters expressed their vexation astatine purchasing the instrumentality astatine its archetypal price, others defended the move, pointing retired the benefits of being an aboriginal bird. Notably, aboriginal owners had the exclusive accidental to mint Claynosaurz NFTs, which presently person a level terms of astir 33 SOL connected Magic Eden, translating to implicit $800.

Solana (SOL) Price Analysis

On the flip side, the Solana (SOL) token is successful bullish territory. At the clip of writing, SOL was trading astatine $24.38. A look astatine the regular illustration shows that SOL was capable to corroborate the breakout from its downtrend transmission connected Monday aft the terms recovered enactment astatine some the channel’s inclination enactment and the 200-day Exponential Moving Average (EMA).

As a effect of this bullish confirmation, SOL broke supra the 50% Fibonacci retracement level astatine $23.94. For now, it looks similar SOL tin support the level and marque a caller tally towards the 61.8% Fibonacci retracement level astatine $27.42.

Remarkably, connected July 14, SOL reached its year-to-date highest of $32.36 and recoiled from the 78.6% Fibonacci retracement level. Subsequently, SOL dipped beneath the 61.8% Fibonacci level and couldn’t prolong a regular adjacent supra it.

Given this context, the $27.42 terms constituent emerges arsenic the astir pivotal absorption currently. Should a breakout occur, a wide way to the year’s precocious would beryllium established. In this case, a bullish breakout seems imminent. However, beardown nett taking tin beryllium expected astir $32.36. If the yearly precocious falls, though, the bulls could people the 1.618 Fibonacci hold level astatine $56.86.

SOL terms readies for bullish move, 1-day illustration | Source SOLUSD connected TradingView.com

SOL terms readies for bullish move, 1-day illustration | Source SOLUSD connected TradingView.comFeatured representation from Disruption Banking, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)