Solana has had a solid year truthful far. The web has experienced a important surge successful trading measurement crossed its decentralized exchanges (DEXs). A rising DEX measurement usually indicates increasing integrated enactment and involvement successful a blockchain network. Analyzing the organisation of these volumes and liquidity crossed Solana’s protocols helps america recognize which parts of its ecosystems are thriving and wherever astir of the enactment occurs.

Solana’s DEX ecosystem is undeniably huge. Data from Dune puts the full fig of traders connected the web astatine conscionable supra 5.8 million. The liquidity, measured arsenic the full worth locked crossed decentralized exchanges, reached $1.2 cardinal connected Mar. 25.

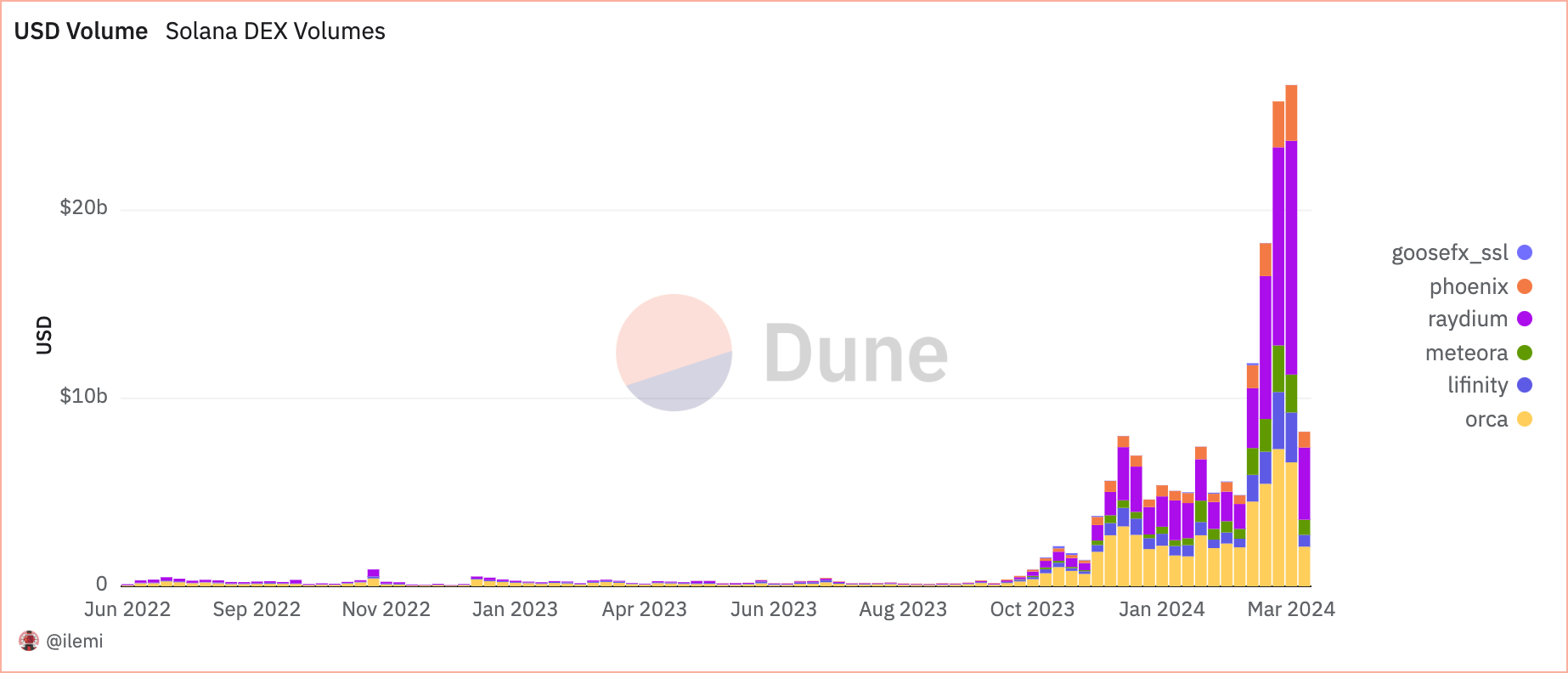

A person look astatine Solana’s DEX volumes denominated successful US dollars shows unthinkable maturation this year, with volumes rising from $4.6 cardinal astatine the opening of the twelvemonth to an all-time precocious of $26.7 cardinal connected Mar. 18. As of Mar. 25, DEX trading volumes settled astatine $8.2 cardinal — an expected consolidation aft specified a crisp spike successful a abbreviated period.

Graph showing the trading measurement connected Solana’s decentralized exchanges from Jun. 27, 2022, to Mar. 25, 2024 (Source: Dune Analytics)

Graph showing the trading measurement connected Solana’s decentralized exchanges from Jun. 27, 2022, to Mar. 25, 2024 (Source: Dune Analytics)Orca dominated DEX volumes for astir of 2024, signaling betwixt $2 cardinal and $4 cardinal regular trading volume. However, its dominance weathered astatine the extremity of February erstwhile Raydium ascended to go the go-to DEX for Solana traders, marking $12.4 cardinal successful measurement connected Mar. 18. Despite the important driblet successful measurement by Mar. 25, Raydium inactive accounted for astir of it, further cementing its presumption arsenic the DEX leader.

On Mar. 25, Raydium accounted for 46.7% of the full DEX volume, followed by Orca astatine 25.7%. Phoenix and Meteora trailed behind, accounting for 10.2% and 9.7%, respectively.

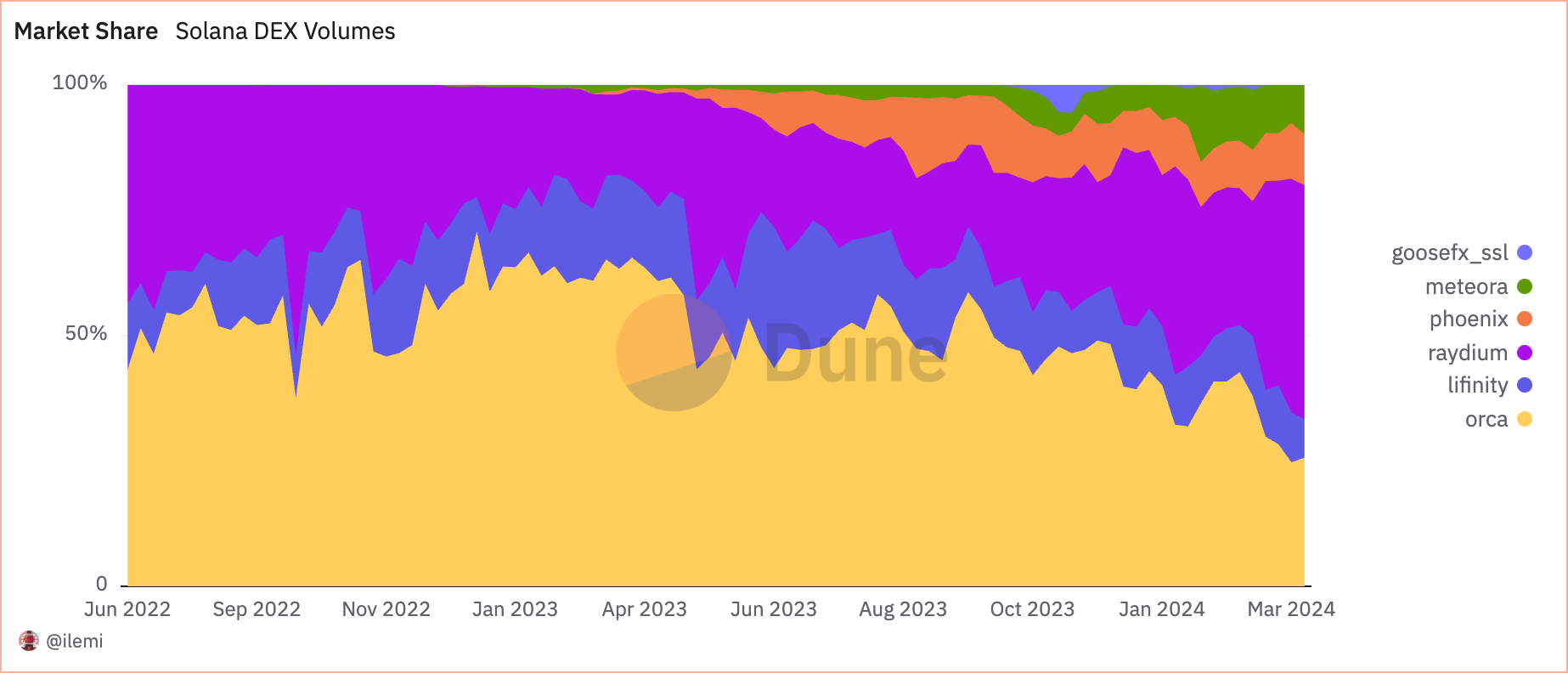

Graph showing the marketplace stock of DEX measurement connected Solana from Jun. 27, 2022, to Mar. 25, 2024 (Source: Dune Analytics)

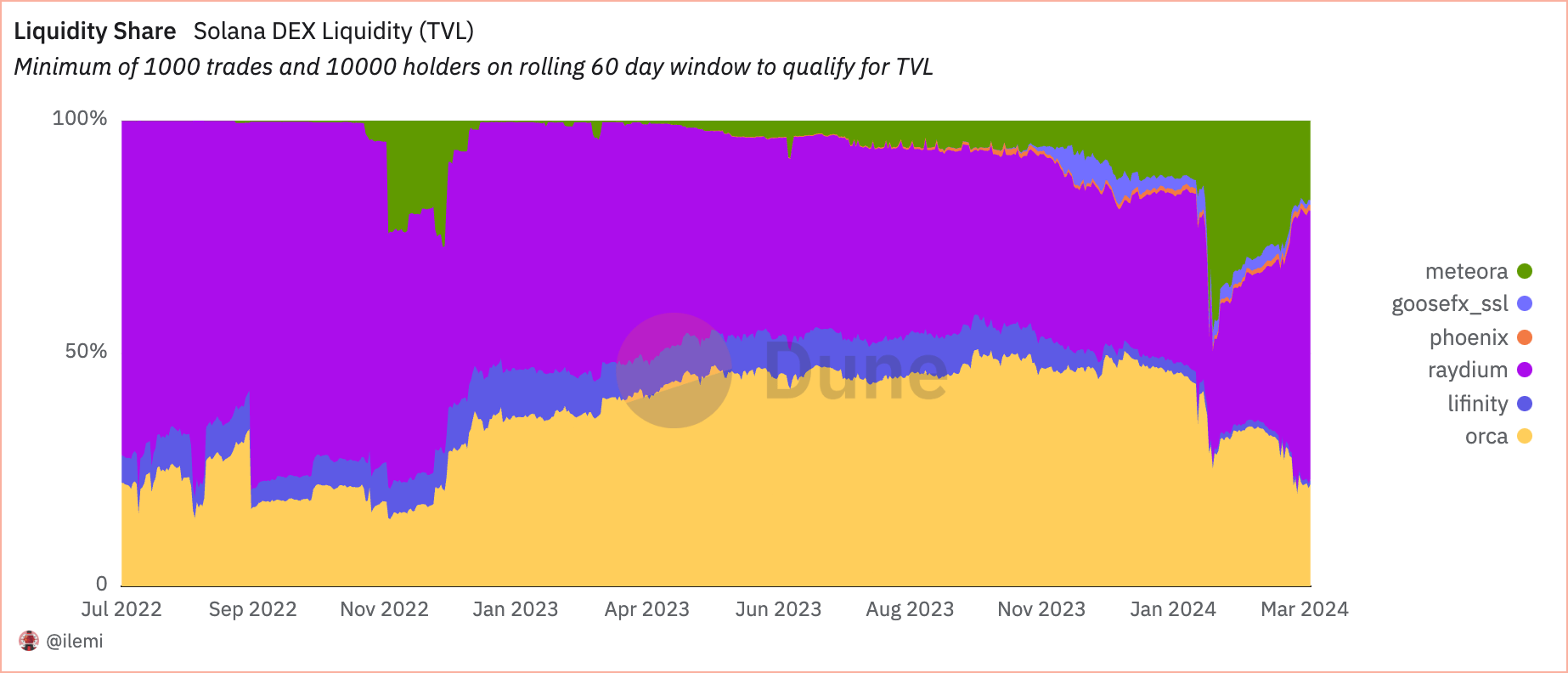

Graph showing the marketplace stock of DEX measurement connected Solana from Jun. 27, 2022, to Mar. 25, 2024 (Source: Dune Analytics)When it comes to liquidity, Raydium reigns ultimate arsenic well. As of Mar. 25, Raydium held $694.9 cardinal worthy of tokens, accounting for 58.6% of the full liquidity connected Solana DEXs. Orca had $205.7 cardinal successful liquidity, oregon 21.1% of the share, portion Meteora accounted for conscionable implicit $201 cardinal oregon 17%.

Graph showing the marketplace stock of DEX liquidity connected Solana from Jul. 2, 2022, to Mar. 25, 2024 (Source: Dune Analytics)

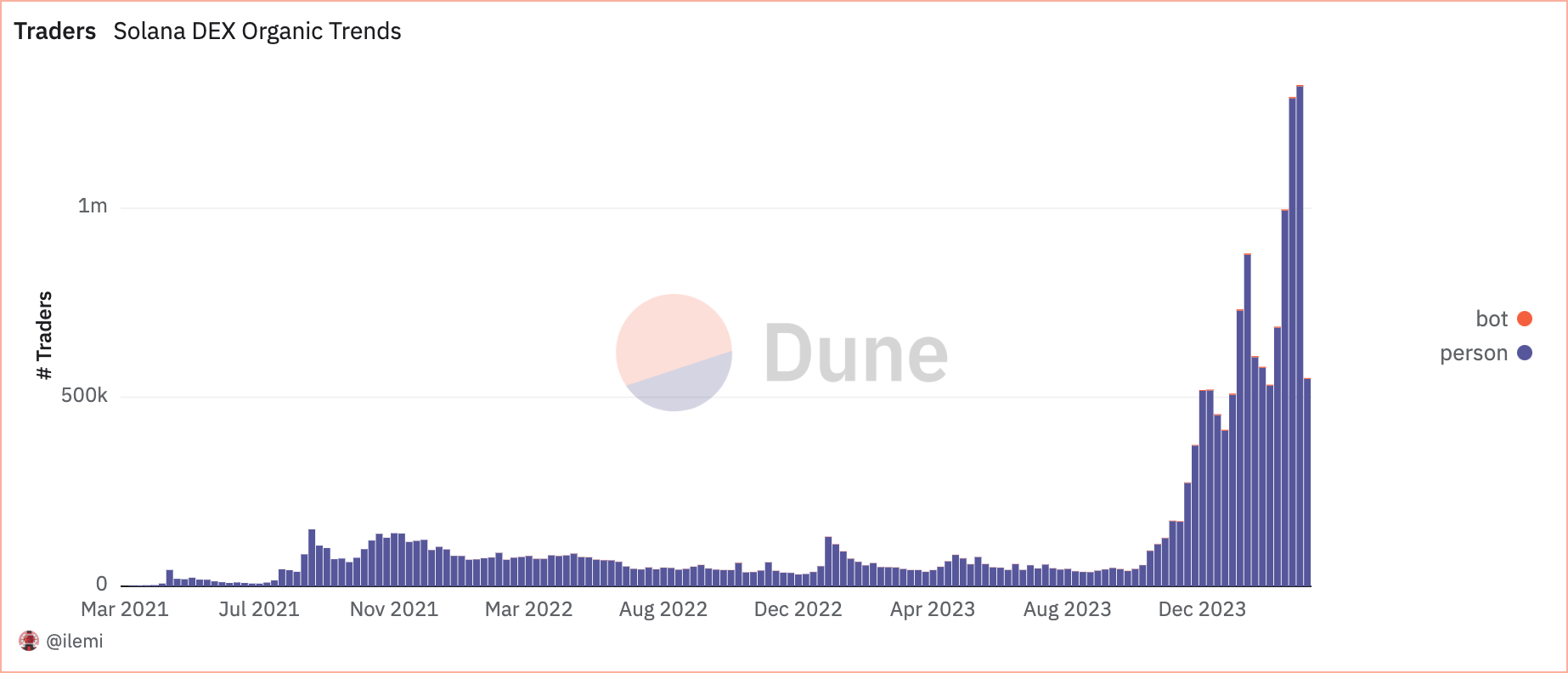

Graph showing the marketplace stock of DEX liquidity connected Solana from Jul. 2, 2022, to Mar. 25, 2024 (Source: Dune Analytics)An influx of traders caused this summation successful measurement and liquidity. The fig of integrated traders connected the web accrued from astir 453,000 astatine the opening of the twelvemonth to an all-time precocious of 1 cardinal connected Mar. 18, portion lone astir 3,000 “traders” were identified arsenic bots.

Chart showing the fig of integrated (blue) and bot (red) traders connected Solana DEXs from Mar. 15, 2021, to Mar. 25, 2024 (Source: Dune Analytics)

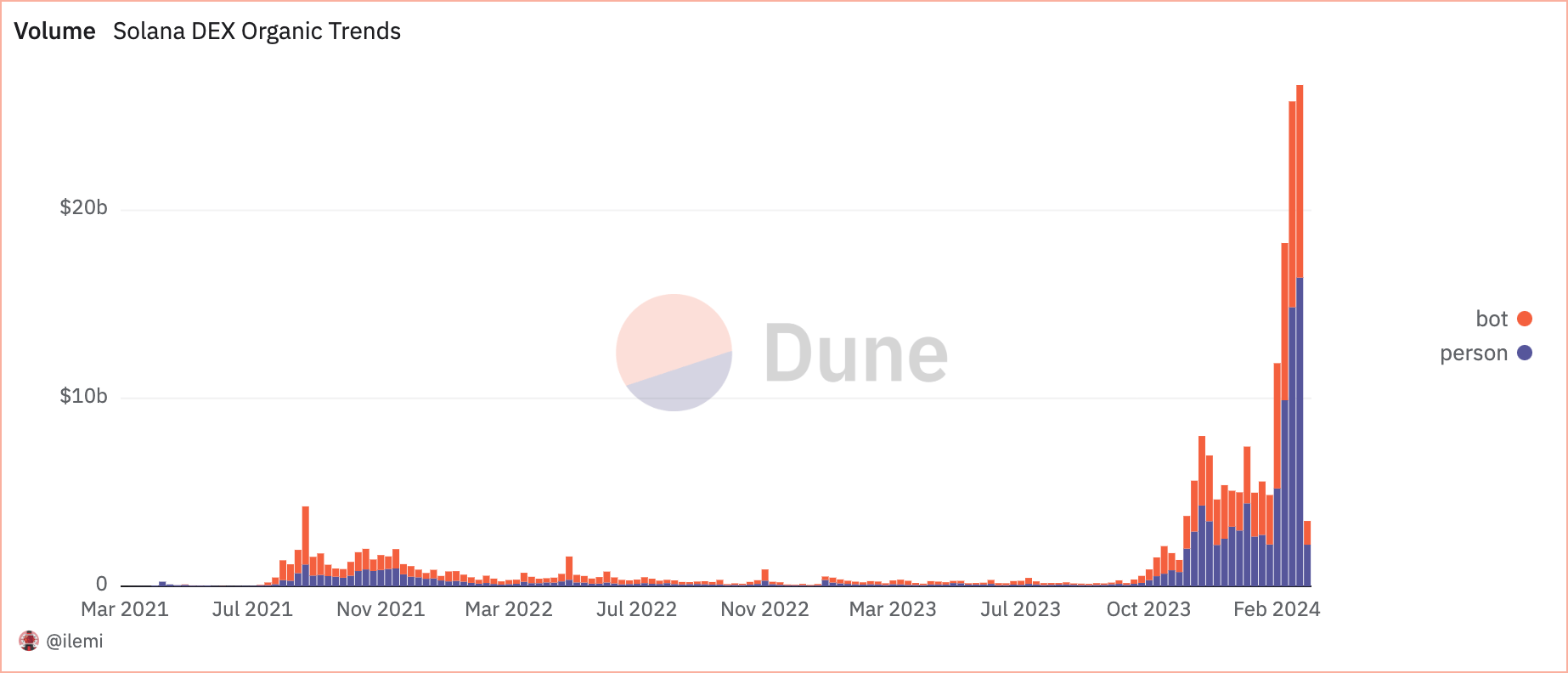

Chart showing the fig of integrated (blue) and bot (red) traders connected Solana DEXs from Mar. 15, 2021, to Mar. 25, 2024 (Source: Dune Analytics)However, contempt the comparatively tiny fig of bots, they managed to rack up a important measurement connected Solana’s decentralized exchanges. On Mar. 18, retired of the $26.7 cardinal successful measurement crossed DEXs, bots accounted for $10.2 billion. While the measurement coming from bots dropped by $1.2 cardinal connected Mar. 25, it inactive represented a 3rd of the full measurement recorded that day. This has been a persistent inclination passim the year, with bot measurement consistently accounting for betwixt 30% and 40% of the regular DEX volumes.

Chart showing the DEX measurement coming from integrated (blue) and bot (red) traders from Mar. 29. 2021, to Mar. 25, 2024 (Source: Dune Analytics)

Chart showing the DEX measurement coming from integrated (blue) and bot (red) traders from Mar. 29. 2021, to Mar. 25, 2024 (Source: Dune Analytics)The summation successful measurement and liquidity connected Solana’s DEXs confirms the web is booming. Data from Dune showed an accrued involvement and information successful the DEX marketplace and identified Raydium arsenic the predominant DEX platform. The important relation bots person successful driving trading measurement up doesn’t detract from the evident integrated maturation the web has experienced.

These developments tin bode good for Solana. The network’s quality to pull specified precocious levels of engagement and liquidity has enactment it astatine the forefront of DeFi. However, sustaining specified precocious levels of engagement is wherever things get complicated. Suppose the web and its protocols negociate to support show and proceed with their innovative offerings (airdrops and high-interest yield). In that case, we tin expect Solana to presumption itself arsenic the king of DeFi.

The station Solana DEX volumes surge with implicit 5.8M traders driving growth appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)