Tokens of Solana (SOL) and Dogecoin (DOGE) dipped the astir among the large cryptocurrencies adjacent arsenic bitcoin remained mostly unchanged implicit the past 24 hours.

SOL mislaid arsenic overmuch arsenic 8% amid a continual “risk-off” sentiment for large cryptocurrencies. DOGE dropped 5%, portion BNB Chain’s BNB, Cardano’s ADA, and XRP slid a comparatively lesser 3.5%, information connected CoinGecko showed.

Outside of the apical ten, Avalanche’s AVAX slid 11%, portion Shiba Inu’s SHIB mislaid conscionable 2.5% contempt being a comparatively much volatile token. Ether (ETH) mislaid 3.2% amid falling request for artifact abstraction connected Ethereum, suggesting little improvement and on-chain activity.

Block abstraction is the magnitude of transactional information that tin beryllium included successful each block, with users paying ‘gas’ fees for doing so. Lower artifact request mostly means a autumn successful idiosyncratic enactment connected immoderate peculiar network.

On-chain analytics steadfast Glassnode said successful a enactment earlier this week that derivatives marketplace suggested fearfulness of further downside remains among investors.

“Poor terms performance, fearful derivatives pricing, and exceedingly lacklustre request for block-space connected some Bitcoin and Ethereum, we tin deduce that the request broadside is apt to proceed seeing headwinds,” Glassnode said.

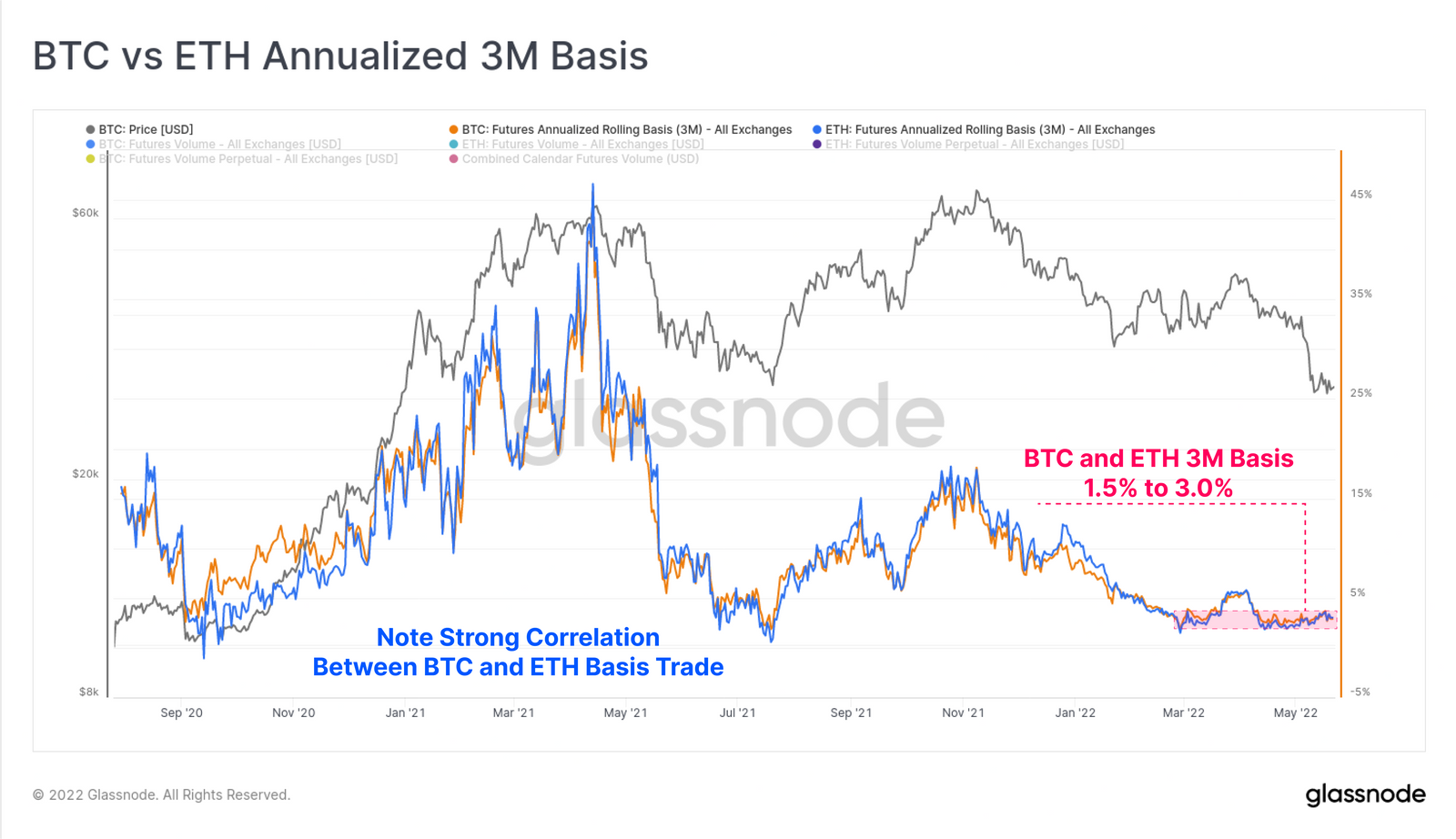

Yields connected a three-month rolling ground for futures hover implicit astir 3.1% for some assets, which “is historically precise low,” Glassnode said. Such yields are generated erstwhile determination is mispricing betwixt an asset’s spot and futures price. Traders spell agelong connected the underlying plus and abbreviated its, oregon a related asset’s, futures. The quality is pocketed.

Yields connected a fashionable bitcoin and ether futures commercialized person decreased steadily. (Glassnode)

However, little yields springiness traders small crushed to deploy superior and participate markets, which could mean further downside arsenic caller superior fails to bid up spot, and futures, prices. The superior could re-enter if broader markets supply debased returns.

“[Yield] is present higher than the US 10yr Treasury output of 2.78%, which whitethorn commencement giving capitalist superior a crushed to re-enter the space,” Glassnode analysts said.

The bearish futures information came alongside options enactment connected bitcoin that suggested a bearish sentiment among traders, arsenic reported earlier this week. The put/call ratio connected bitcoin options reached 12-month-highs of implicit 0.72, indicating traders were hedging their portfolios against a determination downwards.

Put options are a declaration that gives the enactment purchaser the right, but not the obligation, to merchantability a specified magnitude of an underlying plus astatine a fixed price. Call options, connected the hand, let telephone buyers to acquisition the plus astatine a predetermined terms successful the future.

The put/call ratio is simply a measurement of puts against calls, which indicates however traders are positioning for a marketplace move.

Current conditions stay bearish, however. Bitcoin has spent the past week trading wrong a choky scope betwixt $28,700 and $30,500 and has printed implicit 8 consecutive weeks of downside for the archetypal clip successful its trading history.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)