Beijing-based VisionSys AI (VSA), a publicly-traded steadfast dedicated to brain-machine interface technologies and artificial quality systems, unveiled Wednesday a $2 cardinal Solana (SOL) treasury strategy, joining a increasing inclination of listed companies pivoting to integer plus treasury plays.

The initiative, led by VisionSys subsidiary Medintel Technology, is to statesman with a program to get and involvement $500 cardinal successful SOL wrong the adjacent six months, the institution said successful a property release. The steadfast teamed up with Marinade, 1 of the largest staking operators connected Solana with a $2.2 cardinal full worth locked connected the protocol, to negociate and make output connected holdings.

VisionSys AI's banal was down 20% premarket pursuing the news, but has been a blistery sanction this year, rising much than 300% since coming disposable for commercialized successful April. The steadfast yesterday appointied aboriginal Solana backer Hakob Sirounian arsenic main strategy serviceman to oversee the firm's "initiatives successful blockchain and decentralized technologies."

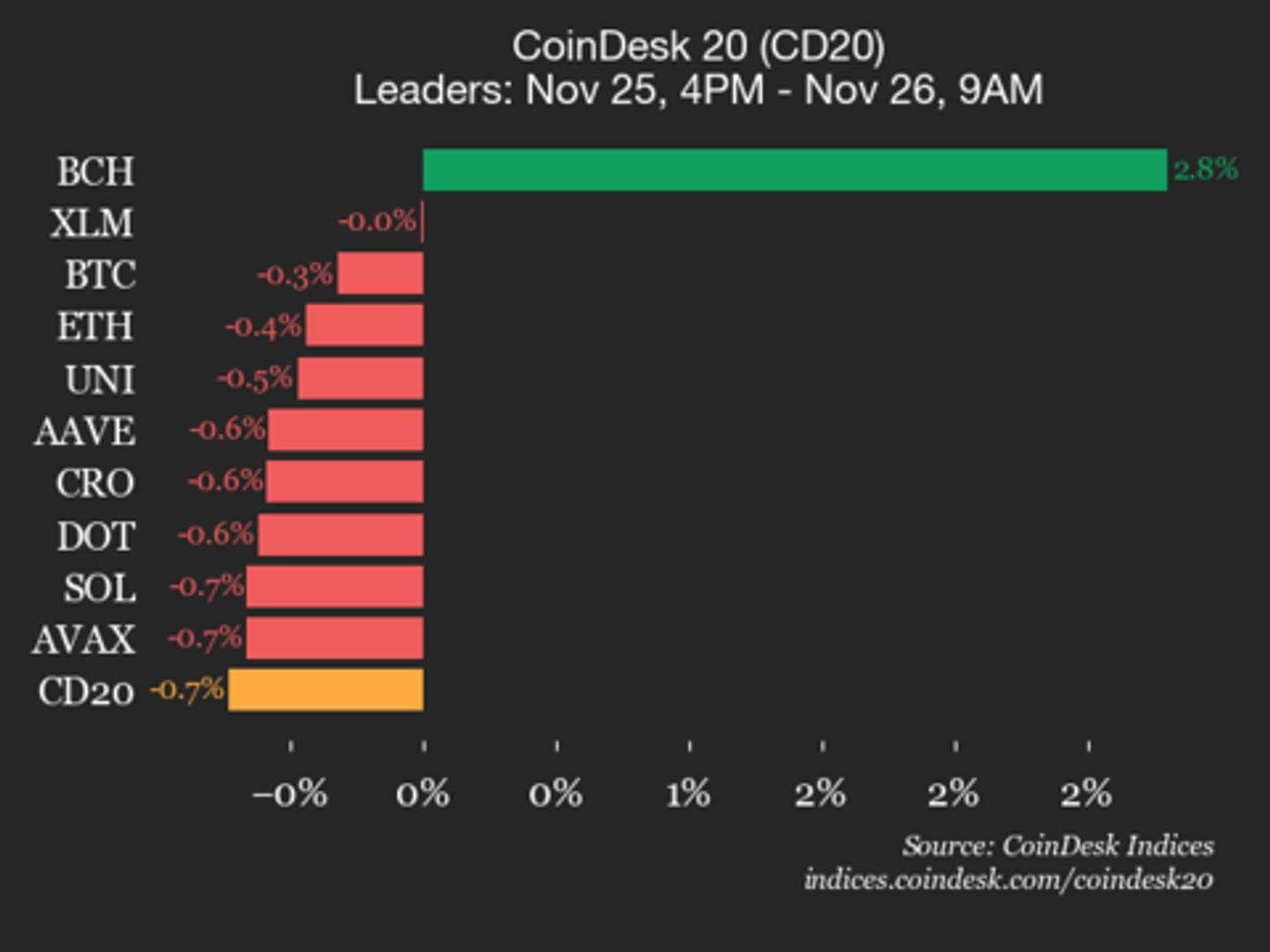

SOL was among the apical performers successful a rallying crypto marketplace connected Wednesday, up 6% to $219.

The institution is the latest summation to a roster of nationalist firms pivoting to holding crypto straight connected their equilibrium sheets, seeking to reflector aboriginal adopters similar Micheal Saylor's Strategy (MSTR), which has go the largest firm proprietor of bitcoin (BTC).

The inclination has expanded beyond BTC to different tokens specified arsenic ether (ETH) and SOL, with firms seeking to make income with yield-earning startegies connected decentralized concern (DeFi) markets. Solana treasury firms specified arsenic Forward Industries (FORD), Defi Development (DFDV) and Upexi (UPXI) collectively clasp implicit $3 cardinal successful SOL, Blockworks data shows.

1 month ago

1 month ago

English (US)

English (US)