A caller study by marketplace quality steadfast Messari has highlighted an bonzer show by Solana (SOL) during the 4th fourth of 2024, characterizing it arsenic perchance the champion 4th for immoderate blockchain successful history.

Solana Becomes Second-Largest DeFi Network

The report reveals a staggering 213% quarter-over-quarter (QoQ) maturation successful Chain GDP—essentially the full app gross generated connected the Solana network—rising from $268 cardinal successful Q3 to an awesome $840 cardinal successful Q4. November stood retired arsenic the astir lucrative month, contributing $367 cardinal to the ecosystem.

Among the starring applications driving this gross surge were Pump.fun, which generated $235 million, marking a 242% QoQ increase, and Photon, which saw adjacent much explosive maturation with a 278% increase, bringing successful $140 million.

Solana’s full app gross maturation successful Q4 2024. Source: Messari

Solana’s full app gross maturation successful Q4 2024. Source: MessariThe wide uptick successful gross tin beryllium attributed mostly to renewed speculation successful memecoins and a surge successful AI-related cryptocurrencies launched during this period.

Solana’s decentralized concern (DeFi) total worth locked (TVL) grew by 64% QoQ, reaching $8.6 cardinal and positioning it arsenic the second-largest DeFi network, surpassing Tron successful November.

The DeFi TVL, erstwhile expressed successful SOL, saw a 28% QoQ increase, totaling 46 cardinal SOL. The mean regular spot decentralized speech (DEX) measurement besides skyrocketed by 150% QoQ to $3.3 billion, driven by a resurgence successful memecoin trading and the emergence of AI-themed tokens.

In presumption of stablecoins, Solana’s marketplace headdress grew by 36% QoQ to scope $5.1 billion, making it the fifth-largest stablecoin market among competing networks. The dominance of USDC continued, with its marketplace headdress expanding by 53% to $3.9 billion, capturing a 75% marketplace share.

Increased Activity And Speculation

The liquid staking rate, which measures the percent of liquid-staked SOL, roseate by 33% to 11.2%, indicating that a important information of the eligible SOL supply—66%—is present staked. This maturation is important for a thriving ecosystem built connected yield-bearing SOL.

The NFT marketplace besides saw a humble increase, with mean regular measurement rising by 7% QoQ to $2.7 million. Tensor dominated this space, achieving $103 cardinal successful volume—a 14% QoQ increase—while Magic Eden experienced a alteration of 28% to $68 million.

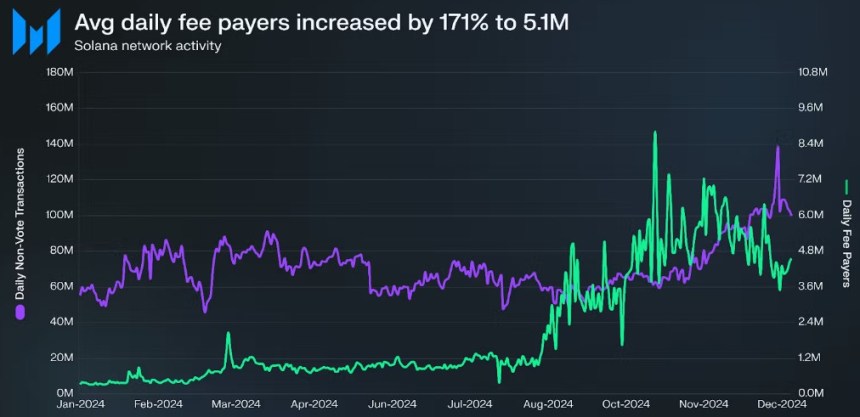

Network enactment metrics reflected robust engagement, with mean regular interest payers expanding by 171% QoQ to 5.1 million. The fig of caller interest payers surged adjacent much dramatically, increasing by 189% to 3.8 million. Average regular non-vote transactions roseate by 32%, reaching 81.5 million.

Solana’s mean regular interest payers increase. Source: Messari

Solana’s mean regular interest payers increase. Source: MessariInterestingly, the mean transaction interest saw a notable uptick, expanding by 122% QoQ to $0.05, driven by heightened network enactment fueled by speculation regarding a much favorable regulatory situation for cryptocurrencies successful the US.

Despite these gains, staked SOL experienced a alteration of 5% successful Q4, attributed successful portion to the FTX property unlocking its tokens. However, SOL’s market cap itself grew by 27% QoQ to $91 billion, peaking astatine $120 cardinal successful November.

By the extremity of the quarter, SOL ranked sixth among each cryptocurrencies successful marketplace cap, trailing down Bitcoin (BTC), Ethereum (ETH), Tether’s USDT, XRP, and Binance Coin (BNB).

Currently, SOL is trading astatine $199, down 22% implicit the past 2 weeks, amid increasing macroeconomic challenges that are having a important interaction connected hazard assets.

Featured representation from DALL-E, illustration from TradingView.com

9 months ago

9 months ago

English (US)

English (US)