A caller study from crypto information and probe steadfast Messari has shed airy connected the show of the Solana (SOL) ecosystem during the 3rd 4th of 2024. The study highlights a substance of maturation and challenges faced by the blockchain amid broader volatility successful the cryptocurrency marketplace during that period.

Solana Stablecoin Market Cap Rises To $3.8 Billion

One of the standout metrics from the study is the maturation of Solana’s Total Value Locked (TVL) successful decentralized finance (DeFi), which roseate by 26% quarter-over-quarter (QoQ) to scope $5.7 billion.

This maturation positioned Solana arsenic the third-largest web successful presumption of DeFi TVL, surpassing Tron successful precocious September. Notably, the TVL denominated successful SOL besides increased, increasing by 20% QoQ to 37 cardinal SOL.

Solana’s Q3 TVL growth. Source: Messari

Solana’s Q3 TVL growth. Source: MessariKamino emerged arsenic a starring subordinate wrong the Solana ecosystem, experiencing a 57% maturation successful TVL, ending the 4th with $1.5 cardinal and capturing a 26% marketplace share. This surge is attributed to the integration of caller tokens, including PayPal’s USD (PYUSD) and jupSOL, which person enhanced the platform’s appeal.

Despite the wide affirmative trends, decentralized exchange (DEX) measurement experienced a flimsy decline, reflecting a downturn successful memecoin trading. Average regular spot DEX measurement fell by 10% QoQ to $1.7 billion.

Per the report, the diminishing involvement successful memecoins was evident, arsenic lone 2 tokens—WIF and POPCAT—managed to marque it into the apical 10 by trading measurement for the quarter.

In contrast, Solana’s stablecoin ecosystem showed resilience, with the marketplace headdress for stablecoins increasing by 23% QoQ to $3.8 billion, solidifying its fertile arsenic the fifth-largest web successful this category.

On the non-fungible token (NFT) front, however, the show was little favorable. Average regular NFT measurement fell by 27% QoQ to $2.5 million, with Magic Eden maintaining a ascendant marketplace stock contempt experiencing a 44% diminution successful volume.

Network Activity Thrives

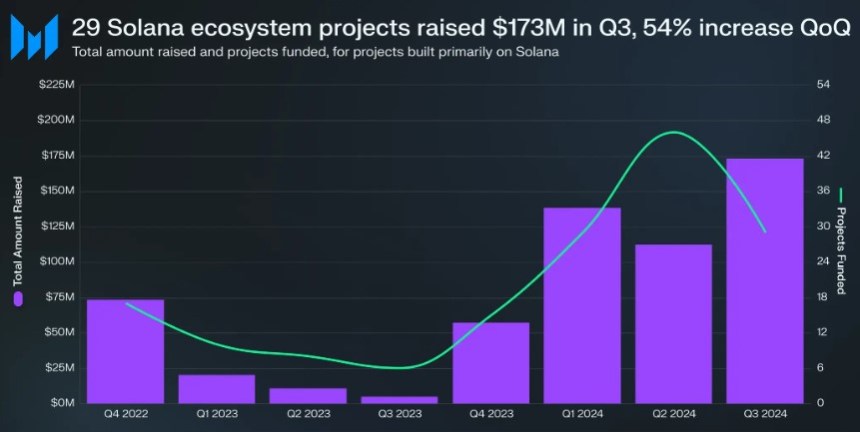

Despite the challenges, the fig of backing rounds for projects wrong the Solana ecosystem saw a simplification of 37% QoQ, with lone 29 projects announcing funding. Yet, the full magnitude raised soared to $173 million, a 54% summation QoQ and the highest quarterly backing since Q2 2022.

Funding maturation successful the Solana blockchain during Q3. Source: Messari

Funding maturation successful the Solana blockchain during Q3. Source: MessariNetwork enactment remained robust, arsenic evidenced by a 109% summation successful mean regular interest payers, which reached 1.9 million. Additionally, the mean regular caller interest payers grew by 430% QoQ to 1.3 million, signaling a increasing idiosyncratic base.

The mean transaction fee connected Solana accrued by 6% QoQ to 0.00015 SOL (approximately $0.023), portion the median transaction interest dropped by 19% to 0.000008 SOL (around $0.0013).

As of October 15, Solana’s marketplace capitalization besides grew by 5% QoQ, reaching $71 cardinal and maintaining its presumption arsenic the fifth-largest cryptocurrency, trailing lone Bitcoin, Ethereum, Tether, and Binance Coin.

However, the Real Economic Value (REV) of Solana, which tracks transaction fees and miner extractable worth (MEV) for validators, decreased by 25% QoQ to 1.3 cardinal SOL (approximately $196 million), with 56% of this full coming from transaction fees.

At the clip of writing, SOL was trading astatine $166, down 5% for the 7 time period.

Featured representation from DALL-E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)