Solana‘s full worth locked (TVL) presently stands astatine $4.666 billion, with a bridged TVL reaching conscionable implicit $21 cardinal arsenic of property time. This fig is distributed crossed dozens of protocols, each contributing to the burgeoning ecosystem successful a unsocial way.

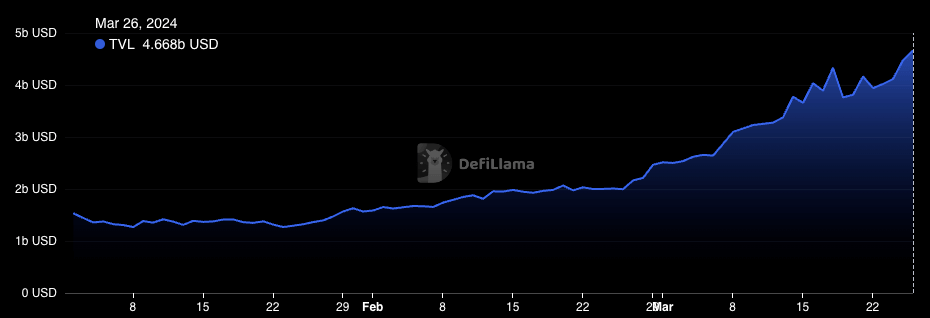

Graph showing the full worth locked (TVL) successful the Solana ecosystem from Jan. 1 to Mar. 26, 2024 (Source: DeFiLlama)

Graph showing the full worth locked (TVL) successful the Solana ecosystem from Jan. 1 to Mar. 26, 2024 (Source: DeFiLlama)The organisation of worth crossed protocols is an indicator of idiosyncratic preferences, emerging trends, and the fast-growing and evolving needs of the Solana community. Analyzing this organisation is important successful knowing the absorption the web is heading and its users’ priorities:

- Marinade ($1.958b) is Solana’s starring liquid staking solution, allowing users to involvement SOL and person stSOL, enhancing liquidity and flexibility.

- Jito ($1.763b) accelerates Solana’s blockchain performance, focusing connected scalability and businesslike transaction processing.

- Kamino ($1.397b), a liquidity absorption platform, optimizes output farming strategies, enhancing the DeFi experience.

- Marginfi ($827.77m) integrates trading and lending into a azygous platform, offering divers fiscal products.

- Raydium ($611.32m) is an automated marketplace shaper (AMM) and liquidity supplier built connected the Solana blockchain for the Serum decentralized speech (DEX).

- BlazeStake ($467.54m) focuses connected staking solutions, offering users a mode to gain rewards by securing the network.

- Jupiter ($383.4m) offers perpetual swap contracts, enabling leveraged trades without expiry dates.

- Drift ($336.49m) is simply a decentralized level offering derivatives and leverage trading connected Solana.

- Solend ($283.35m) is simply a decentralized protocol for lending and borrowing, showcasing the maturation of lending markets connected Solana.

- Orca ($270.2m) is simply a user-friendly DEX that emphasizes simplicity and accessibility successful trading.

A person look astatine the TVL organisation utilizing data from DeFiLllama shows a wide inclination towards protocols offering liquidity and lending services, with Marinade, Jito, and Kamino leading the pack. This indicates a robust request for liquidity solutions and yield-generating opportunities among Solana’s users. It besides reflects a increasing sophistication successful the DeFi space, wherever users question much than conscionable token swaps — they’re actively looking for platforms that tin supply precocious leverage and a greater imaginable to earn.

As the largest protocol successful presumption of TVL, Marinade reflects this accrued involvement successful staking solutions, peculiarly those that supply precocious liquidity. By offering stSOL successful instrumentality for staking SOL, Marinade addresses the liquidity dilemma often faced by stakers, allowing them to enactment successful DeFi activities without locking their assets.

Jito and Kamino bespeak a penchant for scalability and optimized output farming. Jito’s absorption connected expanding Solana’s throughput capabilities shows users are looking for a competitory borderline successful transaction efficiency. On the different hand, Kamino caters to output farmers and their analyzable farming strategies, showing the assemblage is gravitating toward much analyzable fiscal instruments than conscionable swaps.

Comparing the popularity of lending protocols against decentralized exchanges (DEXs) shows lending platforms like Solend have amassed important TVL. While it’s notably little than the worth locked successful staking solutions, it shows a increasing penchant for lending. While Solana is inactive successful its infancy, adjacent successful DeFi terms, this inclination indicates a maturing abstraction with a mature subset of users looking into leveraging their assets for loans oregon earning involvement — a stark opposition to the earlier days of DeFi, wherever DEXs dominated the landscape.

The organisation of TVL crossed Solana’s protocols sheds airy connected a web that is becoming progressively diversified. While memecoins person go a important inclination connected Solana, their interaction connected TVL and its organisation seems minimal. As these tokens person a precise abbreviated lifespan and are predominantly traded connected DEXs, their transient quality means they lend small to the stableness oregon maturation of Solana’s TVL.

The station Solana’s DeFi scenery matures with important maturation successful liquidity and lending sectors appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)