A caller connection made by Austin Federa, a strategist astatine the Solana Foundation, has sparked a wide statement wrong the crypto community. On Monday, Federa projected a caller conceptualization for respective enhancements connected the Solana blockchain via a station connected X, suggesting that “most of the L2-ish things connected Solana are amended thought of arsenic Network Extensions.”

“While the underlying tech stack mightiness lucifer Bitcoin oregon Ethereum L2’s, the relation and relation is truthful radically antithetic I deliberation founders would champion beryllium served by Network Extensions. Network Extensions widen the Solana web to caller places, oregon bring caller execution environments, specialized processing, etc to the Solana network. State Compression, cNFTs, Neon’s EVM layer, possibly adjacent Phoenix each acceptable this intelligence framing imo,” Federa wrote.

Why This Could Put Solana ‘In Limbo’

Responding to this post, Ignas, a fashionable crypto expert and co-founder of Pinky Brains, voiced his analysis and concerns to his 105,000 followers connected X. Ignas highlights the captious quality of the ongoing statement astir Solana’s developmental strategy. He raises a cardinal question astir whether the crypto assemblage volition clasp the caller “Network extension” terminology oregon proceed to favour the Layer 2 framing.

Ignas elaborates connected the imaginable risks associated with Solana’s rebranding of its scalability solutions arsenic Network Extensions. He cautions that if Solana’s modulation leads to antagonistic outcomes akin to those experienced by Ethereum—such arsenic liquidity fragmentation and a degraded idiosyncratic acquisition owed to the complexities of bridging betwixt layers—then the aboriginal of SOL could beryllium jeopardized, leaving it successful a authorities of limbo.

“ETH was stuck betwixt BTC and SOL during this bull run. BTC was ‘better money’ for little blimpish and organization investors, and SOL arsenic a faster, simpler, and cheaper astute declaration level with higher upside than ETH. If Solana communicative shifts from a monolithic exemplary to scaling with L2s (like Ethereum), SOL could go the caller ETH. [..] past SOL is genuinely successful limbo,” Ignas warns.

The interaction connected the Solana terms could beryllium significant. According to Ignas, Ethereum would stay the “safer option” for semipermanent investors due to the fact that of its higher decentralization and nary downtimes. “Plus, if degens commencement chasing ‘network extension’ tokens for SOL beta alternatively of buying SOL, it could stagnate SOL’s terms growth,” the expert added.

Meanwhile, Ignas did not disregard the imaginable advantages of Solana’s strategy entirely. He acknowledged that integrating Network Extensions from the outset, with aggregation furniture solutions already successful place—a measurement Ethereum had not taken during its archetypal Layer 2 rollouts—could mitigate immoderate of the communal challenges associated with Layer 2 solutions.

This proactive integration could sphere a unified idiosyncratic acquisition and forestall the fragmentation of liquidity. “As a result, Solana could support the ‘monolithic narrative’ portion benefiting from modular attack solutions. The ‘network extension’ communicative could past prevail,” Ignas concludes.

However, if the Solana communicative shifts to L2s, determination could beryllium an bare void for a caller monolithic champion. The crypto expert concluded: ”Solana’s displacement to a modular scaling attack creates an accidental for a caller monolithic scaling champion successful the eyes of crypto community. Could this beryllium the cleanable infinitesimal for Monad to launch? Or volition different Layer 1 blockchain prehend the monolithic concatenation crown from Solana? Exciting!”

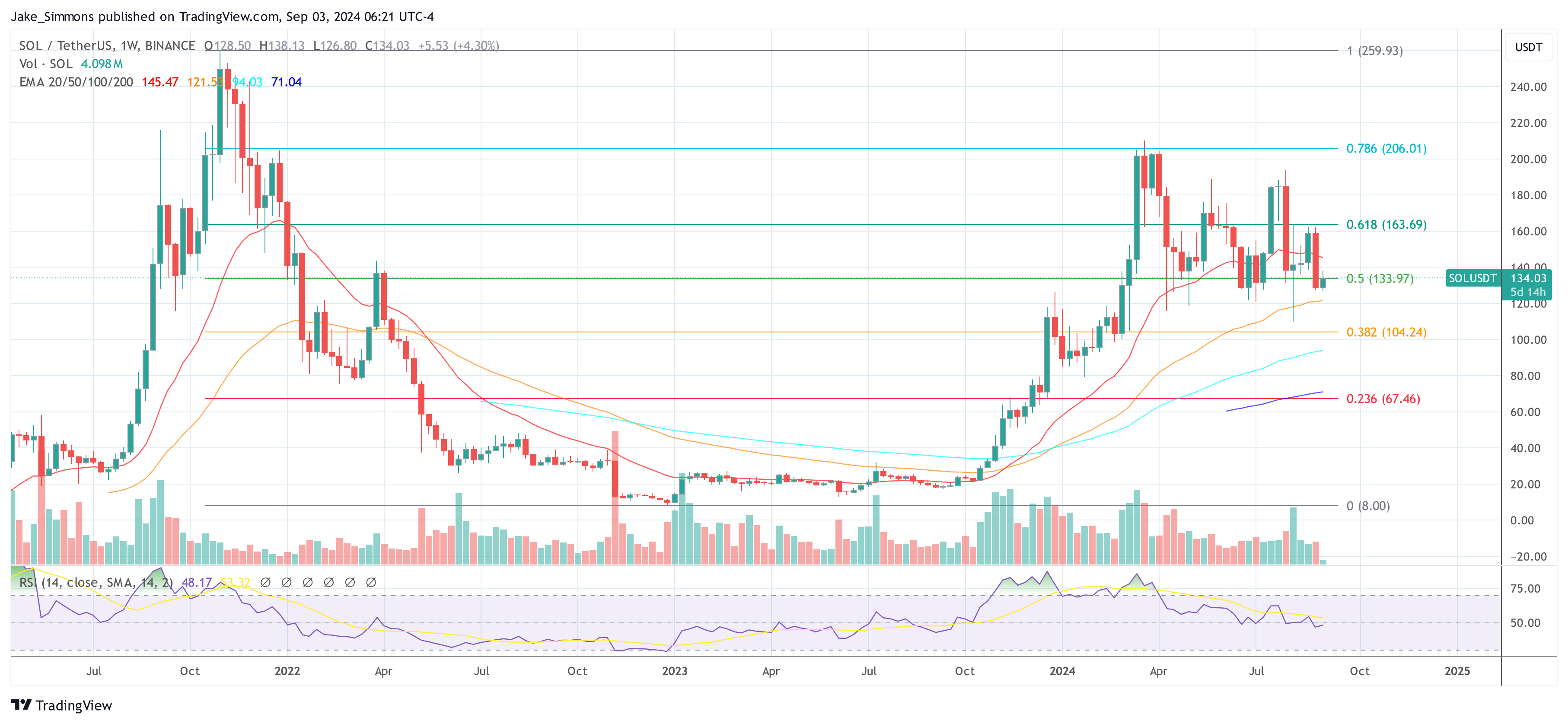

At property time, SOL traded astatine $134.

SOL needs to reclaim the 0.5 Fib, 1-week illustration | Source: SOLUSDT connected TradingView.com

SOL needs to reclaim the 0.5 Fib, 1-week illustration | Source: SOLUSDT connected TradingView.comFeatured representation from Solana.com, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)