The post Solana (SOL) Price Holds Below $130 as Bitcoin and Ethereum Consolidate—Here’s What to Watch in 2026 appeared first on Coinpedia Fintech News

As the crypto markets are heading for the yearly close, the volatility has just lit up. Bitcoin price surged over $90,000 for a while but failed to reach the critical resistance at $90,500. As a result, the price dropped below $88,000, dragging the Ethereum price below $3000. Besides, Solana price also faced a similar downfall after hitting the psychological barrier at $130 and dropped to $122 to $123 level. Although the price is constantly failing to secure $130, in the broader perspective, the token is preparing for a divine move.

On the other hand, the token had attracted enough attention through inflows and accumulations. Therefore, it would be interesting to watch whether these factors will push the SOL price beyond $150 in early 2026.

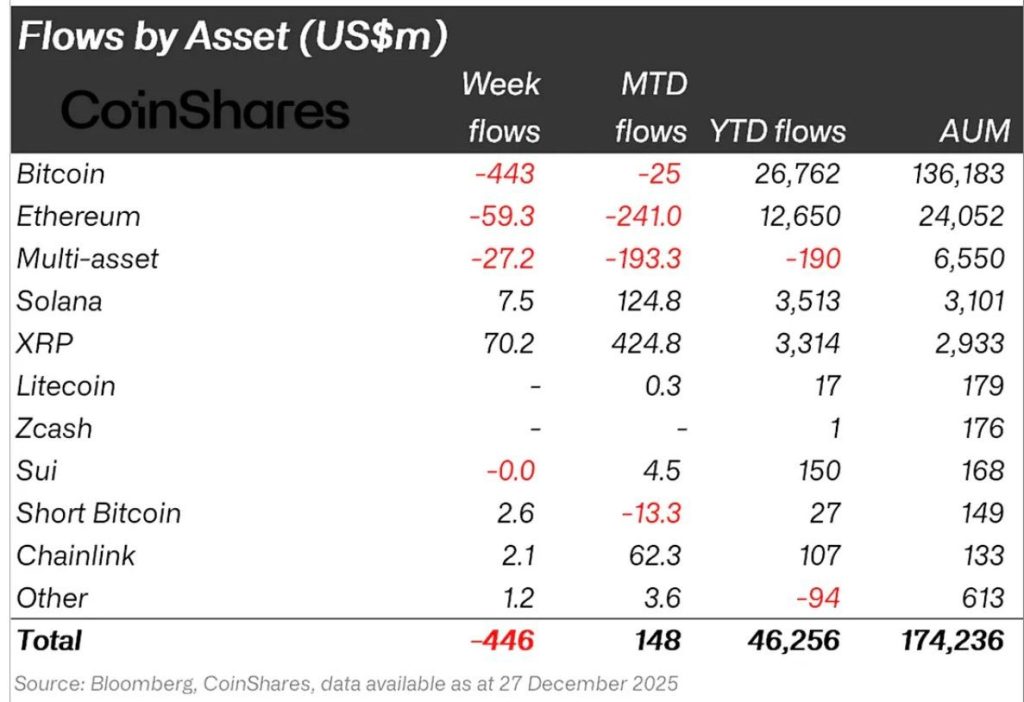

Capital Rotation: Fund Flows into Solana

Recent fund-flow data from CoinShares shows a clear divergence. While Bitcoin and Ethereum products have experienced net weekly outflows, Solana-linked products recorded a third consecutive week of modest inflows. This does not signal a broad risk-on shift, but it does highlight rotation rather than exit. In late-cycle consolidation phases, capital often seeks assets showing momentum without overcrowding—Solana currently fits that profile.

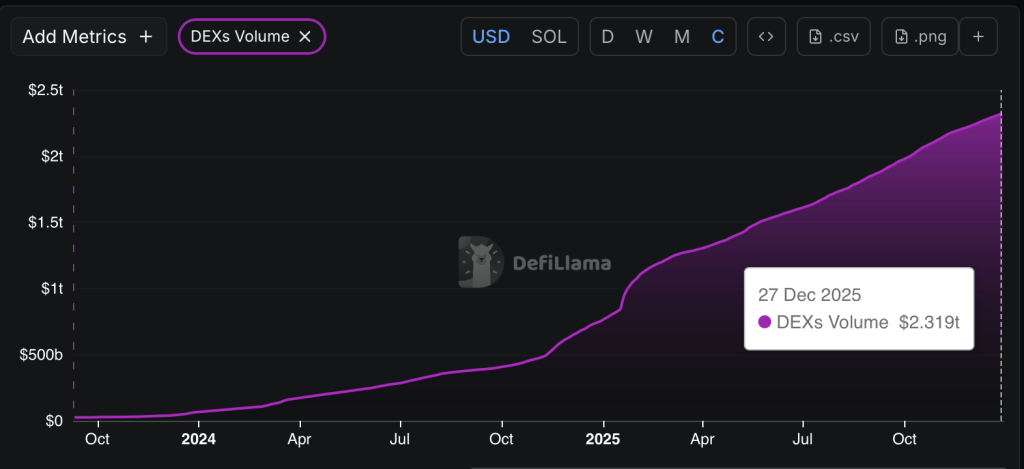

On-Chain Liquidity: DEX Spot Volume Crosses $2.3T YTD

On-chain data reinforces this picture. According to Defilama, aggregate DEX spot volume across Solana-based protocols has crossed $2.3 trillion year-to-date. This reflects cumulative decentralized trading activity rather than a single venue, driven largely by retail participation and memecoin-related flows. While centralized exchanges still dominate total volumes, the scale of on-chain liquidity highlights Solana’s growing role as a major trading hub.

Solana Price Analysis: Weekly Compression at a Make-or-Break Zone

From a technical standpoint, Solana’s weekly chart adds weight to the relative-strength narrative. SOL continues to trade within a large ascending structure, supported by a rising trendline that has held since early 2023. Importantly, price is consolidating just above the 200-week EMA near $121, a level that has repeatedly acted as dynamic support during pullbacks.

At the same time, SOL faces persistent resistance in the $145–$150 zone, where multiple weekly rejections have occurred. This has created a compression setup, with higher lows pressing into long-term resistance. Volume has remained steady, and OBV is holding near elevated levels, suggesting accumulation rather than distribution.

As long as SOL holds above the rising trendline and the 200-week EMA, the broader structure remains constructive. A weekly close above $150 would confirm a breakout and open the door toward $180–$200. Conversely, a decisive break below $120 would weaken the setup and expose downside toward the $95–$100 support area.

Conclusion: Can Solana Reach $150 in Early 2026?

Whether Solana reaches the $150 level in early 2026 will depend less on narrative and more on price confirmation. On the weekly chart, SOL continues to hold above the rising trendline and the 200-week EMA near $120, keeping the broader structure constructive. As long as this support zone holds, downside risk remains contained.

However, $145–$150 remains a major supply zone, where sellers have repeatedly stepped in. A weekly close above $150, followed by acceptance, would mark a structural breakout and significantly improve the probability of continuation toward higher levels. Until that happens, Solana is likely to remain in consolidation. In short, $150 is achievable—but only if price confirms strength, not before.

1 month ago

1 month ago

English (US)

English (US)