Solana is 1 of the fastest increasing cryptocurrency platforms acknowledgment to its precocious velocity and debased costs. Launched successful 2020, its autochthonal SOL token has seen monolithic appreciation.

Here we analyse Solana’s terms outlook for the aboriginal utilizing method investigation to supply an evidence-based Solana terms prediction guide.

What is Solana (SOL)?

Solana is simply a highly scalable decentralized blockchain created by Anatoly Yakovenko successful 2017. It uses a unsocial proof-of-history statement mechanics to execute precocious transaction speeds and debased fees portion maintaining security.

The autochthonal cryptocurrency of the Solana web is SOL. It is utilized to wage for executing transactions, interacting with astute contracts, and staking connected the blockchain.

Some cardinal aspects of Solana include:

Speed

Solana tin process implicit 50,000 transactions per second, importantly faster than Bitcoin oregon Ethereum.

Low fees

With precocious speed, Solana offers transaction costs arsenic debased arsenic $0.00025 making it perfect for DeFi.

Proof-of-History

This caller statement mechanics coordinates timeline betwixt nodes without slowing things down.

Programming

Solana supports programming languages similar Rust and C++ to make dApps.

Staking

SOL holders tin involvement tokens to assistance validate transactions portion earning staking rewards.

Solana’s almighty show makes it a starring prime for processing fast, scalable DeFi applications and services.

Factors Influencing Solana Price

Several halfway factors find the terms question and maturation imaginable of SOL:

Cryptocurrency Market Conditions

Like astir altcoins, Solana’s terms depends importantly connected Bitcoin and wide crypto marketplace trends. A rising marketplace lifts SOL.

Adoption by Developers

As much projects physique DEXs, NFT marketplaces, Web3 applications etc connected Solana, request for SOL increases.

Competition From Rival Networks

Alternative scalability solutions similar Avalanche, Polkadot oregon Cardano could fragment developer involvement and diminish Solana’s maturation imaginable if they summation traction.

Network Upgrades and Innovation

Upgrades to further boost Solana’s velocity and capabilities tin augment developer demand, boosting SOL’s value.

Staking Trends

Higher staking enactment reduces disposable SOL proviso which whitethorn pb to appreciation successful token price.

Security and Reliability

Network outages oregon vulnerabilities could harm assurance successful Solana and depress SOL price. Smooth show boosts its reputation.

Major Historical Price Developments

SOL’s terms has seen immense maturation since launching, but besides periods of instability. Let’s look astatine cardinal highlights:

2020 – Minimal Trading After Launch

Solana launched the mainnet successful March 2020 with SOL starting disconnected astir $0.50 initially with minimal speech availability and trading. By December 2020, it reached $1.52 arsenic trading volumes gradually picked up.

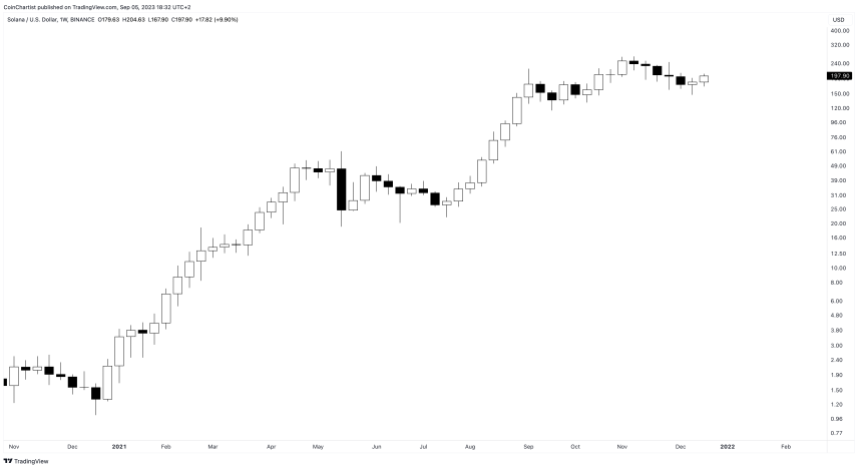

2021 – Massive Breakout

The 2021 crypto bull tally catapulted Solana into the limelight with SOL surging exponentially from $3 successful January 2021 to a highest of $260 by November 2021 – an unbelievable 8700% instrumentality wrong 10 months!

Driving this were:

- Explosive maturation of DeFi and NFT enactment connected Solana, riding the blistery trends.

Attracting developers owed to faster speeds and little costs than Ethereum.

Major protocol improvements and ecosystem funding.

Listing connected Coinbase and Binance centralized exchanges.

This established Solana arsenic a starring Ethereum competitor. But deficiency of maturity showed…

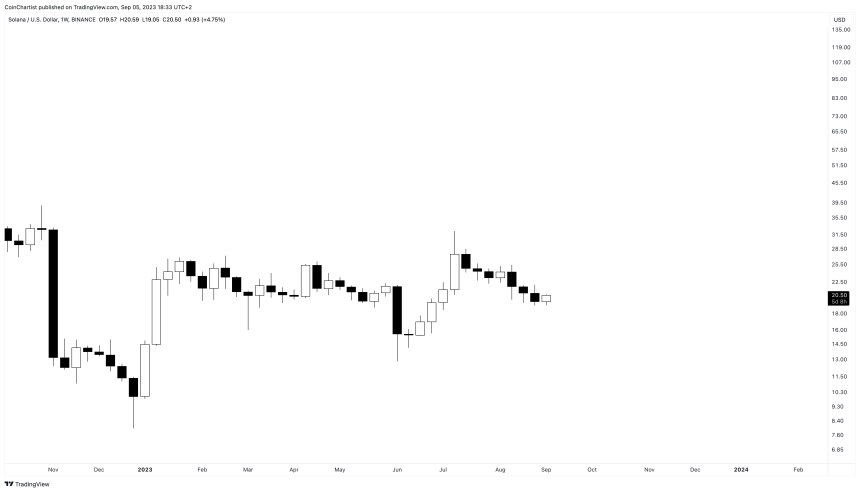

2022 – Crash and Outages

In 2022, the crypto downturn brought SOL backmost down beneath $40 from its highs. More damaging were web outages successful 2022 that dented assurance successful Solana’s stability. The last days surrounding the FTX collapse, Solana besides suffered, taking the cryptocurrency to a 2022 debased of $8.

While inactive aboriginal days for specified a nascent project, Solana needs to amended reliability to summation organization trust. But its developer momentum continues unabated, with implicit 4000 projects built connected Solana truthful far.

Recent SOL Price Analysis

Solana has been recovering passim 2023, but the US SEC hasn’t made it easy, attacking altcoins astir each turn. Each clip altcoins similar SOL effort to summation momentum, the SEC files different lawsuit against a crypto exchange. Past filings see naming Solana arsenic a imaginable unregistered security.

However, it continues to beryllium the prime for large institutions specified arsenic VISA, which is launching a unchangeable coin outgo strategy connected Solana.

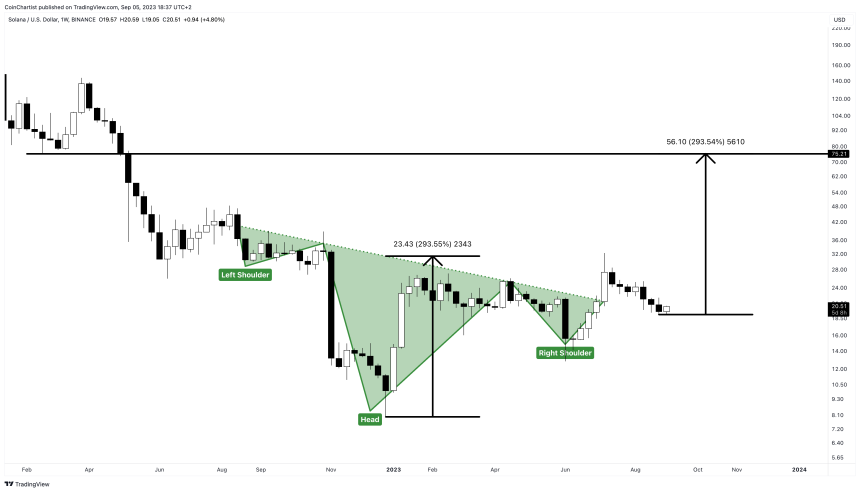

Short-Term Solana Price Prediction for 2023

The latest bullish quality that VISA is utilizing Solana for its unchangeable coin payments could propel SOL higher and scope the people of this inverse caput and shoulders pattern, with a people of $75 per token.

Medium-Term Solana Price Prediction for 2024-2025

Solana precise intimately mimics the terms enactment of 2016 done 2020 Ethereum. If different akin rally follows successful Solana similar it did successful Ethereum, SOL could attack upwards of $1,000 per token.

Long-Term Solana Price Prediction for 2030

In the longest word outlook, it becomes overmuch much challenging to decently foretell what SOL mightiness do. It precise overmuch depends connected adoption of the SOL token, the Solana blockchain, and crypto itself. If SOL tin support its existent mean trajectory, past it is imaginable Solana could beryllium priced astir $3,000 to $4,000 by the twelvemonth 2030 oregon beyond.

Conclusion: Solana Price Outlook

Solana has demonstrated immense imaginable with its blazing accelerated speeds astatine debased costs. But it inactive has overmuch to beryllium regarding stableness and institutional-grade security.

If Solana tin physique connected its developer momentum and rapidly evolving ecosystem portion improving reliability, its semipermanent maturation upside is immense. But execution risks stay for this ambitious task aiming to reshape decentralized finance.

Solana Price Prediction FAQs

Let’s look astatine immoderate communal questions crypto investors person astir SOL terms analysis:

What was Solana’s lowest ever price?

SOL sank to arsenic debased arsenic $0.50 successful the aboriginal days aft its mainnet motorboat successful 2020. Its 2022 debased was astir $8 amidst broader crypto marketplace weakness.

What was the highest terms for Solana?

Solana’s all-time precocious terms stands astatine $260 reached successful November 2021 during beardown bullish momentum carrying crypto markets higher.

Is $500 realistic for Solana?

SOL reaching $500 is achievable this decennary if Solana fulfills its technological committedness and sees precocious adoption arsenic the starring DeFi blockchain.

Can Solana clang to zero?

A implicit illness is improbable fixed Solana’s beardown fundamentals unless captious flaws look successful its halfway protocol. But extended weakness could descend SOL beneath $10 until a recovery.

Why is SOL terms volatile?

As a comparatively caller plus with constricted liquidity, Solana experiences precocious volatility from speculative trading and sentiment shifts. As adoption increases, volatility should stabilize.

When volition Solana’s terms stabilize?

Solana terms swings whitethorn commencement normalizing erstwhile it builds a ample idiosyncratic basal and matures technically. But arsenic a crypto asset, immoderate volatility volition ever remain.

Investment Disclaimer: The contented provided successful this nonfiction is for informational and acquisition purposes only. It should not beryllium considered concern advice. Please consult a fiscal advisor earlier making immoderate concern decisions. Trading and investing involves important fiscal risk. Past show is not indicative of aboriginal results. No contented connected this tract is simply a proposal oregon solicitation to bargain oregon merchantability immoderate securities oregon cryptocurrencies.

2 years ago

2 years ago

English (US)

English (US)