U.S. Senate campaigner Brian Solstin successful a Tweet opposed Senator Cynthia Lummis‘ bill aimed astatine incorporating integer assets into the U.S. fiscal strategy by arguing that Bitcoin should beryllium considered separately from different integer assets, utilizing a study published by the fiscal services company Fidelity Investments to explicate why.

Senator Lummis,

A connection from Fidelity.

BITCOIN FIRST: Why investors request to see bitcoin

separately from different integer assetshttps://t.co/uE9ejQPPeW

— Bryan Solstin for US Senate (@BryanBSolstin) June 7, 2022

Senator Lummis co-authored the draught measure with Senator Kristen Gillibrand. The measure offered to integrate each crypto-assets into the existing fiscal strategy fully. The measure does not separate betwixt crypto-assets but suggests implementing a abstracted enactment to negociate their implementation.

Candidate Solstin lone opposed the portion of the measure that considered each crypto assets without distinguishing. According to Solstin, Bitcoin is fundamentally antithetic from each different integer assets and needs peculiar attraction erstwhile being incorporated into the fiscal system.

Why should Bitcoin beryllium different?

Fidelity Investment’s report considers Bitcoin arsenic a monetary bully connected a trajectory to go the superior wealth of the future, dissimilar immoderate different crypto asset.

Bitcoin is the aboriginal of money

The study argues that Bitcoin represents a amended monetary bully than golden oregon different fiat currencies, which is wherefore it volition go the world’s superior currency.

Bitcoin, Gold, and Fiat Money

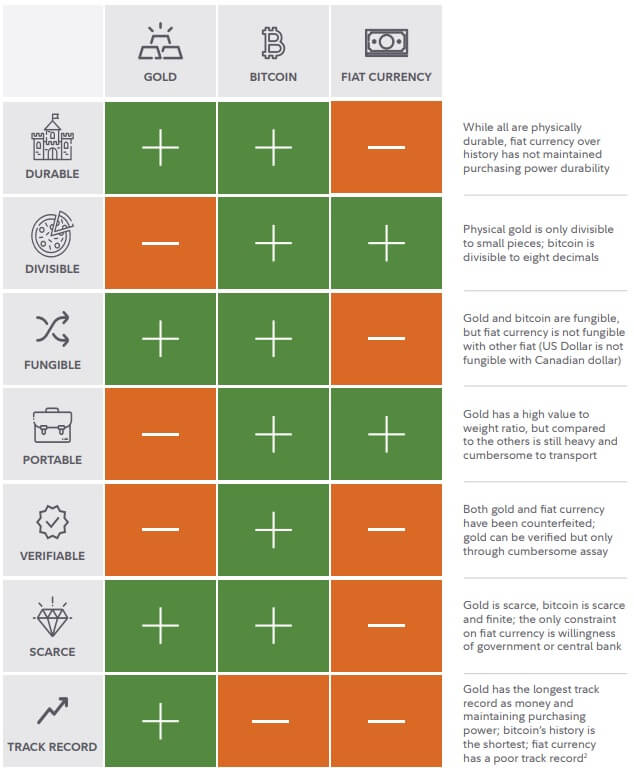

Bitcoin, Gold, and Fiat MoneyWhen compared to golden and fiat money, Bitcoin stands retired successful presumption of durability, divisibility, fungibility, mobility, verifiability, and scarcity. Despite its discouraging way record, Bitcoin inactive seems the champion monetary enactment aft a well-rounded comparison.

In addition, the study points retired that the Bitcoin web offers the largest, astir secure, and astir decentralized strategy erstwhile compared to different assets, crypto oregon otherwise. These captious characteristics importantly impact Bitcoin’s aboriginal arsenic the aboriginal currency.

Other crypto assets

While acknowledging the strengths of different crypto assets, the study states that nary of them person the characteristics to go the currency of the aboriginal and that is wherefore they request to beryllium assessed with a antithetic position than Bitcoin.

The study states:

“There is not needfully communal exclusivity betwixt the occurrence of the Bitcoin web and each different integer plus networks. Rather, the remainder of the integer plus ecosystem tin fulfill antithetic needs oregon lick different problems that bitcoin simply does not.”

This is wherefore different assets have

In bid to accent this quality and support investors accordingly, the ineligible model should beryllium divided into two: 1 to analyse Bitcoin’s emergence arsenic the aboriginal currency, and different to measure the worth of different crypto assets, the study states.

The station Solstin opposes Lummis’ bill; says Bitcoin should beryllium abstracted from different integer assets appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)