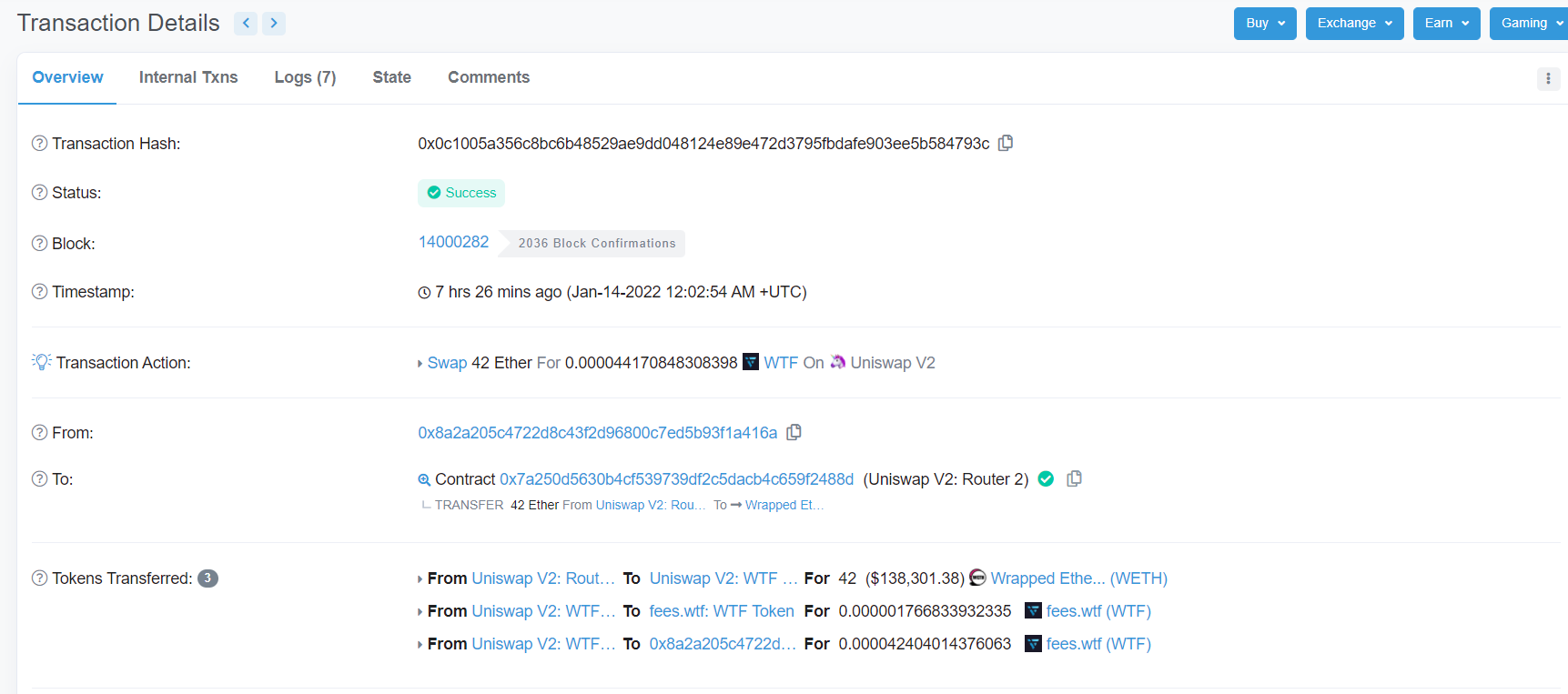

Data shows the idiosyncratic accidentally swapped 42 ether for 0.00004 WTF. However, this magnitude of WTF was worthy conscionable $0.00000525172 astatine the clip of writing, arsenic per data from CoinGecko.

The slippage was caused owed to low liquidity successful the trading pool, causing immoderate successful crypto circles to criticize however Fees.wtf developers funded the archetypal pool.

Fees.wtf is simply a fashionable instrumentality that allows users to way the fees they walk connected Ethereum. It airdropped its WTF tokens connected Thursday, jumping connected the larger inclination of crypto projects distributing tokens to idiosyncratic wallets based connected their usage with those protocols alternatively of listing straight connected the market.

Speculators jumped into accumulating WTF soon aft its listing connected Ethereum-based speech Uniswap, hoping that an eventual terms emergence would nett them handsome returns. But the debased magnitude of archetypal liquidity connected Uniswap pb to tears alternatively of glory.

A liquidity excavation imbalance caused 1 idiosyncratic to suffer 42 ether. (Etherscan)

Liquidity pools connected decentralized exchanges (DEX) similar Uniswap are dissimilar however accepted exchanges operate. A excavation refers to a acceptable of 2 tokens provided by users to a DEX, which past uses astute contracts to lucifer trades and automatically summation oregon trim prices astatine which the 2 tokens commercialized with each other.

That’s wherever the occupation lay. Blockchain information shows Fees.wtf developers seeded the initial pool connected Uniswap with implicit 2,211 WTF and 0.000001 ether, causing a immense imbalance successful the trading pool. This allowed users to merchantability debased amounts of WTF for comparatively precocious amounts of ether, portion buyers of WTF ended up purchasing the tokens astatine a overmuch higher value.

Purchasing WTF aft the airdrop could person been a atrocious stake successful hindsight. The token’s prices fell much than 60% successful the past 7 hours, data shows, falling from an archetypal $0.28 to arsenic debased arsenic $0.09 successful Asian hours connected Friday.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)