Crypto marketplace sentiment remains fearful arsenic the broader marketplace continues to slump, but that could beryllium a bully thing, arsenic anemic hands merchantability off, Santiment argued.

Crypto could spot an “unexpected November rally” with the latest indicators showing traders are getting progressively fearful, which usually results successful a displacement of wealth from weaker hands to semipermanent accumulators.

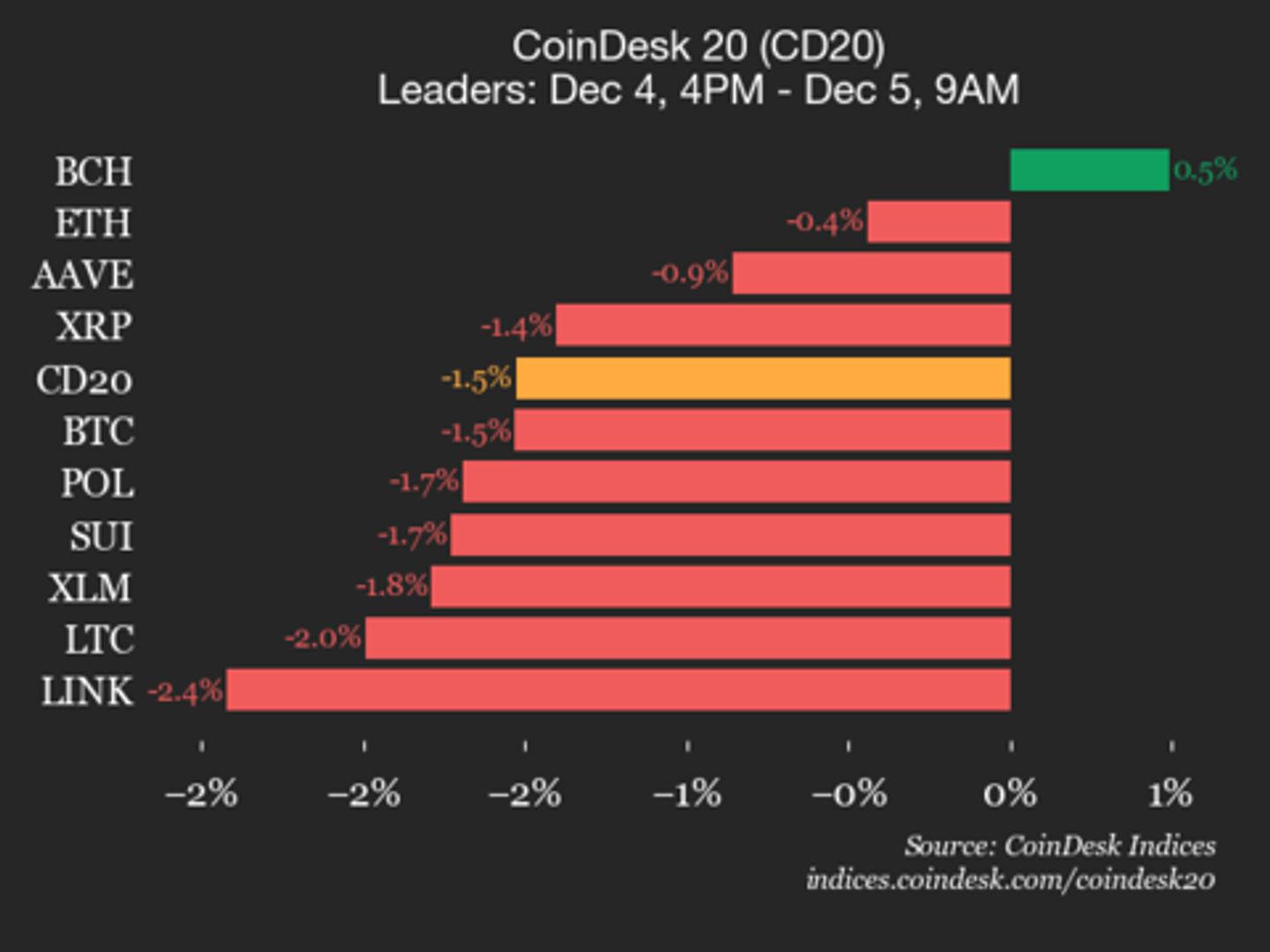

Social media comments astir Bitcoin (BTC) are evenly split betwixt bullish and bearish, portion Ether (ETH) has conscionable implicit 50% much bullish vs bearish comments. Both are little than usual, Santiment said successful an X station connected Wednesday.

At the aforesaid time, little than fractional the comments connected societal media astir XRP (XRP) are bullish, making it 1 of the astir “fearful moments of 2025” for the token.

A sell-off could beryllium a positive for the market

Crypto marketplace sentiment remains fearful arsenic the broader marketplace continues to slump. Analysts person attributed it to a scope of macroeconomic factors, like traders shifting to assets with clearer exposure to economical policies and recognition flows, arsenic the extremity of the US Government shutdown looms.

The Crypto Fear & Greed Index, which tracks wide marketplace sentiment, returned a people of 15 retired of 100 connected Thursday, marking “extreme fear,” the lowest standing since February.

Joe Consorti, caput of Bitcoin maturation astatine trading and liquidity protocol Horizon, said the wide sentiment among traders is astatine the aforesaid level it was successful 2022, erstwhile Bitcoin was astir $18,000, citing information from Glassnode.

However, Santiment said traders’ souring moods could beryllium “welcomed quality for the patient,” and substance an “unexpected November rally,” due to the fact that determination are much diamond-handed holders waiting to drawback up what weaker hands sell.

“When the assemblage turns antagonistic connected assets, particularly the apical marketplace caps successful crypto, it is simply a awesome that we are reaching the constituent of capitulation,” Santiment said.

“Once retail sells off, cardinal stakeholders scoop up the dropped coins and pump prices. It’s not a substance of if, but erstwhile this volition adjacent happen.”Samson Mow, the laminitis of Bitcoin exertion infrastructure institution Jan3, who argued the Bitcoin bull tally is yet to statesman past week, shared a akin sentiment connected Tuesday, claiming that “newish buyers” are the lone ones selling and traders with semipermanent holding plans are utilizing it arsenic a accidental to stack much crypto into their wallets.

Related: Bitcoin whale and retail large ‘divergence’ is simply a informing sign: Santiment

Holders with condemnation snapping up coins

Mow argues that selling unit is coming from radical who bought Bitcoin successful the past 12 to 18 months and are taking profits owed to fears that the rhythm has peaked.

“These are not Bitcoin buyers from archetypal principles, but alternatively speculators that travel the news,” helium said.

“This cohort of sellers is besides depleted, and HODLers with condemnation person present taken their coins, which is ever the champion lawsuit scenario. 2026 is going to beryllium a large year. Plan accordingly.”Magazine: Good luck suing crypto exchanges, marketplace makers implicit the flash crash

3 weeks ago

3 weeks ago

English (US)

English (US)