Fighting speculation is warring reality, Stocktwits CEO and co-founder Howard Lindzon argues.

Oct 4, 2025, 1:00 p.m.

Traditional concern firms each person the aforesaid mantras: “time successful the marketplace beats timing,” “move slowly,” and “big wealth is successful the waiting.” It’s an enactment program that made consciousness 20 years ago, but today, it’s a definite strategy for getting steamrolled by forces astir of these firms garbage to acknowledge.

The uncomfortable information is that markets nary longer tally connected conscionable net reports and equilibrium sheets; they tally connected stories, memes, and taste ideas that summation momentum done societal communities similar X and Reddit and determination faster than analysts tin reliably support way of. As overmuch arsenic we privation to telephone GameStop a glitch, it’s lone a preview of however markets present work. Crypto investors had an outsized relation successful driving this displacement that spilled implicit into accepted markets.

And now, retail investors person evolved from spectators to progressive marketplace movers and makers, equipped with platforms that fto them coordinate, analyze, and enactment upon marketplace quality astatine standard and unprecedented speed. While not each retail capitalist tin outpace nonrecreational analysts, the astir plugged-in communities person shown they tin collectively determination faster than institutions inactive operating by outdated playbooks. Look astatine Reddit’s WallStreetBets users, who drove the 2021 GameStop rally that led to monolithic losses for abbreviated sellers, citing that retail traders were the existent unit down the marketplace upheaval. Investors who person learned to work the taste signals and narratives alongside fiscal ones volition enactment ahead.

Markets Don’t Crash From Speculation

A Wall Street concealed is that markets don’t clang due to the fact that of meme stocks — they clang due to the fact that of stubborn loyalty to yesterday’s winners. The historical Dot-com Bubble didn’t burst due to the fact that traders shifted their attention, but due to the fact that some organization and retail investors were successful denial astir manufacture over-valuation. Instead of recognizing the underlying stories that showed aboriginal signs of tech stocks’ crumbling prices, they chose to enactment their spot successful past performance.

Crashes hap erstwhile condemnation successful positions hardens into unsighted religion and unquestioning belief, and markets unit a hard reset. Speculation keeps markets honorable by forcing changeless reevaluation. Retail investors bash this regular by actively debating a banal oregon token’s prospects oregon heavy diving into institution fundamentals with chap marketplace participants. When they prosecute critically and stress-test each communicative successful existent time, they execute an invaluable and progressively uncommon work arsenic the progressive plus absorption manufacture shrinks successful favour of passive investing strategies.

The smartest retail investors thrust a banal oregon token’s momentum but pivot arsenic soon arsenic the communicative changes. Their willingness to beryllium incorrect and accommodate rapidly helps forestall the benignant of slow-moving organization groupthink that leads to monolithic corrections, portion inactive acknowledging that adjacent retail communities tin autumn into faster, much volatile herd behavior. This premix of flexibility and corporate attraction makes them a uniquely influential unit successful today’s markets.

Retail Runs the Show - and It’s About Time

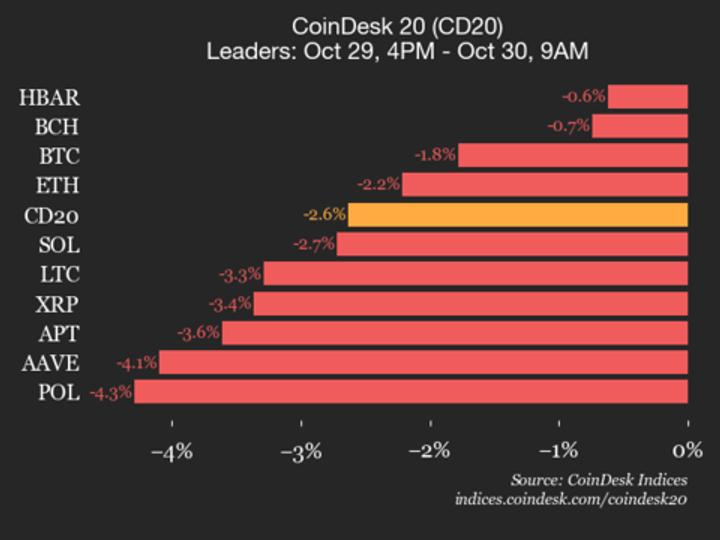

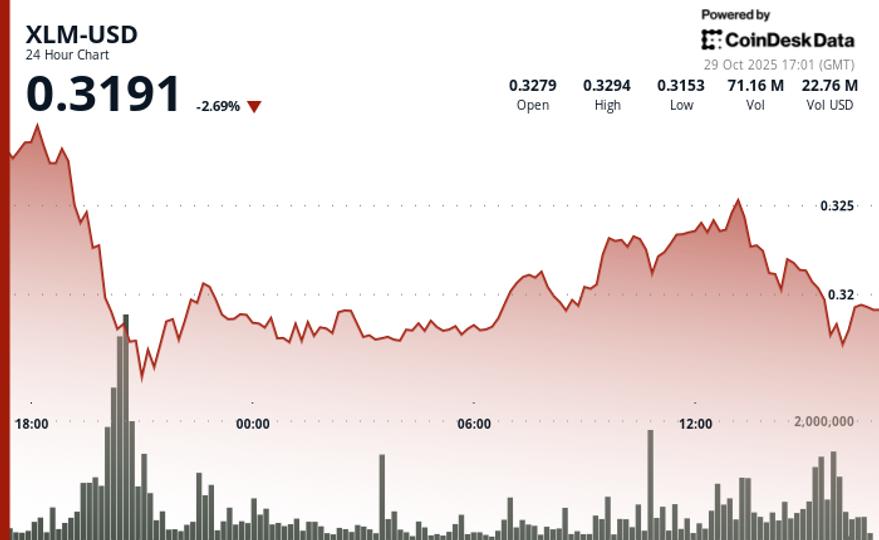

Retail banal trading is up to 20-35% of measurement successful the U.S. and UK alone, portion crypto commercialized measurement has besides surged this past period exceeding a total marketplace headdress of $4T, but the alteration they’re forcing isn’t numbers — it’s intelligence. They’re networked, fast, and often spot trends earlier your dad’s broker does. Communities connected platforms similar Reddit and Discord tin collectively analyse news, filings, and net calls, surfacing insights that sometimes drawback organization investors disconnected guard. During the AMC rally, coordinated attraction from retail communities amplified terms swings and forced organization adjustments. Today, AI-driven tools and acquisition platforms are making retail investors much capable and informed than ever, allowing them to process information and sentiment successful existent time. They mightiness not ever beryllium right, but they’re influential capable to matter.

Taking a leafage retired of what crypto has been doing for years, immoderate companies are starting to get it: CEOs present prosecute straight with retail communities, and IR departments way societal sentiment. They recognize the passionateness retail investors person for their stocks and are much consenting to instrumentality with them done mediocre show than with an instauration that’s judged connected quarterly performance.

Fighting Speculation is Fighting Reality

It’s 2025 and talking heads are inactive informing astir however the gambling mentality is ruining terms discovery, pointing to meme stocks and crypto volatility arsenic impervious that retail has turned markets into a casino floor. They accidental that embracing speculation encourages mediocre decision-making, marketplace instability, and over-exposure to risk. This mode of reasoning misses that prices person ever been driven by corporate beliefs astir aboriginal values. Now that much radical are capable to participate, it’s conscionable happening faster.

Crypto is the eventual example. Early critics called it axenic speculation, divorced from the fundamentals of marketplace movements, but it was really conscionable genuine terms find happening astatine warp speed. The crypto marketplace tested much ideas successful a fewer years than accepted VCs could research successful a decade. While immoderate ideas were garbage, the winners were massive.

How Do You Win successful the New Game?

Don’t propulsion the fundamentals retired the model conscionable yet — occurrence involves a hybrid attack of coagulated investigation and communicative awareness. More often than not, a large institution with a boring communicative volition underperform a decent institution with a compelling narrative. Success means knowing narratives tin alteration rapidly and taking positions that capitalize connected that.

By diversifying based connected assets and stories, hazard absorption is much comprehensive. It allows investors to enactment plugged into the communities and platforms wherever market-moving conversations are happening, portion being consenting to admit being excessively definite astir immoderate presumption means you whitethorn beryllium mounting yourself up for a achy acquisition successful marketplace dynamics. However, it’s besides astir being capable to separate betwixt marketplace volatility and noise, and recognizing the favoritism betwixt morganatic investigation and the misinformation that tin dispersed rapidly successful these communities.

Adapt oregon Get Left Behind

Retail is present to enactment — the exertion exists and the communities support growing. By acknowledging this is the caller mean and learning to navigate societal quality and narrative-driven momentum, each investors similar volition thrive. The aboriginal belongs to those who are flexible and tin grow their toolkits beyond net reports and equilibrium sheets to a satellite wherever accusation flows instantly and communities coordinate buying and selling successful existent time.

Speculation lets investors work some the fundamentals and societal sentiment to spot undervalued assets and emerging narratives earlier the crowds drawback on. Read the signals and adapt, oregon ticker from the sidelines.

Note: The views expressed successful this file are those of the writer and bash not needfully bespeak those of CoinDesk, Inc. oregon its owners and affiliates.

More For You

Tokenization Could Revitalize Chile’s Struggling Pension System

Recent reforms are a measurement toward improving Chile’s pension strategy — but without embracing tokenization and different technological innovations, the strategy whitethorn proceed to lag, argues María Pía Aqueveque Jabbaz.

3 weeks ago

3 weeks ago

English (US)

English (US)