In a caller interrogation with Bloomberg, Reggie Browne, Co-Global Head of ETF Trading and Sales astatine GTS, shared insightful predictions regarding the imaginable trading dynamics of spot Bitcoin exchange-traded funds (ETFs). Browne foresees these ETFs trading astatine a important premium, estimating arsenic precocious arsenic 8% supra their nett plus worth (NAV).

Why Spot Bitcoin ETFs Could Trade At A 8% Premium To NAV

“I deliberation the spreads volition beryllium precise competitory and tight. The marketplace shaper assemblage is resilient and prepared to connection a batch of liquidity,” Browne stated. However, helium highlighted a captious concern, saying, “I deliberation it’s going to beryllium the premium to NAV… US broker dealers can’t commercialized Bitcoin currency wrong their broker dealers. So you’re going to person to commercialized hedges implicit futures and commercialized it connected a premium, and past instrumentality that off, and I deliberation determination is simply a batch of complexity there.”

This complexity, according to Browne, arises from the currency instauration exemplary forced by the SEC and regulatory constraints that bounds nonstop Bitcoin trading wrong US broker dealers, compelling them to trust connected futures for hedging. He expressed, “What I think, potentially, you could spot 8% of premium supra just value. It’s a large number, but let’s spot however it plays out.”

Additionally, Browne touched upon the taxable of in-kind creations and redemptions, aspects that were points of contention during negotiations with the Securities and Exchange Commission (SEC). Despite the challenges, helium remains optimistic astir their aboriginal implementation. “Absolutely, I deliberation this was truly conscionable to get the shot moving… the in-kind volition travel aft we ascent a mates of mountains,” Browne remarked.

Echoing Browne’s sentiments, Eric Balchunas, a Bloomberg ETF expert, commented connected the imaginable premium, expressing astonishment astatine the anticipated precocious rate. He drew a examination with Canada’s spot ETFs, which are besides currency creations but person overmuch smaller premiums, contempt occasional spikes.

[Browne] thinks bid-ask spreads connected spot ETFs volition beryllium choky but (thx to currency lone creations) premiums could beryllium arsenic precocious arsenic 8%. That’s truly precocious and I’m a spot shocked tbh. For discourse Canada spot ETFs are currency creations and their premiums are precise small.. albeit the occasional 2% day.

The crypto assemblage is intimately monitoring the SEC arsenic it approaches a captious deadline to determine connected the archetypal batch of respective spot Bitcoin ETF applications by tomorrow, January 10. Prominent plus managers specified arsenic BlackRock, Fidelity, Ark Invest, Bitwise, Franklin Templeton, Grayscale, WisdomTree, and Valkyrie are among those with pending applications.

Browne believes that the support of spot Bitcoin ETFs could pull important capitalist interest, projecting monolithic inflows implicit the archetypal year. “I expect investors to adhd astatine slightest $2 cardinal to spot Bitcoin ETFs wrong the archetypal 30 days they trade, if approved. For the afloat year, I spot $10 billion-$20 cardinal successful the funds,” helium noted. This prediction underscores the important involvement and imaginable marketplace interaction of spot Bitcoin ETFs.

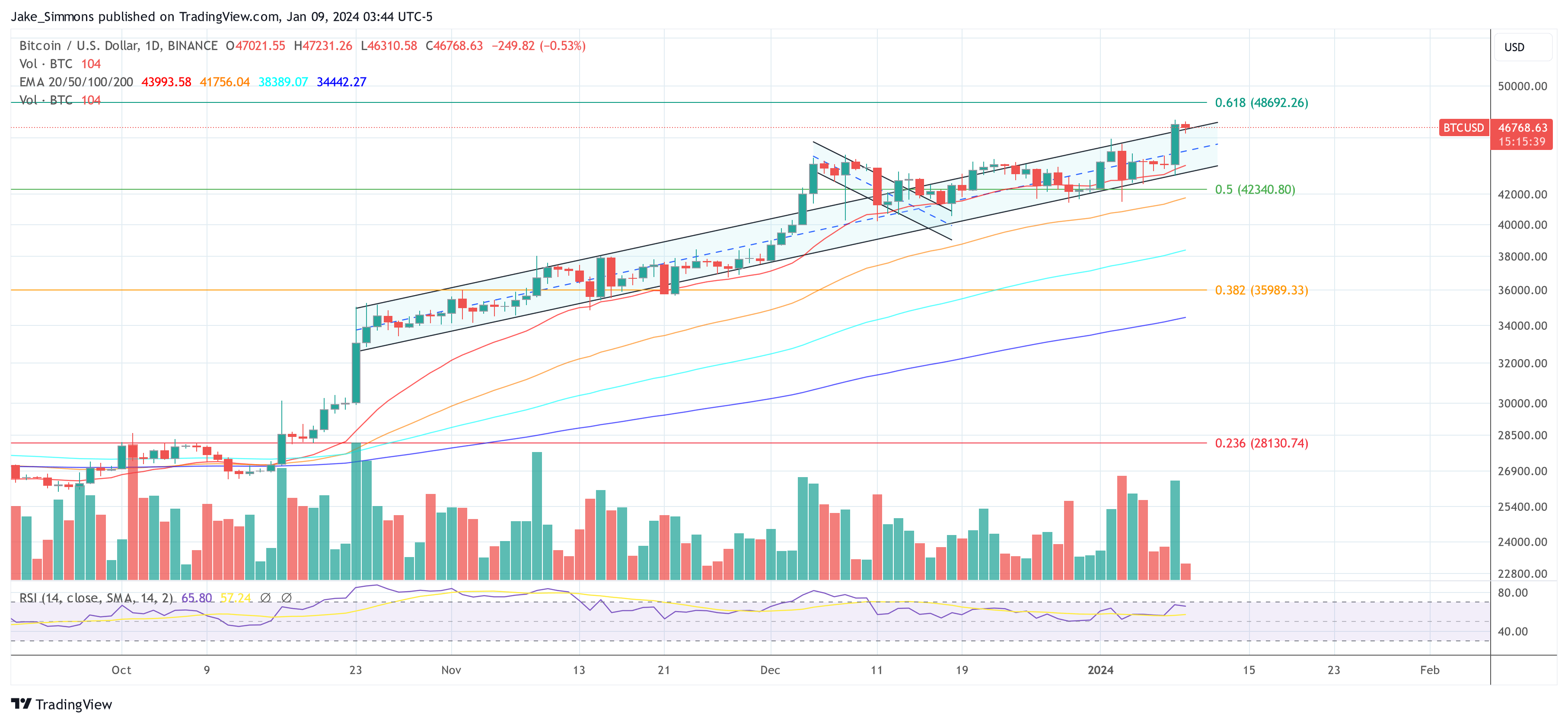

At property time, BTC traded astatine $46,768.

BTC terms rallied to $47,000, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC terms rallied to $47,000, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from Shutterstock, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)