Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Capital poured into US-listed Bitcoin exchange-traded funds this week, with Tuesday unsocial witnessing astir $1 cardinal successful caller cash.

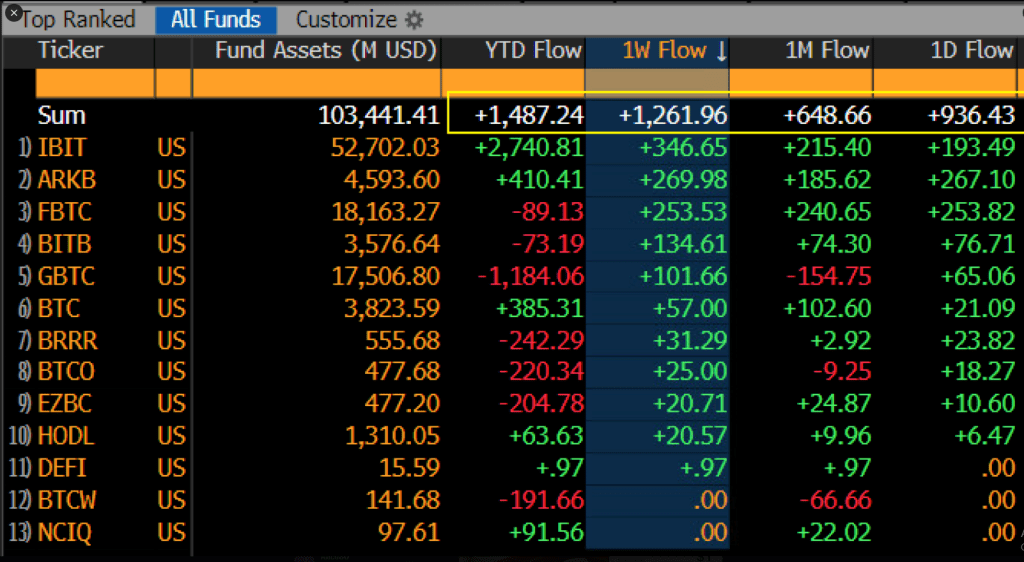

The unreserved propelled play inflows to $1.2 cardinal and full assets nether absorption (AUM) to $103 billion, based connected Bloomberg data. The concern deluge occurred portion Bitcoin’s terms roseate supra $93,000, reaching $93,700 – its highest since aboriginal March.

BlackRock Fund Remains Top Dog Among Rivals

BlackRock’s iShares Bitcoin Trust (IBIT) remains astatine the forefront with year-to-date inflows of $2.7 billion. The money took successful different $346 cardinal past week alone.

Ark Invest’s ARKB and Grayscale’s Bitcoin funds lag down with importantly smaller year-to-date inflows of $410.41 cardinal and $385.31 million.

Not everything is coming up roses, however. Grayscale’s GBTC has seen $1.18 cardinal of outflows since January, going against the wide affirmative tide.

The spot bitcoin ETFs went Pac-Man mode yesterday, +$936m, $1.2b for week. Also notable is 10 of 11 of the originals each took successful currency too. Good motion to spot travel extent vs accidental $IBIT doing 90% of the lifting. Price up $93.5k. Pretty beardown each things considered IMO. pic.twitter.com/HeLwffgT8F

— Eric Balchunas (@EricBalchunas) April 23, 2025

Increasing Institutional Confidence Reflected In Broad Participation

Ten of 11 spot Bitcoin ETFs saw inflows of caller funds this week, Bloomberg elder ETF expert Eric Balchunas reported. They’re going “Pac-Man mode”, the expert said connected X. That broad-based engagement indicates organization players are diversifying their bets into respective funds alternatively than focusing connected 1 oregon two.

The worth traded crossed each Bitcoin spot ETFs totaled $496 million, portion nett assets successful them present correspond astir $57 cardinal – equivalent to astir 2.80% of Ethereum’s marketplace cap.

Ethereum Products Keep Losing Streak While XRP Shocks

As Bitcoin-linked investments thrive, Ethereum products simply can’t look to get a break. According to reports from CoinShares, concern products centered astir Ethereum mislaid yet different $26.7 cardinal past week.

This takes their eight-week outflow magnitude to a mind-boggling $772 million. Even successful the look of this continued outflow, Ethereum remains successful 2nd spot for year-to-date inflows astatine $215 million.

Short Bitcoin Products Under Ongoing Pressure

Short Bitcoin products are experiencing the squeeze. Short BTC products had their seventh consecutive week of outflows, with $1.2 cardinal exiting these funds.

CoinShares information amusement that these abbreviated bets person present mislaid $36 cardinal implicit 7 weeks – 40% of their assets nether management. The ongoing outflows from abbreviated positions are accordant with Bitcoin’s caller terms strength.

XRP is the lone objection among alternate coins, and its concern products attracted implicit $37 cardinal past week, the 3rd highest for year-to-date inflows connected $214 million. This defies the inclination observed successful astir of the different altcoins, which inactive look selling pressure.

Certainly, each of this caller wealth being poured into Bitcoin ETF investments is possibly the clearest motion yet that accepted fiscal institutions are coming astir to cryptocurrency arsenic an plus class.

We’re talking astir $1 cardinal coming into the marketplace successful conscionable 1 day: this looks similar the dawn of a caller epoch successful which acceptance of the plus people by the mainstream is adjacent greater.

Featured representation from Wallpapers.com, illustration from TradingView

7 months ago

7 months ago

English (US)

English (US)