On Wednesday, January 10, the US Securities and Exchange Commission (SEC) finally approved the motorboat of spot Bitcoin ETFs, representing a singular lawsuit successful US trading history.

So far, marketplace information connected these concern funds person confirmed theories of accrued organization request for Bitcoin, with implicit $800 cardinal successful full nett inflows and $3.6 cardinal successful trading measurement recorded crossed the archetypal 2 days of trading.

Although these inflows are yet to beryllium reflected in BTC’s price, arsenic the premier cryptocurrency dipped by 2% successful the past week, the spot Bitcoin ETFs person surely kicked disconnected with a blast which is indicative of imaginable gains for the world’s largest plus and the wide crypto market.

Spot Bitcoin ETFs Attract Over $1.4 Billion In Two Days – Bloomberg Data

In an X post connected January 13, Bloomberg ETF expert Eric Balchunas shared immoderate penetration connected the awesome show of the spot Bitcoin ETFs successful their debut trading week.

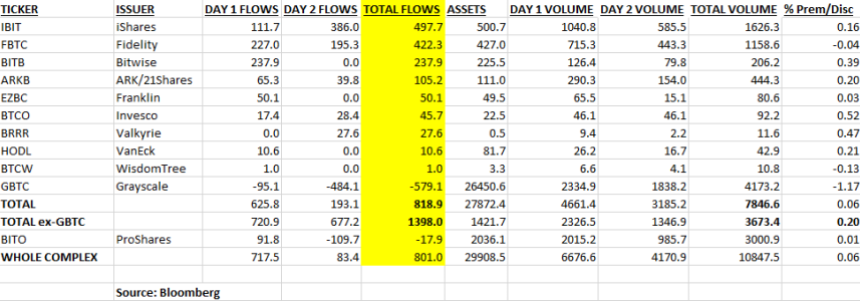

Balchunas noted that of the 11 approved spot BTC ETFs, 9 person recorded a full inflow of implicit $1.4 billion. Leading the batch is BlackRock’s IBIT, with an estimated plus inflow of $497.7 million, intimately followed by Fidelity’s FBTC, which boasts astir $422.3 cardinal successful investment.

The BTC spot ETFs of Bitwise and ARK/21 Shares person besides produced a importantly affirmative show attracting $237.9 cardinal and 105.2 million, respectively. On the different hand, Grayscale’s GBTC has been the marketplace outcast, signaling a stunning $579 cardinal successful outflows implicit the archetypal 2 days of trading.

Following the SEC’s support connected Wednesday, investors cashed successful heavy connected GBTC, which was precocious converted from a closed-end money to a spot ETF. SkyBridge Capital laminitis Anthony Scaramucci has already commented connected this inclination describing it arsenic 1 of the imaginable reasons down Bitcoin’s dip successful the past week.

In total, the spot Bitcoin ETF marketplace recorded an awesome nett inflow of $818.9 cardinal successful its debut trading week. These figures are apt to amended successful the adjacent fewer weeks arsenic selling measurement yet declines. Meanwhile, investors inactive expect the debut of Hashdex’s spot ETF – DEFI – which is undergoing money conversion from the company’s Bitcoin futures ETF.

BTC Price Overview

At the clip of writing, Bitcoin exchanges hands astatine $42,980 reflecting a 0.73% nonaccomplishment successful the past day. Meanwhile, the token’s regular trading measurement has plummeted by 62.33% and is present valued astatine $16.9 billion. However, with a marketplace headdress of $842.23 billion, Bitcoin remains the largest cryptocurrency successful the world.

Featured representation from Yahoo Finance, illustration from Tradingview

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)