Crypto volition go much profoundly integrated into accepted concern (TradFi) done exchange-traded funds (ETFs) and firm holdings this year, according to crypto-trading steadfast Wintermute.

In addition, a ample firm lawsuit specified arsenic an acquisition oregon merger volition beryllium settled successful stablecoins, the marketplace shaper and liquidity supplier said successful an yearly reappraisal and outlook.

Among its different forecasts:

The U.S. volition statesman consultations to make a strategical bitcoin reserve, with China, the UAE and Europe pursuing suit.

A publically listed institution volition merchantability indebtedness oregon shares to bargain ether (ETH), mimicking MicroStrategy's (MSTR) bitcoin acquisition policy.

A systemically important slope volition connection spot cryptocurrency trading to clients.

The predictions travel important request maturation past year, which saw over-the-counter (OTC) trading organization trading volumes much than triple pursuing the support past January of bitcoin (BTC) ETFs and aboriginal accomplishment of ether (ETH) ETFs. The study attributed the involvement to improved regulatory clarity and request for capital-efficient trading. The mean OTC commercialized size accrued 17% and full measurement 313%, it said.

Derivatives volumes grew by implicit 300%, driven by institutions searching for much blase output and hazard absorption instruments. In spot trading, Wintermute noted a record-breaking single-day OTC measurement of $2.24 billion, surpassing 2023's play grounds of $2 billion.

Shift successful Asset Preferences

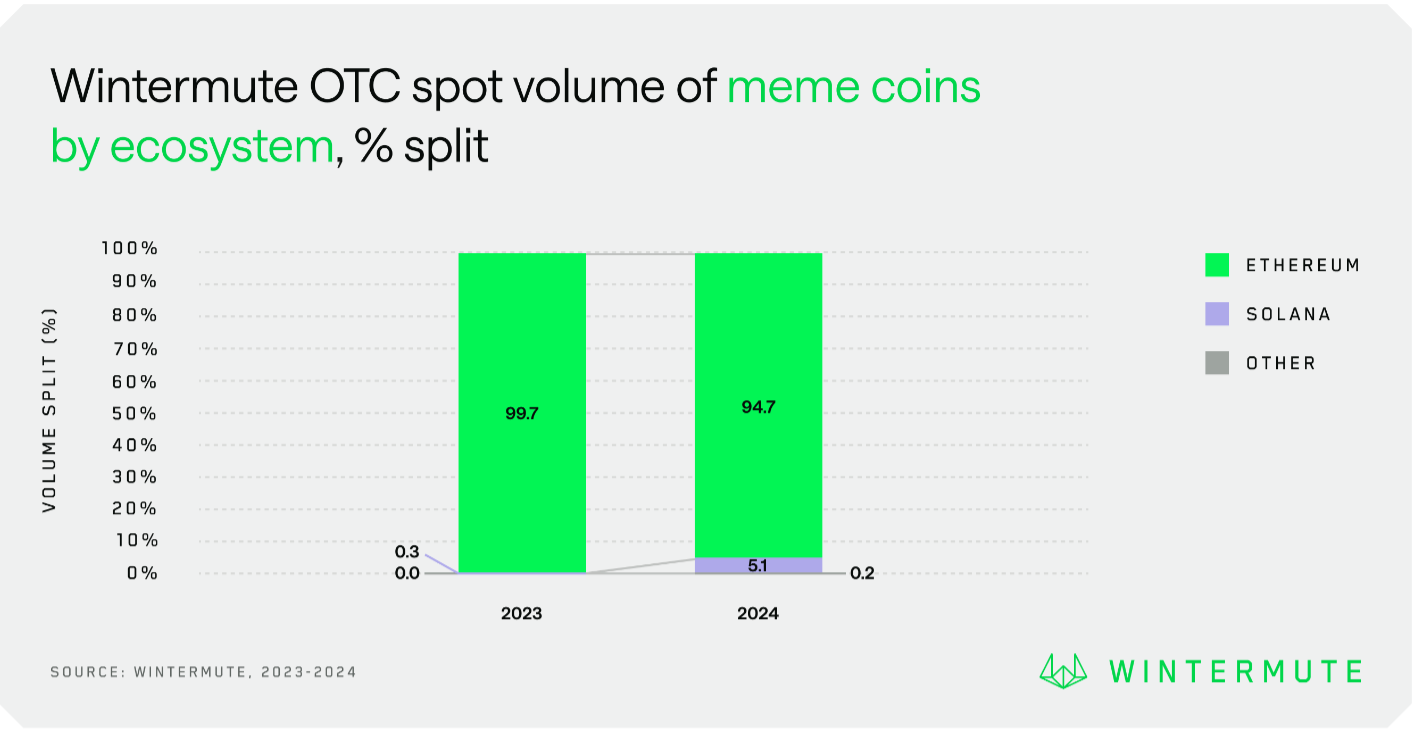

Memecoins were 1 of the occurrence stories successful 2024, seeing their marketplace stock much than treble to 16%. This was chiefly driven successful the Solana ecosystem by tokens specified arsenic dogwifhat (WIF), bonk (BONK) and ponke (PONKE), though ether continues to dominate.

"We saw record-breaking maturation driven by request for blase products similar CFDs and options, reflecting a maturing marketplace that progressively mirrors accepted finance," CEO Evgeny Gaevoy said successful the report. "We expect adjacent greater momentum arsenic crypto integrates deeper into planetary fiscal infrastructure done ETFs, firm holdings, tokenization, and the emergence of structured products."

11 months ago

11 months ago

English (US)

English (US)