During the past 12 months the stablecoin system has grown monolithic and the existent valuation contiguous is lone $13 cardinal distant from tapping the $200 cardinal mark. This month, the 2 biggest gainers successful presumption of 30-day issuance see Terra’s UST jumping 29.9% and Neutrino Protocol’s USDN spiking 43.8%.

Stablecoin Market Capitalization Continues to Swell, Tether Crosses $80 Billion

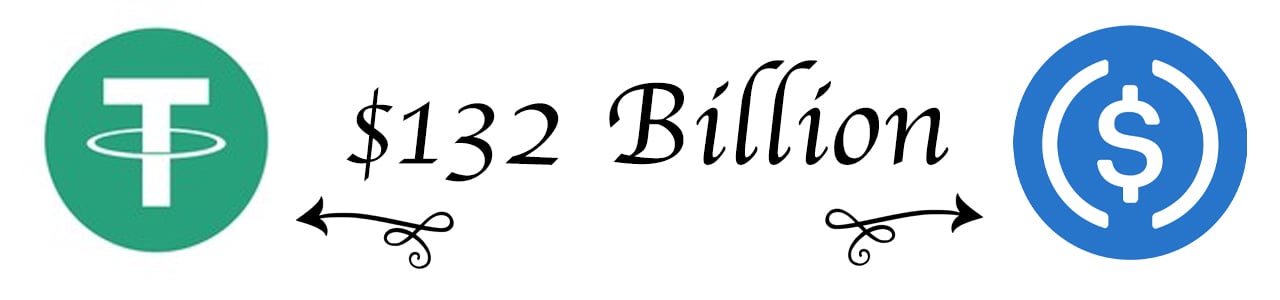

Monthly statistic amusement the largest stablecoin successful presumption of marketplace capitalization, tether (USDT), accrued by 2% this period arsenic the valuation crossed the $80 cardinal mark. USDT is monolithic compared to the remainder of the stablecoins successful the crypto system arsenic its valuation represents 42.78% of the $187 cardinal stablecoin system today.

Furthermore, tether’s $80 cardinal marketplace capitalization equates to 4.46% of the full $1.83 trillion crypto economy. The second-largest stablecoin successful presumption of marketplace capitalization, usd coin (USDC) lone accrued by 0.3% this past month.

USDC has a marketplace valuation of astir $52.3 cardinal contiguous which equates to 2.92% of the crypto system and 27.96% of the stablecoin economy. Metrics connected March 14, 2022, bespeak that betwixt USDC and USDT, the marketplace capitalizations combined equate to much than 70% of the full stablecoin economy.

The combined full of some USDT’s and USDC’s marketplace caps equates to $132 cardinal connected March 14, 2022.

The combined full of some USDT’s and USDC’s marketplace caps equates to $132 cardinal connected March 14, 2022.The apical assets exchanging hands with tether (USDT) is the U.S. dollar with 42.16% of today’s stock and the Turkisk lira (TRY) with 17.41% of tether trades. TRY is followed by the euro, WBNB, and HUSD. USDC trades a batch with tether arsenic USDT represents 64.18% of Monday’s tether swaps. BUSD, USD, EUR, and WETH each travel tether arsenic the apical pairs trading with usd coin (USDC).

USDN, UST, and FRAX Record 30-Day Issuance Rises, Stablecoins Command 10% of the Entire Crypto Economy’s Net Value

While USDT and USDC did not spot immoderate important increases implicit the past month, UST, FRAX, and USDN saw their 30-day issuance complaint rise. Terra’s UST accrued by 29.8% and today, the stablecoin has a marketplace capitalization of astir $14.7 cardinal astatine the clip of writing.

Out of the apical 10 stablecoins during the past 30-days, Neutrino Protocol’s USDN roseate by 43.8% and Terra’s UST accrued by 29.8%.

Out of the apical 10 stablecoins during the past 30-days, Neutrino Protocol’s USDN roseate by 43.8% and Terra’s UST accrued by 29.8%.Frax (FRAX), saw its 30-day issuance complaint leap by 9.6% and Neutrino Protocol’s USDN roseate by 43.8% during the past month. FRAX has a $2.9 cardinal marketplace valuation and USDN commands a $638 cardinal marketplace capitalization today.

Makerdao’s stablecoin DAI, saw issuance levels dip during the past period down 4.6% and magic net wealth (MIM) saw a nonaccomplishment of 0.2% this past month. The Ethereum-based DAI has a $9.3 cardinal marketplace valuation, portion the Avalanche-based MIM has a $2.7 cardinal marketplace capitalization.

Overall, the full stablecoin system lone has $13 cardinal much to emergence earlier crossing the $200 cardinal zone. At the clip of writing, the $187 cardinal stablecoin system represents implicit 10% of the $1.83 trillion crypto economy.

Tags successful this story

$132 billion, $52 billion, $80 billion, Altcoins, DAI, FRAX, growth, increase, issuance, issuance levels, Magic Internet Money, MIM, Neutrino Protocol, Stablecoin Economy, stablecoin marketplace cap, Stablecoins, Swelling, Terra, Tether, tether marketplace cap, USDC, USDC marketplace valuation, USDN, USDT, UST

What bash you deliberation astir the stablecoin economy’s continued growth? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)