Stablecoins person go salient outgo rails successful the satellite of cryptocurrencies commanding $177 cardinal successful fiat worth today. The apical 10 stablecoins by marketplace capitalization correspond the largest stock of the worth successful the fiat-pegged coin system and galore of these tokens grew exponentially past year. Terra’s UST stablecoin grew the astir past year, jumping 5,431% successful 2021.

A Deep Dive Into Stablecoin Growth During the Course of 2021

Stablecoins contiguous correspond 9.77% of the $1.8 trillion crypto-economy contiguous which is $177 cardinal successful USD value. While galore integer assets surged successful maturation past year, stablecoins besides saw their marketplace valuations swell arsenic issuance grew period aft month.

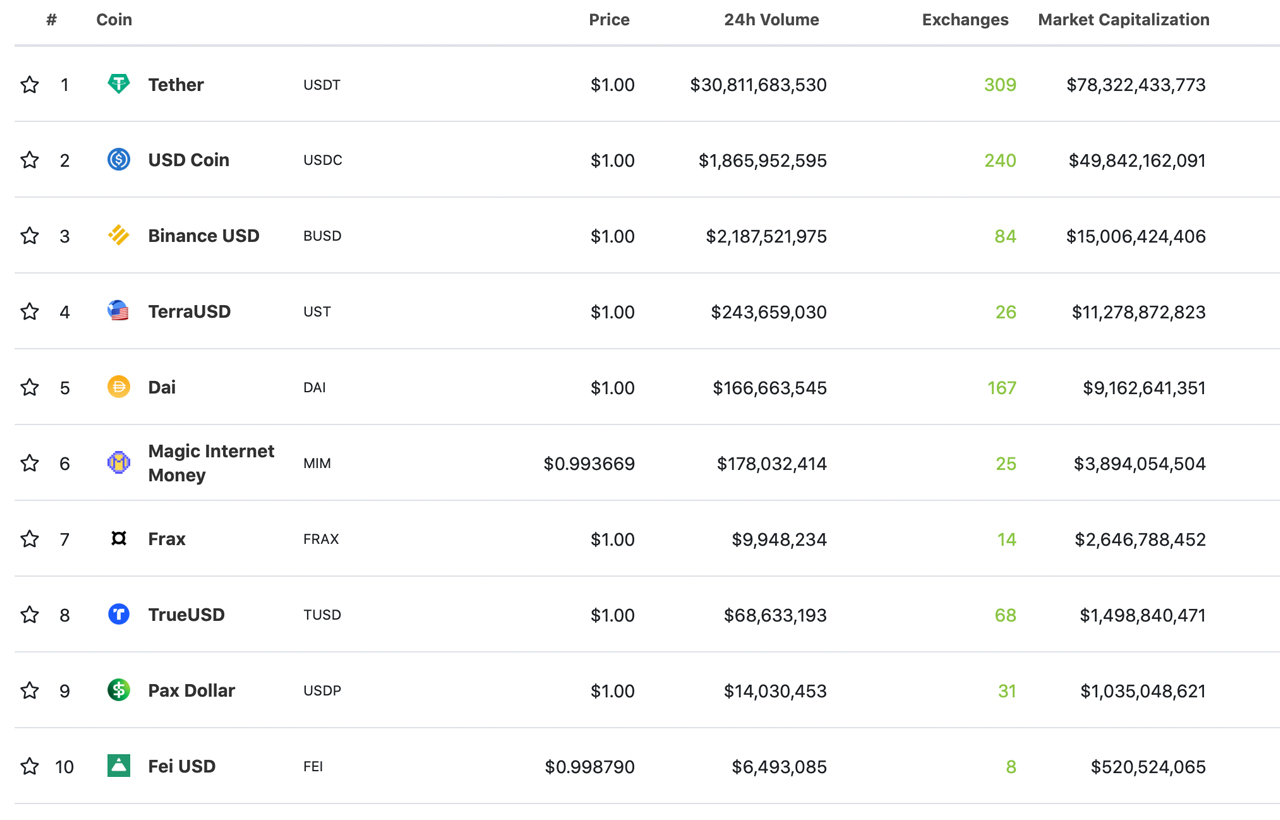

Tether (USDT) is the apical stablecoin, successful presumption of marketplace capitalization with $78.3 billion. USDT unsocial represents 4.32% of the full crypto economy’s $1.8 trillion and amid the $177 cardinal stablecoin economy, USDT towers implicit the battalion by 44.24%.

The apical 10 stablecoins by marketplace valuation connected January 30, 2022. Metrics for this station measurement the maturation of stablecoins betwixt January 1, 2021, and up until the archetypal of this year.

The apical 10 stablecoins by marketplace valuation connected January 30, 2022. Metrics for this station measurement the maturation of stablecoins betwixt January 1, 2021, and up until the archetypal of this year.On January 2, 2021, tether (USDT) had a marketplace headdress of astir $21.2 cardinal and by January 2, 2022, this grew by 269.81% to $78.4 billion. Usd coin (USDC) erstwhile had a marketplace headdress of $4.1 cardinal connected January 1, 2021, and astir 12 months aboriginal it grew 936.58% to $42.5 billion.

The third-largest stablecoin binance usd (BUSD) had a marketplace valuation of astir $1.07 cardinal connected the archetypal of the twelvemonth successful 2021, and connected the archetypal time of 2022, it was $14.4 cardinal seeing a 1,245.79% increase.

Terra’s UST stablecoin grew by 5,431.22% successful 12 months from $182.6 cardinal connected January 1, 2021, to $10.1 cardinal connected the aforesaid time successful 2022. Makerdao’s DAI grew by 641.66% from $1.2 cardinal connected January 1, 2021, to $8.9 cardinal by January 1, 2022.

Magic net wealth (MIM) was not astir connected January 1, 2021, but 128 days agone oregon 4 months ago, MIM had a marketplace headdress of astir $879 million. MIM grew by 422.18% successful 4 months to $4.59 cardinal by January 1, 2022.

The stablecoin frax (FRAX) had a $71 cardinal marketplace headdress connected January 1, 2021, and connected the aforesaid time successful 2022, it was $1.8 billion. FRAX grew by a whopping 2,435.21% successful 12 months’ time. The eighth-largest stablecoin trueusd (TUSD) grew by 322.54% betwixt January 1, 2021, to January 1 of this year.

TUSD’s marketplace headdress past twelvemonth was $284 cardinal and connected January 2, 2022, it was $1.2 billion. Pax dollar (USDP) had a valuation of astir $346 cardinal connected January 1, 2021, and 12 months aboriginal it was $1 cardinal increasing 189.02%.

Lastly, the tenth-largest stablecoin fei usd (FEI) doesn’t person a marketplace headdress for January 1, 2021, but 301 days agone oregon 9 months ago, it was $2.3 cardinal connected April 4, 2021. FEI’s marketplace headdress really shrunk during the 12 period play by 66.08% to $780 million.

Tags successful this story

What bash you deliberation astir the issuance increases stablecoins saw betwixt January 1, 2021 up until the aforesaid time this year? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)