On October 13, 2022, Tether Holdings Limited announced that the stablecoin issuer has reduced the company’s commercialized insubstantial holdings down to zero. The institution has said it would scope this extremity for a portion now, and Tether says that shrinking commercialized insubstantial holdings down to zero “demonstrates Tether’s committedness to backing its tokens with the astir unafraid reserves successful the market.”

Tether Axes $30 Billion Worth of Commercial Paper Holdings, Firm Leverages US T-Bills Instead

The institution down the largest stablecoin by marketplace capitalization, Tether, has revealed that USDT’s reserves are exposed to U.S. Treasury Bills (T-Bills), successful opposition to commercialized insubstantial holdings. The announcement follows the connection Tether’s main exertion serviceman Paolo Ardoino made connected October 3.

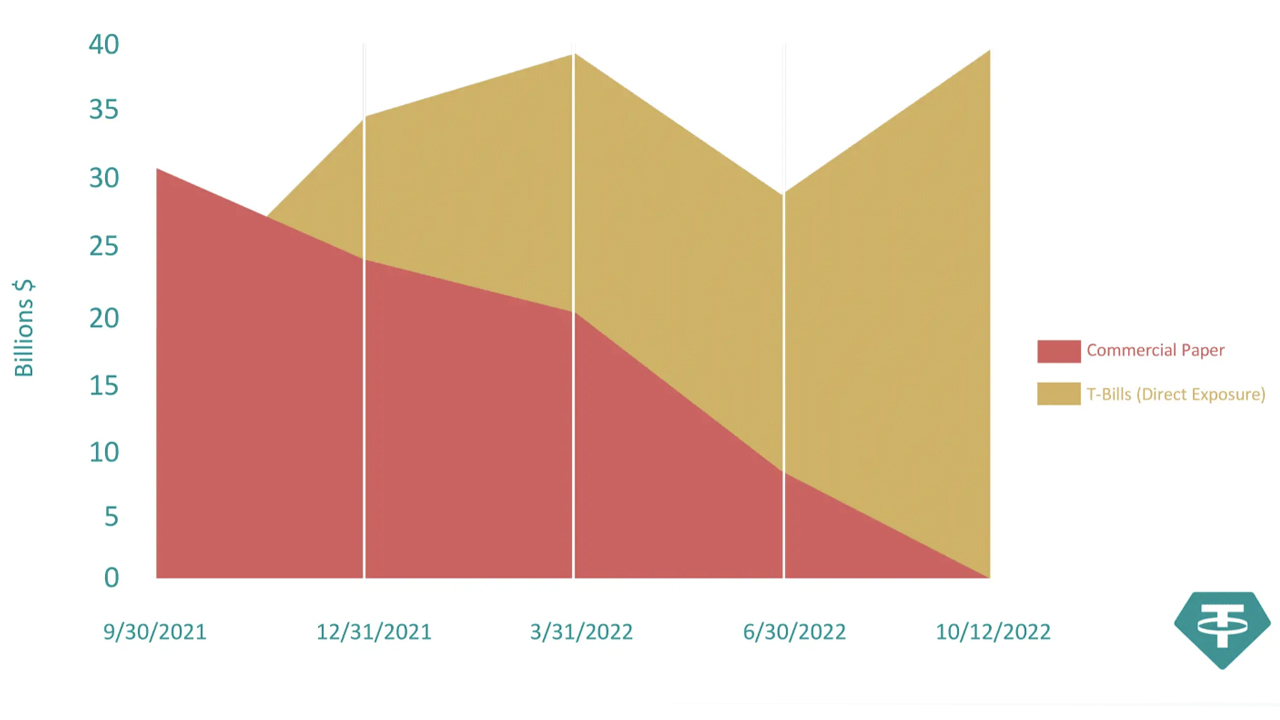

Tether-created illustration that shows the stablecoin’s simplification successful commercialized insubstantial holdings.

Tether-created illustration that shows the stablecoin’s simplification successful commercialized insubstantial holdings.At the time, Ardoino explained that U.S. Treasury bills represented much than 58% of the company’s reserves, and helium further said “ [Commercial paper] vulnerability is [less than] 50M now.” The institution that manages USDT, a stablecoin with a marketplace valuation of astir $68.53 billion, believes the determination to erase commercialized insubstantial holdings is affirmative for the crypto manufacture arsenic a whole.

“Reducing commercialized papers to zero demonstrates Tether’s committedness to backing its tokens with the astir unafraid reserves successful the market,” the institution stated connected Thursday. “This is simply a measurement towards adjacent greater transparency and trust, not lone for Tether but for the full stablecoin industry.”

Tether’s Move Follows the Terra Stablecoin Collapse 5 Months Ago, Both Tether and Usd Coin Have Shed Billions Since Then

Tether’s determination follows the issues associated with the Terra blockchain and the UST de-pegging lawsuit past May. Furthermore, a fistful of stablecoins person de-pegged from the $1 parity pursuing UST’s collapse. The quality besides follows the stablecoin USDC’s marketplace headdress deflating during the past fewer months down to today’s valuation of astir $45.82 billion.

USDT’s marketplace headdress dropped arsenic well, pursuing the Terra collapse, arsenic Bitcoin.com News reported successful mid-June that the fig of USDT successful circulation dropped by implicit 12 cardinal coins successful 2 months. Despite the drops of USDT and USDC successful circulation, the stablecoins are inactive the apical 2 stablecoin assets by marketplace cap, and the 3rd (USDT) and 4th (USDC) largest crypto assets by valuation.

Tags successful this story

Commercial Paper, Commercial Paper Holdings, commercial insubstantial USDT, consolidated reserves report, dollar-pegged crypto, Paolo Ardoino, stablecoin assets, Stablecoin Reserves, stablecoins fluctuate, T-notes, Tether, Tether CTO, Treasuries, us treasuries, US Treasury Bills, US Treasury notes, usd coin, USDC, USDT

What bash you deliberation astir Tether fulfilling the company’s committedness to trim commercialized insubstantial holdings down to zero? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Tether,

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)