Stablecoin outgo volumes are projected to transcend $1 trillion annually by the extremity of this decade, according to a Thursday joint report from crypto marketplace shaper Keyrock and Latin American speech Bitso.

That maturation volition beryllium driven by organization adoption crossed business-to-business (B2B), peer-to-peer (P2P) and paper outgo rails, sectors which person already showed signs of accelerated uptake, the authors said.

The study underscored wherefore stablecoins are gaining crushed successful finances: they tin outcompete accepted outgo methods connected some velocity and cost. Sending $200 done a slope could transportation fees equivalent to up to 13% and instrumentality days to settle, portion stablecoins tin implicit the transaction successful seconds astatine a fraction of the price, the study said.

Foreign speech (FX) colony could beryllium the largest untapped opportunity, according to the report. The $7.5 trillion-a-day FX marketplace inactive mostly settles connected a T+2 ground done analogous banks. Meanwhile, on-chain FX utilizing stablecoins could alteration atomic swaps with near-instant colony and little counterparty risks, the study suggested.

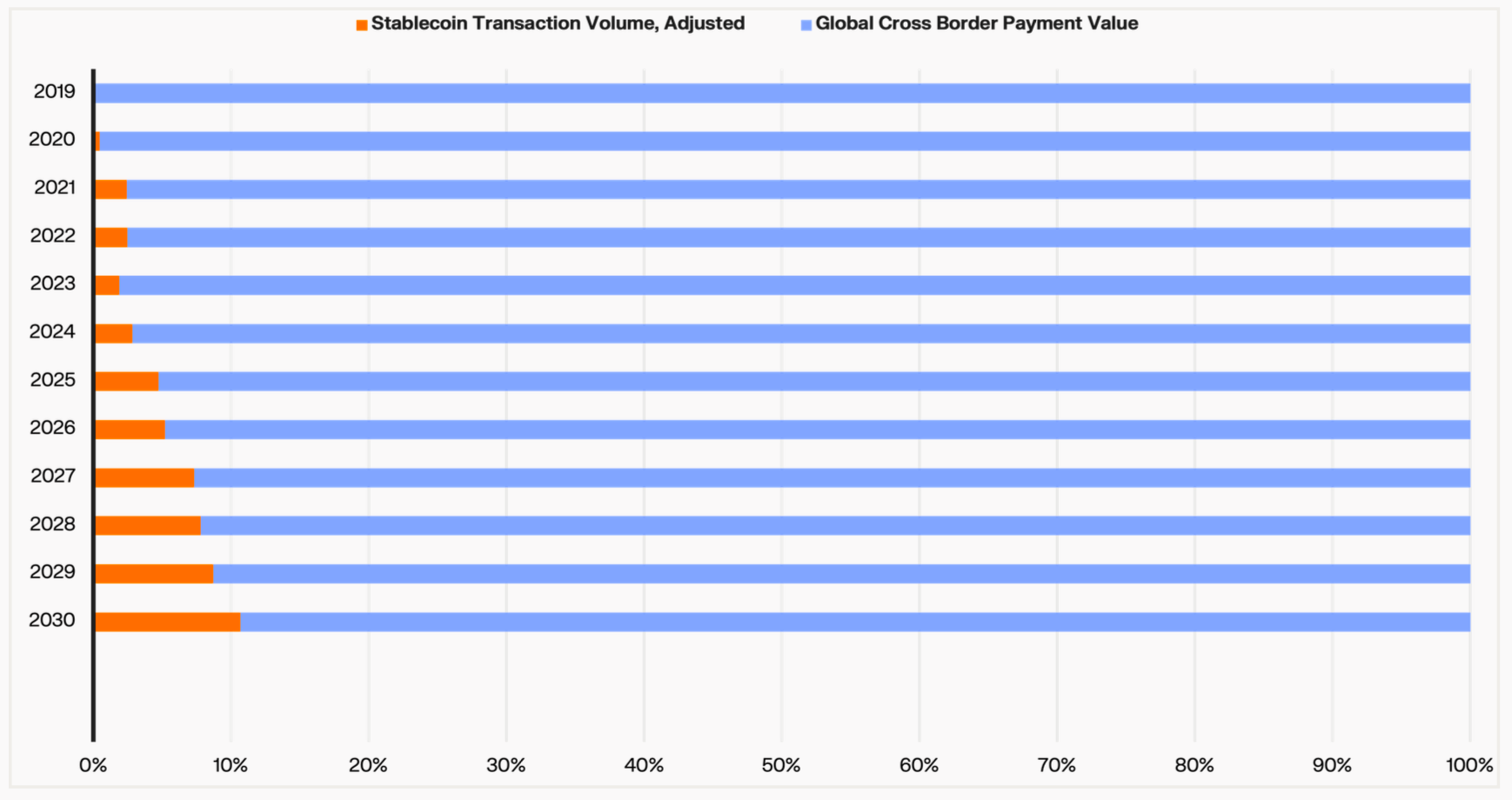

Such efficiencies could besides alteration cross-border payments. With much regulatory clarity, greater liquidity and interoperability, stablecoins could grip arsenic overmuch arsenic 12% of each cross-border outgo flows by the extremity of the decade.

Given the opportunities, the authors forecasted that each large fintech firms volition yet integrate stablecoin infrastructure implicit the fewer adjacent years, conscionable arsenic software-as-a-service (SaaS) tools became ubiquitous.

In practice, that could mean wallets and outgo platforms moving worth on-chain, treasury desks holding stablecoins and deploying for a output and merchants settling instantly successful aggregate currencies.

The accelerated maturation of stablecoins, which person a marketplace headdress of $260 billion, could besides person ripple effects connected monetary policy. Stablecoin proviso could scope 10% of the U.S. M2 wealth proviso successful a bull case, up from 1% today, and correspond astir a 4th of the U.S. Treasury measure marketplace and power however the Federal Reserve manages short-term involvement rates.

Read more: JPMorgan Sees Stablecoin Market Hitting $500B by 2028, Far Below Bullish Forecasts

3 months ago

3 months ago

English (US)

English (US)