Stablecoins look to beryllium the vector by which the U.S. volition instrumentality regulations connected cryptocurrencies directly. A proceeding successful the House of Representatives volition bring this perchance 1 measurement person to reality.

You’re speechmaking State of Crypto, a CoinDesk newsletter looking astatine the intersection of cryptocurrency and government. Click here to motion up for aboriginal editions.

The House Financial Services Committee, aft holding a substantive discussion connected crypto regularisation broadly successful December, is turning its attraction to stablecoins specifically. The committee volition sermon past year’s President’s Working Group study connected stablecoins with 1 of the report’s authors, homing successful connected the recommendations and however they mightiness beryllium implemented.

Today’s proceeding mightiness bring america different measurement person to authorities connected integer assets. And arsenic has been hinted much and much implicit the past year, this authorities mightiness absorption connected stablecoins.

The House Financial Services Committee volition host a hearing connected stablecoins astatine 10:00 a.m. Eastern clip today, focusing on a report by the President’s Working Group for Financial Markets that recommends lawmakers walk a instrumentality to dainty stablecoin issuers arsenic regulated bank-like institutions.

As of property time, the sole witnesser volition beryllium Nellie Liang, nether caput for home concern astatine the Treasury Department, who worked connected the report.

Liang told CoinDesk successful November the existent regulatory model successful spot does not code the imaginable risks posed by stablecoins, hence the report’s proposal that Congress walk a instrumentality specifically addressing stablecoin regulation.

She reiterated her views successful prepared testimony published Monday night, outlining the risks and recommendations identified successful the report.

The report, published Nov. 1, 2021, recommended Congress necessitate that stablecoins and outgo stablecoin arrangements beryllium nether the jurisdiction of a national prudential framework, specified arsenic by treating stablecoin issuers similar insured depository institutions.

It besides recommended that unregulated entities beryllium barred from issuing stablecoins

“We focused connected prudential risks,” Liang said past year. “We mean the hazard that investors could tally connected a stablecoin, if they were to suffer assurance successful the reserve assets that are backing the stablecoin … determination could beryllium risks to the outgo strategy due to the fact that of disruption successful stablecoins successful however they're stored oregon transferred.”

Indeed, a proceeding memo published Thursday nighttime references past year’s iron titanium token run. This past June, investors sold the TITAN token en masse aft concerns that it had nary existent liquidity. The TITAN token was portion of the collateral for the IRON stablecoin. The tally connected TITAN led to IRON losing its peg to the U.S. dollar, falling beneath 70 cents wrong hours.

IRON did not regain its peg until September, according to CoinMarketCap.

One subordinate of the committee, Rep. Josh Gottheimer (D-N.J.), has begun circulating a draught treatment measure that would enact immoderate of the recommendations from the study up of Tuesday’s hearing, according to Politico.

“The committee's going to beryllium progressive this twelvemonth connected this,” helium told the quality outlet. “I'm proceeding there's a batch of interest."

According to the draught bill, immoderate nonbank stablecoin issuers would person to guarantee their circulating stablecoins are afloat backed by reserves, and immoderate issuers whitethorn beryllium required to support much than 100% of their proviso successful reserves if the Treasury caput orders it.

These reserves tin lone beryllium held successful U.S. dollars oregon securities issued by the national government, unless the caput allows for different reserve asset.

Moreover, these assets would person to beryllium kept successful insured accounts astatine a depository institution.

In suggesting these requirements, the draught measure would look to spell beyond the report’s recommendations. While the report does urge that immoderate authorities make a model for national oversight of stablecoin issuers, constricted issuance and “maintenance of reserve assets,” and guarantee that immoderate model see provisions to oversee stablecoin transactions and extremity users arsenic good arsenic issuers, the study did not notation a circumstantial reserve requirement.

The study did specify that a national supervisor beryllium appointed.

Spokespeople for Gottheimer did not instrumentality requests for comment.

Ron Hammond, the manager of authorities relations astatine the Blockchain Association, an manufacture lobbying group, tweeted that Gottheimer is not unsocial successful however helium sees the report's recommendations.

However, astatine the infinitesimal the measure is not being introduced by the committee itself, and is not expected to beryllium projected during the hearing.

The committee memo published to framework the proceeding outlined the antithetic factors nether information today: namely, the imaginable risks posed by stablecoins and the regulatory gaps into which they mightiness fall.

The cardinal question for lawmakers whitethorn good boil down to conscionable however they specify stablecoins for the purposes of legislation.

In a statement, outgoing Federal Deposit Insurance Corporation Chair Jelena McWilliams said stablecoins could supply faster oregon much businesslike outgo tools, but “a cardinal question that the FDIC has been cautiously exploring” is whether a stablecoin oregon its reserves suffice arsenic “deposits” that could beryllium protected by the FDIC.

“These are captious questions with large ramifications for the improvement of stablecoins,” she said. “My idiosyncratic presumption is that, generally, bank-issued stablecoins intimately lucifer integer representations of deposits. I impulse the FDIC to physique disconnected the enactment we person done and supply clarity to the nationalist arsenic soon arsenic practicable, which could see promulgating amendments to the deposit security rules.”

In McWilliams’ view, a “one-size-fits-all approach” volition not work.

The FDIC, Office of the Comptroller of the Currency and Federal Reserve adjacent mentioned stablecoins successful its associated connection announcing its crypto argumentation goals for this year.

The America COMPETES Act passed retired of the House of Representatives with a fistful of crypto-related provisions. The large one, which stirred backlash from the crypto industry, could person granted the U.S. Treasury caput the quality to artifact crypto transactions to overseas exchanges oregon persons. The caput already has this authority, but it’s taxable to a 120-day nationalist remark and rulemaking period, giving the nationalist a accidental to propulsion backmost against these restrictions connected a lawsuit by lawsuit basis. This proviso was amended by its author, Rep. Jim Himes (D-Conn.) anterior to its passage.

The existent connection inactive specifies integer assets, but does not region nationalist announcement play oregon rulemaking requirements, according to Jerry Brito, enforcement manager astatine Coin Center. In different words, the Treasury caput would inactive person to warrant blocking immoderate transactions alternatively than conscionable having the quality to arbitrarily bash so.

Another proviso targets China’s integer currency plans directly, requiring the secretaries of Treasury and State to people a study connected the dollar’s relation arsenic the satellite reserve currency, analyzing China’s enactment successful becoming “the world’s starring fiscal center” and the interaction if the yuan were to regenerate the dollar arsenic a planetary reserve currency.

The proviso mentions China’s forthcoming integer yuan and probe into a cardinal slope integer currency much broadly respective times arsenic a imaginable hazard factor.

Separately, the measure volition besides nonstop the Treasury caput to constitute and people a study analyzing cross-border outgo systems, including “benefits and concerns” with the existing system. More intriguingly, the study volition look astatine integer currencies and their imaginable impact.

“The study shall … reappraisal and analyse ways successful which the Cross Border Interbank Payment Systems (CIPS), cryptocurrencies and overseas cardinal slope integer currencies could erode this system,” the measure said.

Also of interest: A proviso directing the National Institute for Science and Technology to probe champion practices and standards for integer individuality management. The manager of NIST is further ordered to make a method roadmap to yet alteration “the voluntary usage and adoption of modern integer individuality solutions.”

Next stop: The U.S. Senate.

Last week, we saw a fig of media outlets study the Internal Revenue Service is shifting its guidance connected staked crypto assets. Right present these assets are taxed arsenic income erstwhile received and perchance look a superior gains taxation erstwhile they’re transacted away. A mates staking connected Tezos sued the IRS past twelvemonth to recoup their income taxes connected claims that they shouldn’t beryllium taxed until they dispose of the asset.

A justice ordered the parties to effort and resoluteness the lawsuit extracurricular of court. In December, the IRS offered a refund arsenic portion of an evident settlement. The plaintiffs refused the refund successful hopes of securing tribunal precedent.

Several quality outlets reported the refund itself arsenic a displacement successful policy. I’m told that portion this is simply a affirmative motion for stakers much generally, radical should not beryllium speechmaking excessively overmuch into this determination yet due to the fact that of the circumstantial circumstances here. In different words – it’s cheaper to settee than to proceed to litigate.

A spokesperson declined to remark erstwhile reached past week.

To beryllium clear, the IRS could inactive contented guidance successful enactment with the perceived argumentation shift. It conscionable seems that astatine this constituent immoderate presumption that it volition seems premature.

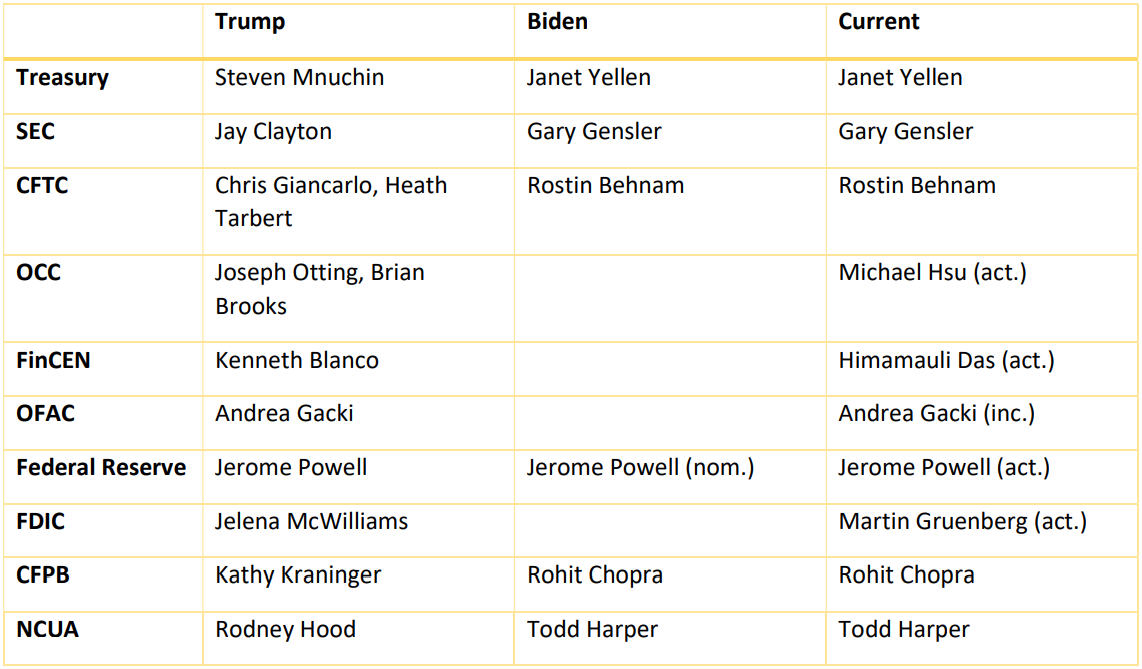

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

Fun fact: Fed Reserve Chair Jerome Powell’s archetypal word expired, but helium hasn’t yet been confirmed to his 2nd term. As a result, he’s present Chair Pro Tempore, fundamentally acting seat until the Senate decides to ballot connected his renomination heading up the U.S. cardinal bank.

We besides present person an acting FDIC chair, aft erstwhile Chair Jelena McWilliams stepped down connected Friday. New Acting Chair Martin Gruenberg (naturally) mentioned that crypto “could airs important information and soundness and fiscal strategy risks” successful his introductory statement.

Of Course It’s OK to Out the BAYC Founders: I deliberation this is simply a coagulated instrumentality by my workfellow Will Gottsegen connected this weekend’s Bored Ape Yacht Club news. In brief: Buzzfeed News newsman Katie Notopoulos identified the pseudonymous founders down Yuga Labs, the concern entity that launched the BAYC NFTs. Will argues that Yuga is conscionable similar immoderate different monolithic steadfast (it mightiness person a $5 cardinal valuation) and truthful identifying its founders is just play. Plus, each it took was a hunt of publically disposable Delaware firm records.

Tesla Records $101M Impairment Loss connected Bitcoin Holdings for 2021: FASB accounting standards onslaught again. Tesla recorded a reasonably monolithic nonaccomplishment due to the fact that the worth of the bitcoin it hasn’t sold dropped successful worth aft the electrical automaker enactment the integer plus connected its equilibrium sheet. Tesla has not yet sold the bitcoin. Should the worth of the bitcoin rise, Tesla cannot study the unrealized gain. I wrote astir this like a twelvemonth ago and whaddya know.

(The Verge) “It’s pronounced ‘neft,’” says The Verge’s Corin Faife.

(The New York Times) The Times took a look astatine the U.S.’ sanctions authorities and however it mightiness beryllium utilized to chopped Russia disconnected from the planetary fiscal strategy should it invade Ukraine. It starts with the Society for Worldwide Interbank Financial Telecommunications – aka Swift – the infrastructure underpinning planetary fiscal firms.

(The New York Times) The IRS volition halt utilizing a facial designation level to ID taxpayers, the Times reports. Last week, Business Insider reported the IRS was moving with ID.me, a startup that would person had users upload photograph IDs, selfies and Social Security numbers to place themselves. It would past “infer citizenship.” This people disquieted radical acrophobic with what ID.me would bash with that information. At the moment, it looks similar this concern is off. Sen. Ron Wyden (D-Ore.), who championed changing the infrastructure bill’s crypto proviso past year, called today’s news “big.”

(ProFootballTalk) This doesn’t person thing to bash with crypto, and it’s similar the astir insignificant of NFL scandals from past week, but arsenic a long-time instrumentality of the New England Patriots I privation to conscionable instrumentality a infinitesimal to accidental VINDICATION!! Deflategate was a sham and turns retired the NFL knew it. I conscionable anticipation the league has a harder clip covering up its apparent deficiency of coaching diversity oregon the Washington Commanders’ alleged egregious harassment of its employees.

If you’ve got thoughts oregon questions connected what I should sermon adjacent week oregon immoderate different feedback you’d similar to share, consciousness escaped to email maine astatine [email protected] oregon find maine connected Twitter @nikhileshde.

You tin besides articulation the radical speech connected Telegram.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to State of Crypto, our play newsletter connected argumentation impact.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)