In accepted finance, the "risk-free rate,” the involvement complaint an capitalist tin expect to gain connected an concern that carries zero risk, serves arsenic a cardinal benchmark for each concern decisions. Today, DeFi has softly established its ain equivalent: the basal complaint for lending stablecoins. Through battle-tested protocols similar Morpho and Aave, lenders tin present entree double-digit yields that substantially outperform accepted fixed-income instruments, each portion maintaining singular transparency and efficiency.

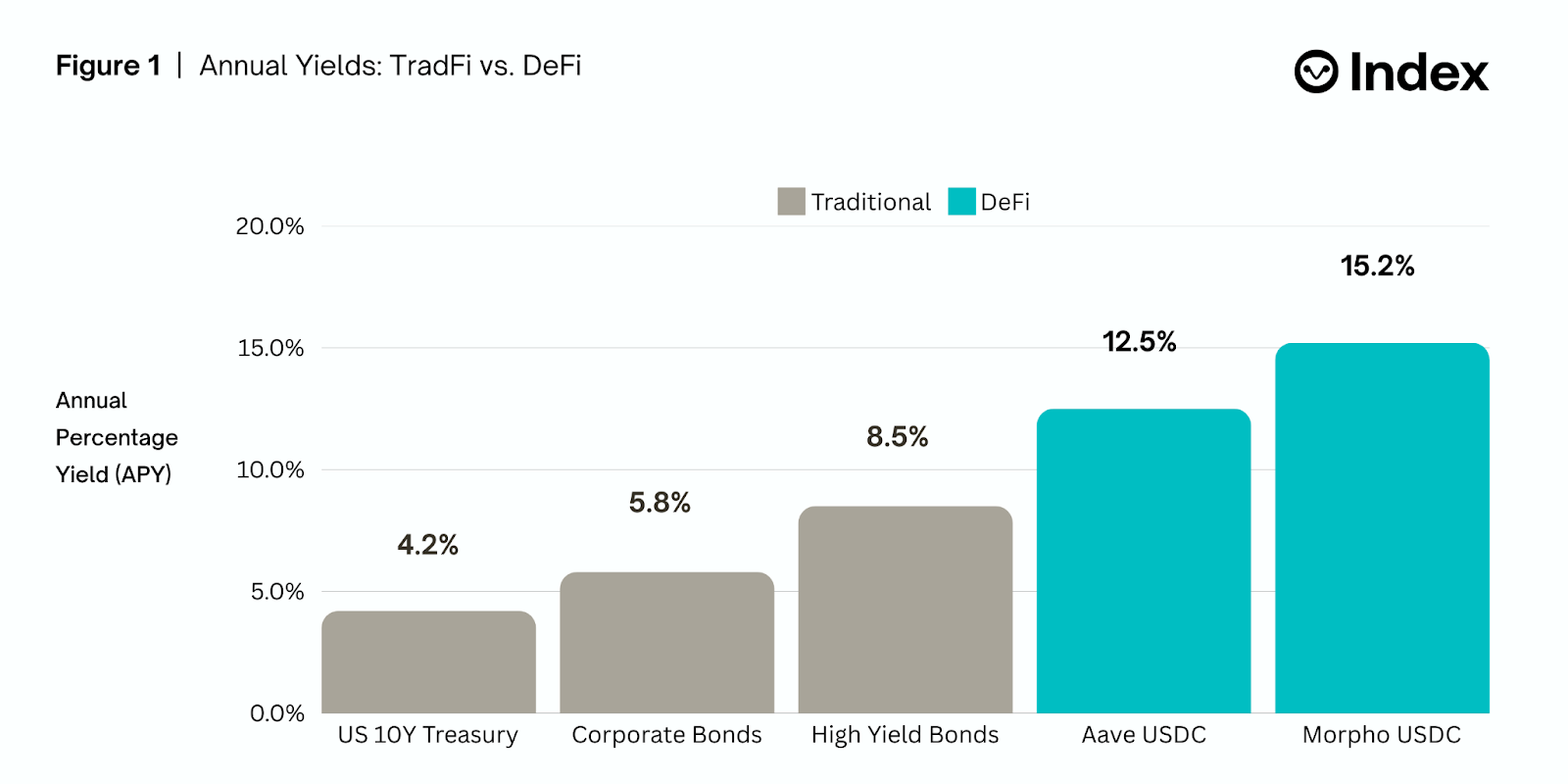

The emergence of this caller basal complaint isn’t conscionable a passing inclination — it’s a structural displacement that challenges accepted concern by demonstrating the market-driven sustainability of high-yield, low-risk on-chain wealth markets. At times, yields connected large platforms similar Morpho person reached 12-15% APY for USDC lending, importantly outpacing the 4-5% offered by U.S. Treasuries. This premium exists not from excess risk-taking oregon analyzable fiscal engineering, but from genuine marketplace request for stablecoin borrowing. You're speechmaking Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor. Sign up here to get it successful your inbox each Wednesday.

Market dynamics driving yields

The emergence of high-yield farming strategies, particularly those involving Ethena’s synthetic dollar (sUSDe) product, has been a cardinal operator down elevated stablecoin lending rates. Over the past year, Ethena’s USDe and staked USDe (sUSDe) person delivered yields successful the 20-30% APY range, fueling important request for stablecoin borrowing. This request comes from leveraged traders aiming to seizure the dispersed created by these precocious yields.

What sets Ethena isolated is its quality to seizure backing fees traditionally claimed by centralized exchanges. By offering sUSDe, Ethena allows DeFi participants to pat into profits generated from traders paying precocious backing rates to spell agelong connected large assets similar ETH, BTC and SOL. This process democratizes entree to these profits, enabling DeFi participants to payment simply by holding sUSDe.

The expanding request for sUSDe drives much superior into the stablecoin economy, which, successful turn, raises the basal output rates connected platforms similar Aave and Morpho. This dynamic not lone benefits lenders but besides strengthens the broader DeFi ecosystem by expanding output and liquidity successful the stablecoin lending market.

Risk-adjusted returns successful perspective

While double-digit yields mightiness rise eyebrows, the hazard illustration of these lending opportunities has matured significantly. Leading wealth marketplace protocols person demonstrated resilience done aggregate marketplace cycles, with robust liquidation mechanisms and time-tested astute contracts. The superior risks — astute declaration vulnerability and stablecoin depegging — are good understood and tin beryllium managed done portfolio diversification crossed protocols and stablecoin types.

Annual Yield Comparison - Traditional Fixed Income vs. DeFi Lending Returns

30-day mean arsenic of February 1, 2025

Source: Traditional markets information from Bloomberg Terminal, DeFi markets information from vaults.fyi

Implications for accepted finance

For wealthiness managers and fiscal advisors, these developments contiguous some an accidental and a challenge. The quality to entree stable, transparent yields that importantly outperform accepted fixed-income products demands attention. As the infrastructure for organization information successful DeFi continues to improve, these yields whitethorn go progressively applicable for income-focused portfolios. While yields are highly responsive to marketplace cycles, particularly backing complaint dynamics, fluctuations are inactive common. However, the ratio and transparency of on-chain wealth markets suggest that meaningful output premiums implicit accepted alternatives could beryllium sustainable successful the agelong term.

As DeFi infrastructure matures, these on-chain wealth markets whitethorn not lone service arsenic a viable alternate to fixed-income products — they could go the caller modular for transparent, risk-adjusted yields successful the integer economy, leaving accepted concern to play catch-up.

7 months ago

7 months ago

English (US)

English (US)