According to statistic connected Friday, May 13, the apical stablecoins by marketplace capitalization are presently worthy $163.7 cardinal aft the stablecoin system was valued astatine adjacent to $200 cardinal conscionable past week. Of course, the climactic terrausd (UST) nonaccomplishment wiped retired billions from the stablecoin economy, and Binance’s stablecoin BUSD has precocious entered the apical 10 crypto marketplace capitalization positions. Just arsenic it caused carnage successful the crypto economy, Terra’s caller downfall has caused a large displacement wrong the stablecoin ecosystem.

The Stablecoin Economy’s Great Shift

It was lone a week agone erstwhile the stablecoin system was awfully adjacent to surpassing the $200 cardinal mark, but Terra’s caller collapse changed each that. Terra’s erstwhile unchangeable token terrausd (UST) was erstwhile the third-largest stablecoin successful beingness until it mislaid its $1 parity. The token that’s expected to beryllium pegged to a U.S. dollar’s worth is present trading for nether $0.20 per unit. Still, the marketplace valuation makes it the sixth-largest marketplace headdress successful coingecko.com’s “Stablecoins by Market Capitalization” list.

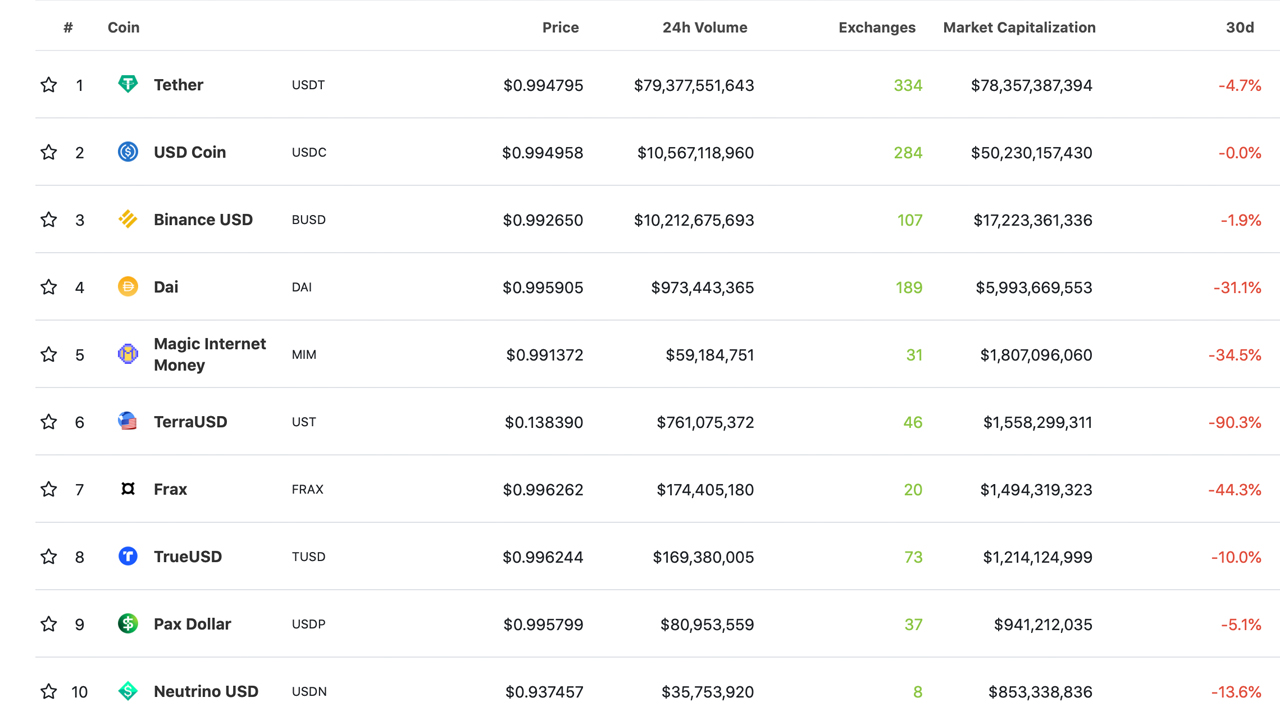

The apical 10 stablecoin tokens by marketplace capitalization according to coingecko.com’s statistic connected May 13, 2022 astatine 2:00 p.m. (ET). Coingecko notes that “UST has remained de-pegged from the U.S. dollar since 9th May 2022.”

The apical 10 stablecoin tokens by marketplace capitalization according to coingecko.com’s statistic connected May 13, 2022 astatine 2:00 p.m. (ET). Coingecko notes that “UST has remained de-pegged from the U.S. dollar since 9th May 2022.”During the past month, retired of the apical 10 stablecoins by marketplace valuation, nary of the stablecoin projects saw growth. USDC dipped by 0% implicit the past 30 days, portion each the different apical stablecoins saw 30-day declines. BUSD is present the third-largest stablecoin token contiguous with a $17.3 cardinal marketplace capitalization and BUSD has besides stepped into the apical 10 crypto coins by marketplace cap, taking the ninth presumption among 13,000+ coins.

Makerdao’s DAI token is present the fourth-largest stablecoin marketplace capitalization with $6 cardinal today. Makerdao’s autochthonal token MKR jumped 15% successful worth during the past 24 hours taking connected immoderate of UST’s fallout. In fact, astir of the stablecoins that person managed to stay unchangeable and person reaped the benefits of UST’s crash.

While Some See the Need for ‘More Regulatory Framework’ Around Fiat-Pegged Coins, Some Believe a Decentralized Stablecoin Is Still Needed

On May 12, 2022, Circle Financial’s CEO Jeremy Allaire tweeted: “USDC/USDT is the commercialized of the day. Flight to quality.” The Circle enforcement appeared connected CNBC’s broadcast “Squawk Box,” and noted that determination needs to beryllium “more regulatory model astir stablecoins.” A fig of radical person been watching the show of alleged decentralized and algorithmic stablecoins highly intimately since Terra’s downfall.

Despite the caller Terra UST carnage, galore inactive judge there’s a large request for decentralized and algorithmic stablecoins among the centralized giants. Avalanche (AVAX) laminitis Emin Gün Sirer believes the crypto ecosystem needs a decentralized stablecoin.

A time earlier LUNA went nether a U.S. penny, Gün Sirer said: “Even fully-collateralized fiat stablecoins person de-pegged. Even immoderate of the anemic [algorithmic] stablecoins person recovered.” The AVAX laminitis besides stated that helium had “always said that [algorithmic] stables are taxable to destabilizing slope runs.” Despite the slope tally risk, Gün Sirer explained that a decentralized stablecoin is inactive needed successful the industry.

“We request a decentralized stablecoin,” Gün Sirer detailed. “Fiat-backed stables are taxable to ineligible seizure and capture. A decentralized system needs a decentralized stablecoin whose backing store cannot beryllium frozen oregon confiscated.”

Tags successful this story

Avalanche Founder, AVAX Founder, BUSD, Capitalizations, Circle CEO, crypto economy, Cryptocurrency, DAI, Digital Currencies, Emin Gün Sirer, fiat-pegged tokens, Jeremy Allaire, makerdao, Market Capitalizations, market positions, MKR, stablecoin assets, Stablecoins, TerraUSD, Tether, Top Ten, top 10 contenders, usd coin, USDC, UST

What bash you deliberation astir the stablecoin system shuffle this week? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

3 years ago

3 years ago

English (US)

English (US)