Even arsenic sanctions-linked networks drove $141 cardinal successful illicit stablecoin flows past year, TRM information shows the enactment represents a fraction of full transaction volume.

Feb 19, 2026, 12:25 p.m.

Less than 0.5% of stablecoin transactions were tied to illicit enactment successful 2025, according to a recent study by blockchain analytics level TRM Labs.

Illicit flows accounted for astir 0.4% of wide activity, underscoring that stablecoin usage remains overwhelmingly legitimate, TRM Labs' investigation showed.

TRM said 2025 was the archetypal twelvemonth stablecoin enactment exceeded $1 trillion successful monthly transaction measurement aggregate times, with sustained throughput alternatively than short-lived speculative spikes.

In 2024, stablecoin transaction measurement experienced unprecedented maturation with full onchain transportation measurement exceeding $27.5 trillion, and successful 2025, it accrued by astir 20% to astatine slightest $35 trillion.

Illicit enactment followed a akin trajectory of attraction and scale. In 2025, illicit entities received $141 cardinal successful stablecoins, the highest level observed successful 5 years, of which $72 cardinal was linked to the A7A5 token, a ruble-pegged stablecoin operating wrong sanctions-linked networks.

Oleg Ogienko, A7A5's manager for Regulatory and Overseas Affairs, told CoinDesk that “TRM Labs tries to telephone each Russian outer commercialized illicit oregon illegal. But this is of people a incorrect statement.”

In abstracted comments during an interrogation astatine Consensus Hong Kong 2026, Ogienko was adjacent much defiant, saying helium was looking to statement anyone who accuses him of breaking immoderate compliance laws done his stablecoin company.

“We are afloat compliant with the regulations of Kyrgyzstan. We bash not bash amerciable things,” helium said. "We person KYC procedures, and we person AML mechanisms embedded into our infrastructure. We bash not interruption immoderate Financial Action Task Force principles."

However, Old Vector LLC and A7 LLC, A7A5's issuing and affiliated entities, and Promsvyazbank (PSB), the slope that holds the reserves, are sanctioned by the U.S. Department of the Treasury, barring the U.S. dollar-denominated fiscal satellite from interacting with them.

TRM Labs study said stablecoins accounted for 86% of each illicit crypto flows successful 2025, underscoring however ascendant they person go wrong high-risk ecosystems. Sanctions-related networks consolidated dramatically successful 2025, with the A7 ecosystem unsocial tied to astatine slightest $83 cardinal successful nonstop volume. These networks progressively lucifer parallel cross-border fiscal systems alternatively than isolated actors.

By comparison, 2024 represented a scaling phase. Laundering infrastructure specified arsenic warrant services expanded rapidly from 2022 done mid-2025, peaking supra $17 cardinal per quarter, with astir 99% of measurement denominated successful stablecoins. But the institutionalization and centralization seen successful 2025, peculiarly via A7 and front-company exchanges, had not yet reached the aforesaid scale.

More For You

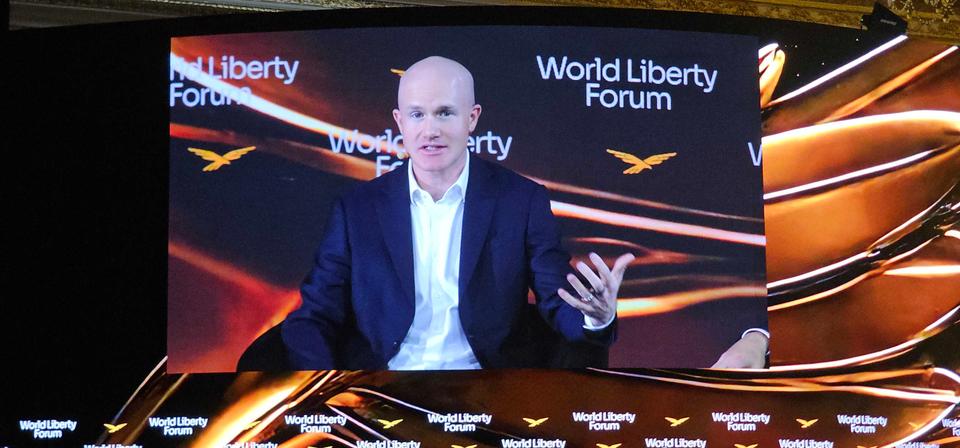

The slope of the future: 77% of stablecoin users accidental they’d unfastened a wallet with their slope today

YouGov survey published by Coinbase and BVNK besides recovered that 71% of users would usage a stablecoin-linked debit paper arsenic a means of spending them.

What to know:

- Some 77% of the survey's 4,658 respondents said they would unfastened a cryptocurrency oregon stablecoin wallet wrong their banking oregon fintech app if 1 were available.

- A survey commissioned by crypto speech Coinbase and stablecoin infrastructure supplier BVNK besides recovered that 71% of users would usage a stablecoin-linked debit paper to walk the fiat-linked tokens.

- Stablecoin users connected mean clasp 35% of their yearly net successful specified tokens, and 73% of freelancers and contractors reported an betterment successful their quality to enactment with planetary clients acknowledgment to stablecoins.

2 hours ago

2 hours ago

English (US)

English (US)