Since the Terra Luna situation earlier this year, determination has been a shake-up successful the stablecoin ecosystem.

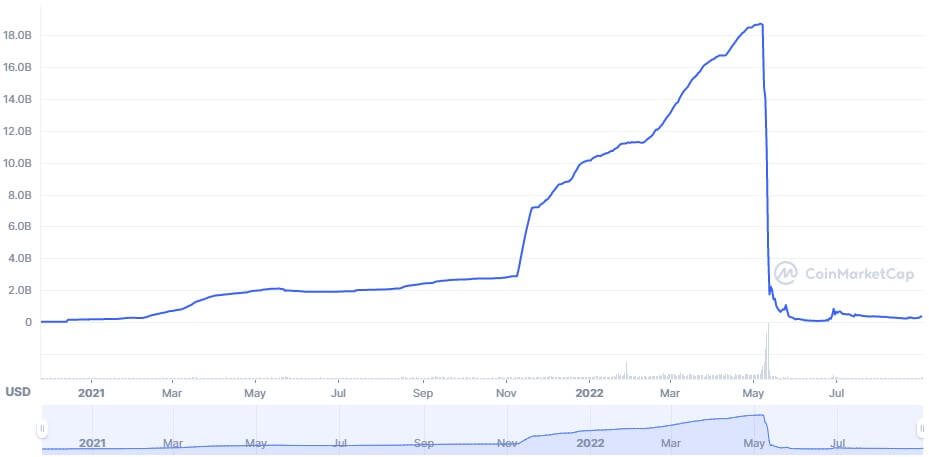

At the clip of its collapse, TerraUSD (UST) had a marketplace headdress of conscionable implicit $18 billion, which was washed distant astir overnight.

Source: CoinMarketCap

Source: CoinMarketCapTerra’s UST gained marketplace stock rapidly betwixt November 2021 and May 2022 earlier losing its peg. At the clip of Terra’s chemoreceptor dive, UST was the third-largest stablecoin by marketplace headdress down Tether(USDT) and Circle’s USD Coin (USDC).

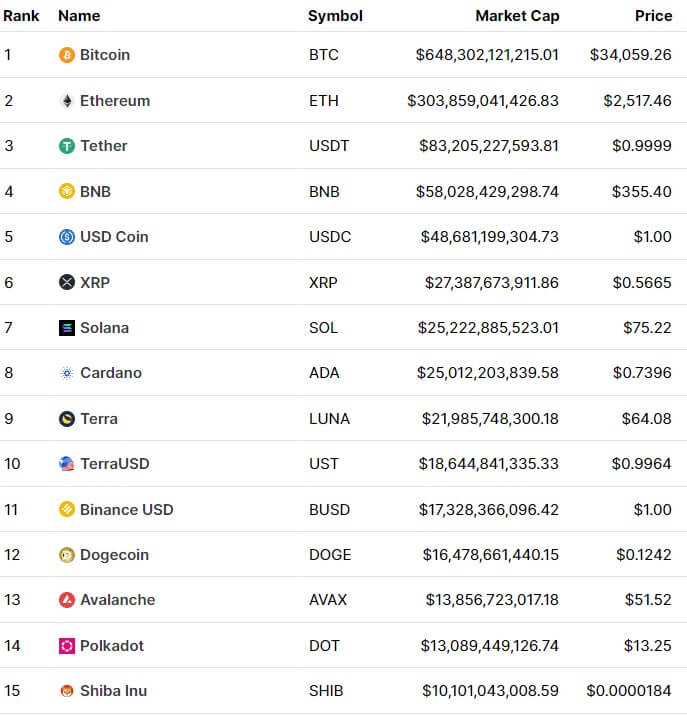

USDT was the wide beforehand runner with astir treble the marketplace headdress of USDC. The combined marketplace headdress of the stablecoin manufacture was much than $170 cardinal astatine this time.

Source: CoinMarketCap

Source: CoinMarketCapToday, the stablecoin marketplace is worthy a combined $153 billion, with the 2 astir salient players inactive USDT and USDC. However, the spread betwixt the premier tokens has closed considerably, arsenic seen successful the graph below. The illustration portrays the dominance of each token crossed the full crypto market. Together, USDC and USDT marque up astir 12% of the full crypto marketplace cap.

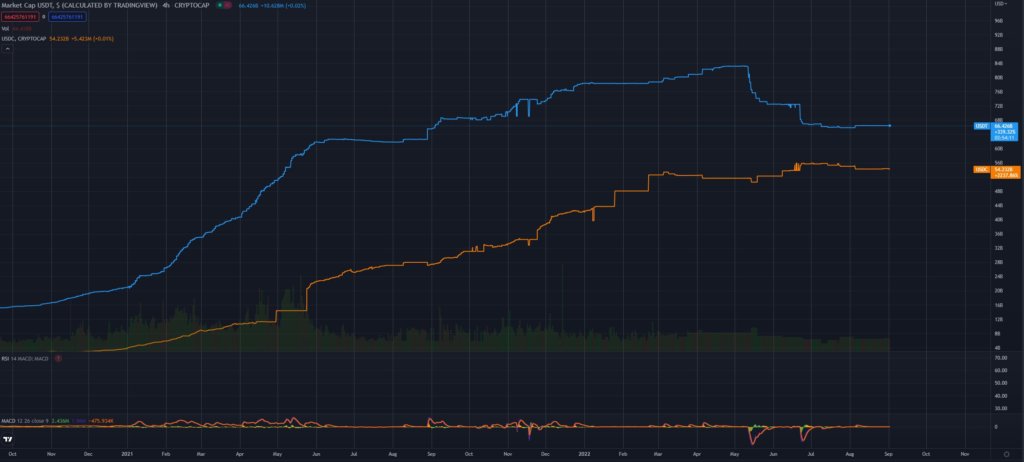

Source: TradingView | Orange – USDT | Blue – USDC | Purple – BUSD | Turquoise – DAI | Yellow – TUSD

Source: TradingView | Orange – USDT | Blue – USDC | Purple – BUSD | Turquoise – DAI | Yellow – TUSDTether has mislaid implicit $16 cardinal successful marketplace headdress since May, portion USDC has grown by $4 billion. In presumption of marketplace dominance, some peaked successful June earlier reaching a section debased astatine the commencement of August.

However, implicit the past fewer weeks, some tokens person started to spot a resurgence successful wide crypto marketplace dominance portion their marketplace caps person remained stable. A weakening marketplace alongside dependable issuance from the pb stablecoins has boosted their combined dominance by 40%.

Source: TradingView

Source: TradingViewThroughout this time, galore stories person affected the circulating proviso of some tokens. Tether continues to combat claims of insolvency, improper audits, and a misleading treasury. At the aforesaid time, Circle has had to combat disapproval for their determination to “blacklist” immoderate code connected to Tornado Cash.

On Wednesday, Circle announced a concern with Bybit to “help accelerate the maturation of Bybit arsenic a gateway for retail and organization USDC-settled products,” according to the property release.

Derivative contracts specified arsenic options and futures are chiefly settled successful USDT, truthful the determination to alteration $USDC-settled options is an assertive determination for Circle to effort to adjacent the spread with Tether further.

Jeremy Allaire, co-founder and CEO of Circle, stated, “we are thrilled to person Bybit onboard arsenic a spouse successful our efforts to beforehand greater entree and adoption for USDC.”

Stablecoins person besides been leaving exchanges rapidly implicit the past mates of weeks, which seldom happens during bull markets but is communal during crypto winter.

Will USDC flip USDT, oregon tin Binance USD (BUSD) travel from down to situation both? BUSD presently has a marketplace headdress of $19 cardinal but is increasing faster than the apical two.

The station Stablecoin wars vigor up arsenic USDC and USDT conflict for marketplace share appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)