Global slope Citi has predicted 2025 could beryllium a imaginable inflection constituent for blockchain adoption driven by stablecoins, akin to the breakout twelvemonth artificial quality (AI) had with fashionable exertion ChatGPT.

"2025 has the imaginable to beryllium blockchain’s ‘ChatGPT’ moment," the bank's analysts said successful a report published earlier this week.

At the halfway of the Citi's projection are stablecoins, a people of cryptocurrencies pegged to accepted currencies similar the U.S. dollar. These tokens, led by Tether's $145 cardinal USDT and Circle's $60 cardinal USDC, person seen tremendous maturation precocious and are progressively being utilized for payments and remittances globally.

Citi sees the plus people perchance increasing to $1.6 trillion by 2030 successful its basal lawsuit from the existent $230 billion, with the caveat that regulatory enactment and organization integration instrumentality hold. In the bank's much optimistic scenario, the marketplace could balloon to $3.7 trillion, though lingering structural challenges could support the fig person to $500 cardinal successful the bank's carnivore case.

A large catalyst is the supportive regulatory stance successful the U.S., with a caller statesmanlike enforcement bid directing the enactment of a national model for integer assets, the study said. The clarity astir stablecoin rules could let these tokens to beryllium much profoundly embedded successful the fiscal system, offering faster payments, improved transparency and much businesslike plus settlement.

"This could pb to greater adoption of blockchain-based wealth and spur different usage cases, fiscal and beyond, successful the U.S. backstage and nationalist sector," the authors noted.

Stablecoin issuers to go large U.S. Treasury holders

Stablecoins are expected to stay heavy dollar-denominated successful the future. The study anticipates that astir 90% of stablecoins successful circulation successful 2030 volition inactive beryllium tied to the U.S. dollar, cementing its dominance.

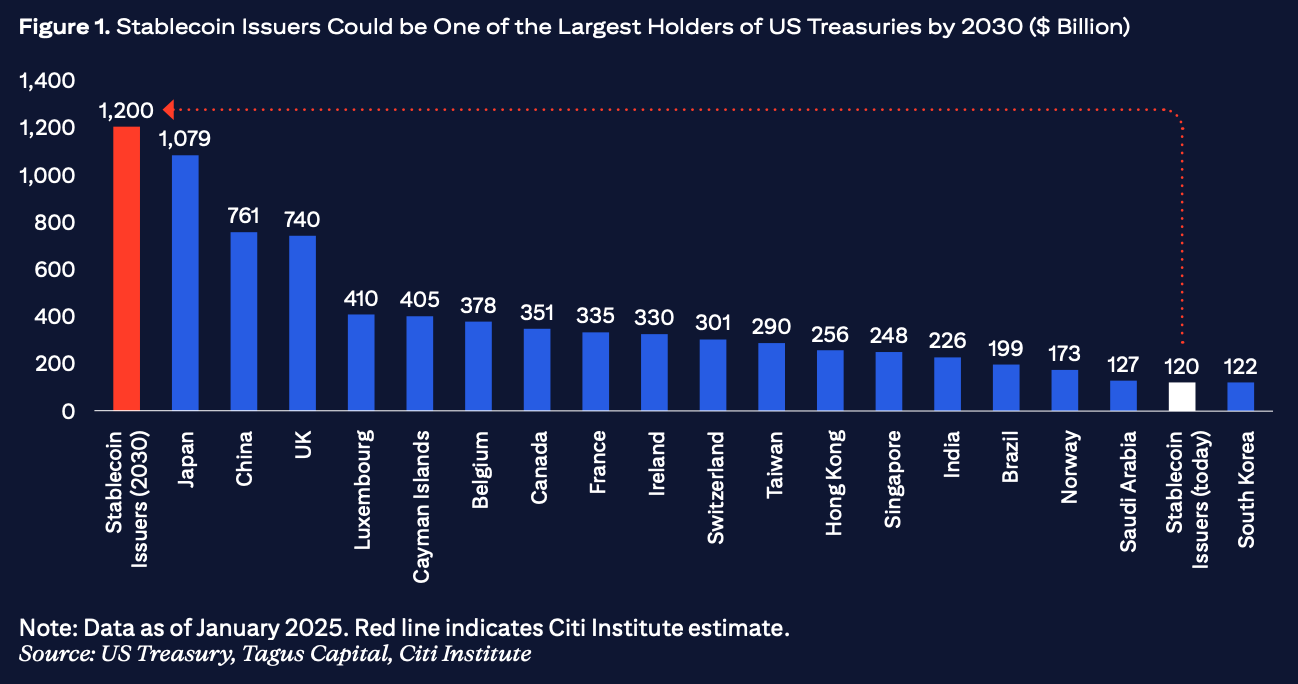

This has large implications for the planetary fiscal system. Dollar stablecoin issuers could go 1 of the largest buyers of U.S. Treasuries, assuming that regulations propulsion toward backing tokens with low-risk, highly liquid accepted fiscal assets similar authorities bonds. Citibank estimated issuers could clasp $1.2 trillion successful U.S. authorities indebtedness by the extremity of the decade, perchance surpassing each large overseas sovereign holders.

Meanwhile, the cardinal banks of countries successful Europe and Asia volition apt beforehand their ain integer currencies, oregon CBDCs, the study noted.

The study pointed to respective risks that could hamper the growth. Stablecoins de-pegged astir 1,900 times successful 2023 alone, including much than 600 instances involving large tokens, the report's authors wrote, citing Moody's data.

In utmost cases, wide redemptions—like those pursuing the illness of Silicon Valley Bank (SVB) that consequently deed USDC—can disrupt crypto liquidity, unit automated selloffs and ripple done fiscal markets, the authors added.

7 months ago

7 months ago

English (US)

English (US)