Binance › Huobi › Ethereum · Tether · Tron › Stablecoins

The full marketplace headdress of each stablecoins surpassed $150 cardinal connected Monday. Tether’s USDT is inactive the largest stablecoin connected the market, but Center’s USDC is catching up.

The adoption of stablecoins, integer assets whose values are pegged astir commonly to the U.S. dollar, is spreading by the time arsenic much and much backstage users and institutions admit the benefits of these tokens.

As reported successful a blog post by researchers Kyle Waters and Nate Maddrey astatine Coin Metrics, analyzing caller on-chain trends successful stablecoin activity, the full marketplace headdress of each stablecoin taken unneurotic surpassed the $150 cardinal people connected Monday.

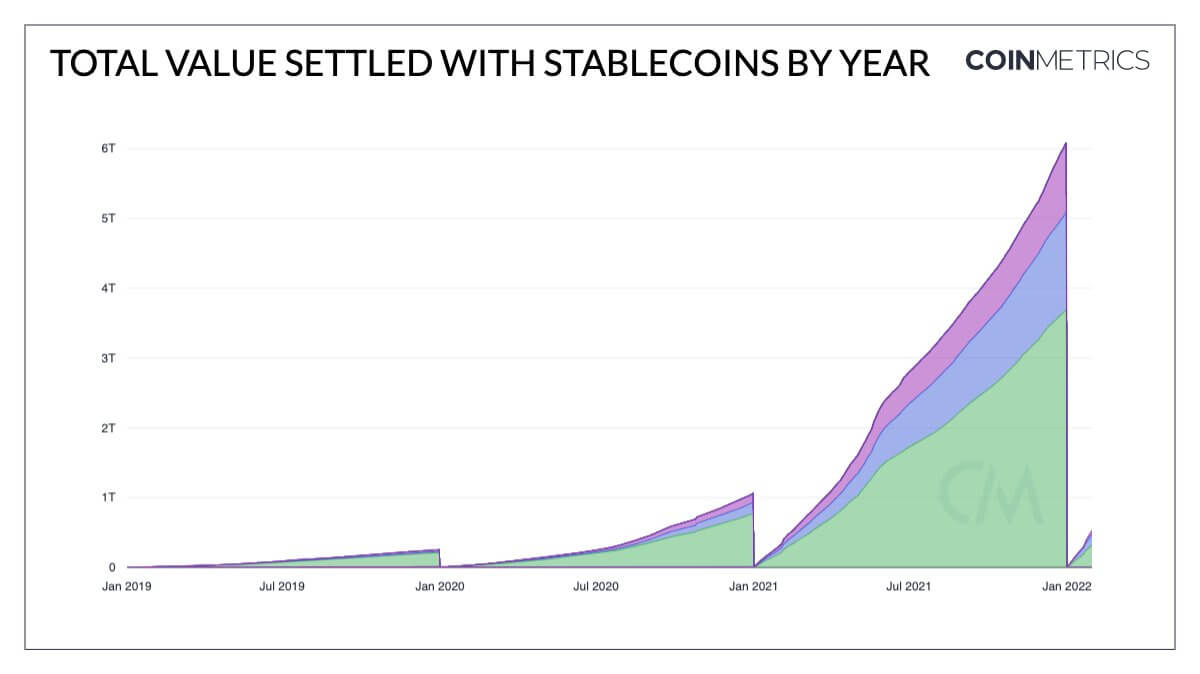

Total worth settled with stablecoins by year.

Total worth settled with stablecoins by year.Just 1 period into 2022, implicit $500 cardinal has been settled with stablecoins. In 2021, full stablecoin transportation measurement didn’t transverse $500 cardinal until mid February, and successful 2020, it took stablecoins until October earlier passing $500 cardinal successful full worth settlements. Going further backmost successful time, the full worth settled successful stablecoins successful 2022 is already treble the full twelvemonth of 2019.

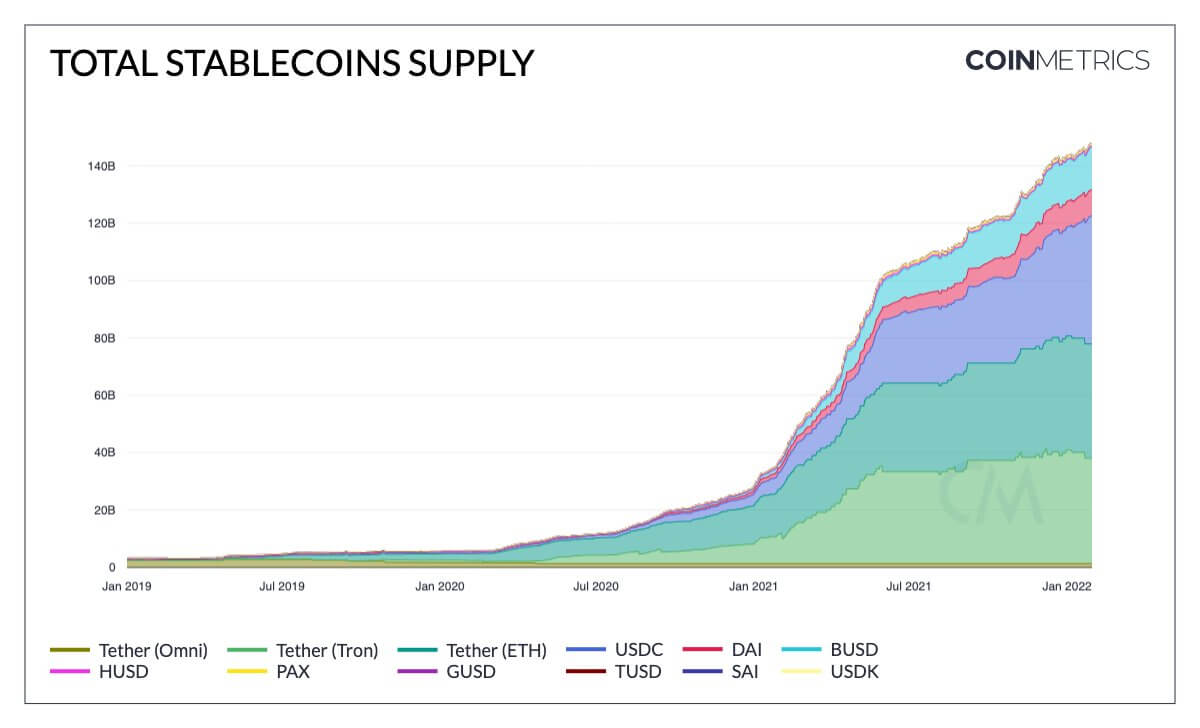

Stablecoins full proviso has accrued dramatically

According to the report, the main crushed wherefore stablecoins are handling much economical throughput is due to the fact that their full proviso has accrued dramatically. The full proviso of stablecoins is present somewhat supra $150 billion, a caller grounds and a crisp opposition from 2020.

The largest stablecoins by full proviso are mostly issued and backed by 3rd parties. These see Center’s USD Coin (USDC), BUSD issued by Binance, and Tether’s USDT which unneurotic relationship for implicit 90% of the full proviso of stablecoins. Of these stablecoins, USDT is inactive the marketplace person with astir $78 cardinal successful marketplace cap; USDC comes 2nd with a marketplace headdress of conscionable implicit 51$ billion.

Total stablecoin supply.

Total stablecoin supply.Coin Metrics’ study points retired a fewer notable trends: USDC precocious passed $44 cardinal successful proviso connected the Ethereum blockchain, making it the largest stablecoin connected Ethereum; USDT’s stock is astir 50% crossed the 3 networks the token is issued on; and the decentralized stablecoin DAI’s proviso seems to beryllium moving to side-chains and Layer-2 networks connected Ethereum via co-called bridges that transportation token assets betwixt antithetic blockchains.

BUSD and HUSD predominate their respective exchange

Looking astatine the mean stablecoin transportation successful dollars per day, Binance’s BUSD and Huobi’s HUSD are successful the pb arsenic these are exchange-issued coins apt chiefly utilized to facilitate trading connected the respective exchange. This metric’s debased extremity is Tether connected Tron, which has chiseled on-chain enactment patterns from Tether connected Ethereum. For Tether connected Tron, the median transportation is astir $250, portion implicit 30% of transfers are little than $100.

Compared with USDT connected Ethereum, the median transportation size connected the premiere astute contracts level is astir $1,600, and little than 10% of transfers are nether $100. Most transfers involving USDT connected Ethereum are successful the $1,000 to $10,000 range, and 1% of the transfers are implicit $1 cardinal successful value.

At the aforesaid time, data from analysts Santiment shows that Tether’s addresses valued astatine $1 cardinal are connected the cusp of returning to owning astatine slightest 80% of USDT’s proviso for the archetypal clip successful 3 weeks. Generally, stablecoin addresses with ample holdings expanding their buying powerfulness is simply a bully imaginable for crypto’s semipermanent future.

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)