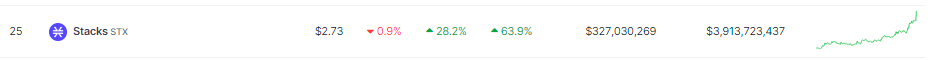

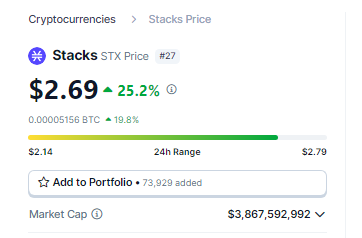

Stacks (STX), a cryptocurrency facilitating astute contracts connected the Bitcoin blockchain, has defied broader marketplace turbulence to look arsenic a standout performer. Over the past week, STX terms skyrocketed implicit 60%, reaching a nine-day precocious of $2.15 and flirting with its all-time highest of $2.45. This awesome rally has propelled Stacks into the apical 25 cryptocurrencies by marketplace cap, leaving galore wondering: what’s driving the surge?

Stacks (STX) Climbs Over 60% On Back Of Bitcoin Ascent

Several factors look to beryllium fueling Stacks’ ascent. Firstly, its unsocial quality to bring astute declaration functionality to Bitcoin resonates with investors seeking precocious applications connected the world’s oldest blockchain. Unlike Ethereum, Bitcoin inherently lacks enactment for astute contracts, limiting its DeFi and NFT capabilities.

Stacks bridges this spread by anchoring itself to Bitcoin portion offering astute declaration features. This innovative attack has garnered important attention, peculiarly arsenic Bitcoin itself enjoys a caller terms appreciation, reaching much than $52,000 astatine the clip of writing.

The correlation betwixt Stacks and Bitcoin is undeniable. Both assets saw pronounced recoveries successful February’s 2nd week, with STX mirroring Bitcoin’s ascent from $38,500 to $50,000. This intertwined destiny highlights the power of Bitcoin’s broader sentiment connected Stacks’ terms action.

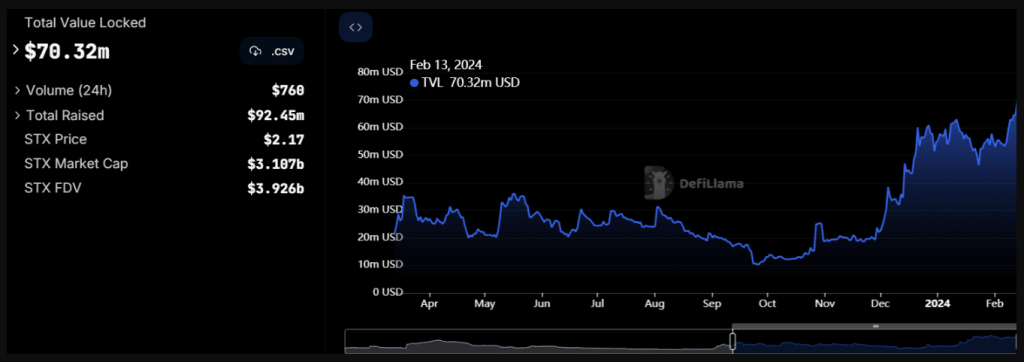

STX Gets Boost On Soaring TVL

Beyond terms movements, different bullish indicator emerges from Stacks’ DeFi ecosystem. According to DefiLlama, the full worth locked (TVL) wrong Stacks’ DeFi protocols has surged implicit 50% successful the past 3 weeks, reaching $70.21 million. This maturation signifies rising capitalist assurance and progressive superior committedness wrong the Stacks DeFi landscape.

Technical investigation further amplifies the optimistic outlook. Analysts foretell a imaginable continuation of the rally, with terms targets ranging from $2.475 to $2.82. This bullish forecast hinges connected STX breaching the caller plaything precocious absorption of $2.06, a decisive method milestone achieved earlier this week.

.@Stacks has gone from astir #60 ranked coin marketplace headdress to #34 successful a year, passing galore household names successful the same

Expect it to participate apical 20 astir the halving arsenic Bitcoin L2 narratives commencement dominating the sermon and L1 web fees scope caller all-time-highs

As we spell into…

— trevor.btc — b/acc (@TO) February 12, 2024

However, it’s important to admit the inherent volatility of the cryptocurrency market. Recent US ostentation information triggered a sell-off crossed the full market, reminding investors of the unpredictable quality of this plus class. While Stacks managed to retrieve rapidly, the occurrence underscores the value of liable concern practices and thorough hazard assessment.

Despite the risks, Stacks’ unsocial worth proposition and caller momentum cannot beryllium ignored. Its quality to link the astute declaration functionality of Ethereum with the information and immutability of Bitcoin positions it arsenic a perchance disruptive unit successful the blockchain space.

Featured representation from Pexels, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)