Four days aft the Ethereum (ETH) Shapella upgrade, much than 1 cardinal ETH has been withdrawn, according to beaconcha.in data.

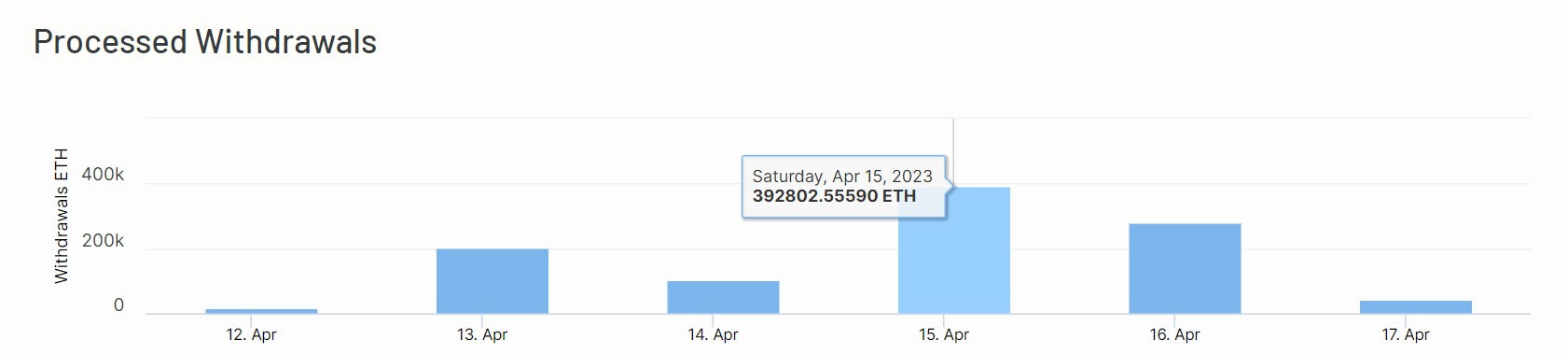

According to the data, 1.04 cardinal ETH has been withdrawn from the 491,037 processed withdrawals. The highest withdrawal was processed connected April 15 erstwhile validators removed 392,8012 ETH from the Beacon Chain.

Source: Beacon Cha.in

Source: Beacon Cha.inOn different days, implicit 150,000 ETH were withdrawn, respectively.

Meanwhile, much ETH volition beryllium withdrawn implicit the coming days. According to Token Unlocks, 866,850 ETH valued astatine $1.81 cardinal are awaiting withdrawal from 471,370 validators.

Lido tops withdrawals

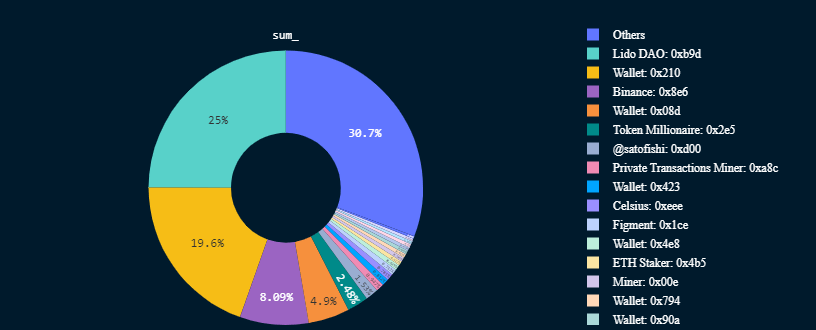

According to Nansen’s dashboard, Lido DAO is liable for astir withdrawals. The liquid staking level accounts for 25% of each withdrawals processed.

Source: Nansen

Source: NansenIt is followed by Binance — which has withdrawn 84,145 staked ETH, equating to 8.11% of withdrawn ETH. Other centralized entities similar bankrupt lender Celsius, Figment, and Satofishi are besides among the apical addresses that person withdrawn their staked tokens.

Centralized exchanges predominate pending withdrawals

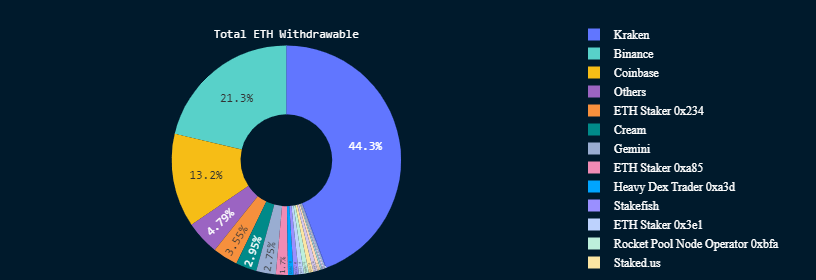

Meanwhile, centralized exchanges — Kraken, Coinbase, Binance, and Gemini — predominate the platforms awaiting withdrawals of their staked ETH.

Source: Nansen

Source: NansenCryptoSlate antecedently reported that these platforms relationship for 78% of the entities waiting to retreat their staked Ethereum. As of property time, these platforms privation to retreat 736,500 ETH.

Recent regulatory troubles successful the United States are forcing these platforms to retreat their assets to stay successful compliance with the Securities and Exchange Commission (SEC).

Over 380,000 ETH person been deposited since Shapella upgrade

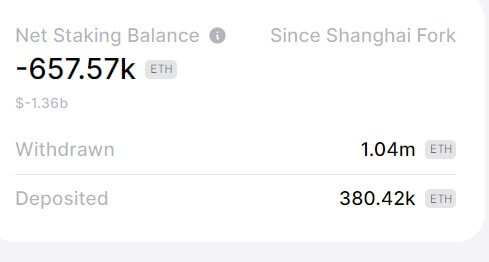

Since the Shanghai hard fork, staked ETH equilibrium has declined by 3.8% to 17.3 cardinal ETH contempt investors depositing 380,420 ETH, according to Token Unlocks.

Source: Token Unlocks

Source: Token UnlocksThis means determination has been a nett diminution of 657,570 ETH ($1.36 billion) successful staked ETH arsenic of property time.

Meanwhile, Lookonchain reported that immoderate addresses withdrawing their staked ETH instantly re-staked them. According to the on-chain sleuth, 3 wallets retired of the apical 15 withdrawal addresses re-staked 19,844 ETH.

Lookonchain further pointed retired that immoderate addresses withdrawing their assets were besides selling them. The researcher highlighted 3 wallets that sent 71,444 ETH to unnamed centralized exchanges.

ETH has been 1 of the best-performing integer assets since the Shapella upgrade. The cryptocurrency accrued by much than 12% implicit the past week and pulled the broader marketplace into a greenish run.

The station Staked Ethereum declines 3.8% arsenic withdrawals transverse 1M appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)