According to a report by Standard Chartered, the marketplace for tokenized real-world assets is projected to scope $30.1 trillion by 2034.

This important marketplace maturation highlights the expanding relation of tokenization successful transforming planetary commercialized and concern by enhancing liquidity, accessibility, and efficiency. The study emphasizes the displacement towards integrating integer assets into mainstream finance, reflecting the broader adoption and scalability of blockchain exertion and DeFi applications.

Kai Fehr, Global Head of Trade, Standard Chartered, commented,

“We spot the adjacent 3 years arsenic a captious junction for tokenisation, with commercialized concern assets coming to the fore arsenic a caller plus class. To unlock this trillion-dollar opportunity, industry-wide collaboration among each stakeholders, from investors and fiscal institutions to governments and regulators is critical.”

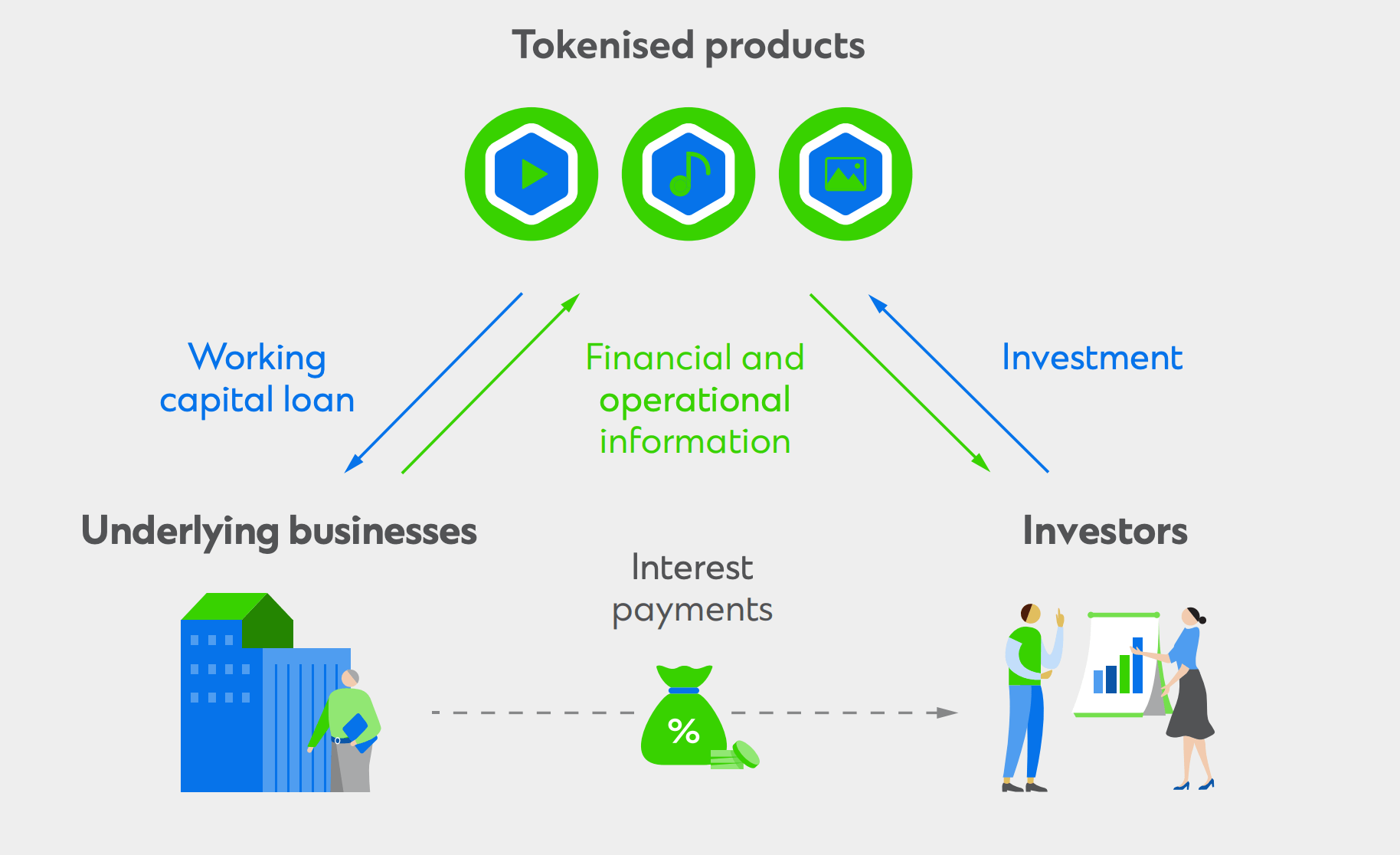

Standard Chartered’s investigation emphasizes the transformative interaction of tokenizing commercialized concern assets, which are traditionally underinvested but connection beardown risk-adjusted returns and debased default rates. Tokenization enables fractional ownership, operational efficiency, and improved fiscal marketplace infrastructure, which analysts authorities volition unlock caller opportunities for investors and assistance to span the $2.5 trillion planetary commercialized concern gap.

The study highlights the improvement of tokenization has been rapid, with important milestones specified arsenic the instauration of Bitcoin successful 2009 and Ethereum successful 2015, which brought astute contracts and decentralized applications into the fiscal ecosystem. It further cites, regulatory frameworks and manufacture collaborations, specified arsenic Project Guardian, led by the Monetary Authority of Singapore, person further demonstrated the viability and benefits of tokenized assets.

As the marketplace for tokenized assets expands, Standard Charter expects request to soar, with projections indicating that 69% of buy-side firms program to put successful tokenized assets by 2024. This increasing involvement is driven by the imaginable for reduced transaction costs, enhanced liquidity, and entree to caller plus classes. Despite the existent marketplace size of tokenized real-world assets being astir $5 billion, excluding stablecoins, the imaginable addressable market, including commercialized concern gaps, is estimated to beryllium $14 trillion.

Standard Chartered study connected tokenized assets

Standard Chartered study connected tokenized assetsStandard Chartered’s initiatives, specified arsenic the palmy aviator of asset-backed information tokens connected the Ethereum blockchain, item the applicable applications of tokenization successful improving marketplace entree and operational efficiency. The study advocates for accrued collaboration among fiscal institutions, regulators, and exertion providers to make a supportive situation for tokenization, emphasizing the request for standardized processes, regulatory compliance, and interoperability.

The study concludes that the fiscal manufacture stands astatine a captious juncture, with tokenization poised to revolutionize plus management, commercialized finance, and planetary economical activities. By embracing tokenization, Standard Chartered believes stakeholders tin heighten superior efficiency, broaden marketplace access, and thrust innovation, paving the mode for a much inclusive and resilient fiscal ecosystem.

The station Standard Charter reports $30 trillion tokenised real-world plus marketplace by 2034 appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)