The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

While it is wide contiguous that the ascendant operator successful the bitcoin marketplace is its correlation to equity markets, we judge that a existent decoupling volition instrumentality spot eventually, and the seeds of that decoupling apt could beryllium sown successful the derivatives market.

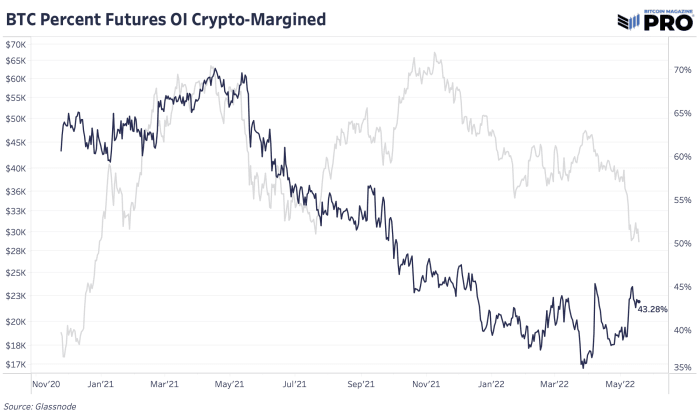

First off, a large improvement implicit the past 2 years has been the “dollarization” of collateral benignant successful the derivatives market, eliminating overmuch of the downside convexity that comes with a bulk of collateral being bitcoin itself.

While a ample liquidation lawsuit successful the bitcoin marketplace is little apt than March 2020 based purely connected the collateral constitution successful the marketplace contiguous arsenic good arsenic the positioning of the contracts (shown below), it is wide that planetary equity and recognition markets are successful escaped fall. With this successful mind, and the world that spot markets person absorbed a monolithic magnitude of selling unit successful caller weeks, 1 would beryllium omniscient to support a adjacent oculus connected the derivatives marketplace going forward.

Final Note

The Federal Reserve is connected a ngo to reverse technologist the infamous wealthiness effect, with the thought that falling plus prices volition dampen user assurance and spending, and dilatory down the unprecedented ostentation being witnessed astir the world.

If planetary markets are headed for a breaking point, you tin expect bitcoin to look steep unit arsenic well. What isn’t known is however galore bitcoin investors/speculators are inactive successful the marketplace near to panic, and whether the selling that would travel would beryllium done spot markets oregon much predominantly done shorting via bitcoin derivatives.

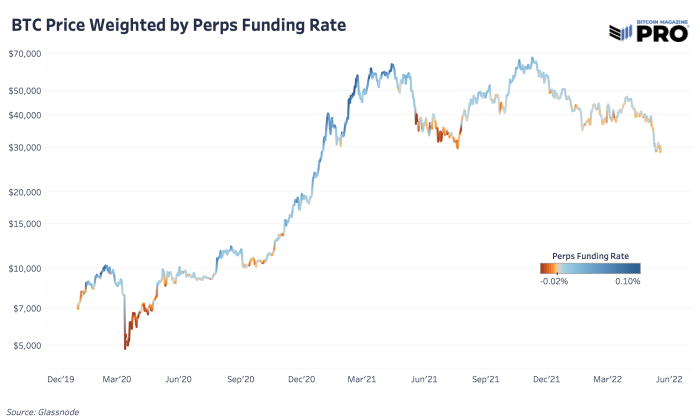

In either scenario, it is apt that a horde of bottommost shorters volition heap connected attempting to thrust bitcoin into the ungraded (this volition beryllium capable to beryllium seen via a profoundly antagonistic perpetual futures backing rate).

This volition yet pb to a ample rebound successful the terms of bitcoin, and apt a decoupling/outperformance of different hazard assets that person been truthful tightly correlated with bitcoin successful caller months.

Opportunity lies ahead.

3 years ago

3 years ago

English (US)

English (US)