Bitcoin’s volatility implicit the play translated to a crisp driblet to beneath $60,000 connected June 24, starring to implicit $537 cardinal successful realized losses for the market.

As with astir spikes successful realized losses, this sell-off was predominantly driven by short-term holders, who accounted for astir the full magnitude of realized losses. This signifier further confirms however susceptible STHs are to marketplace volatility — $441 cardinal of the losses came from holders who owned BTC for 1 period oregon less.

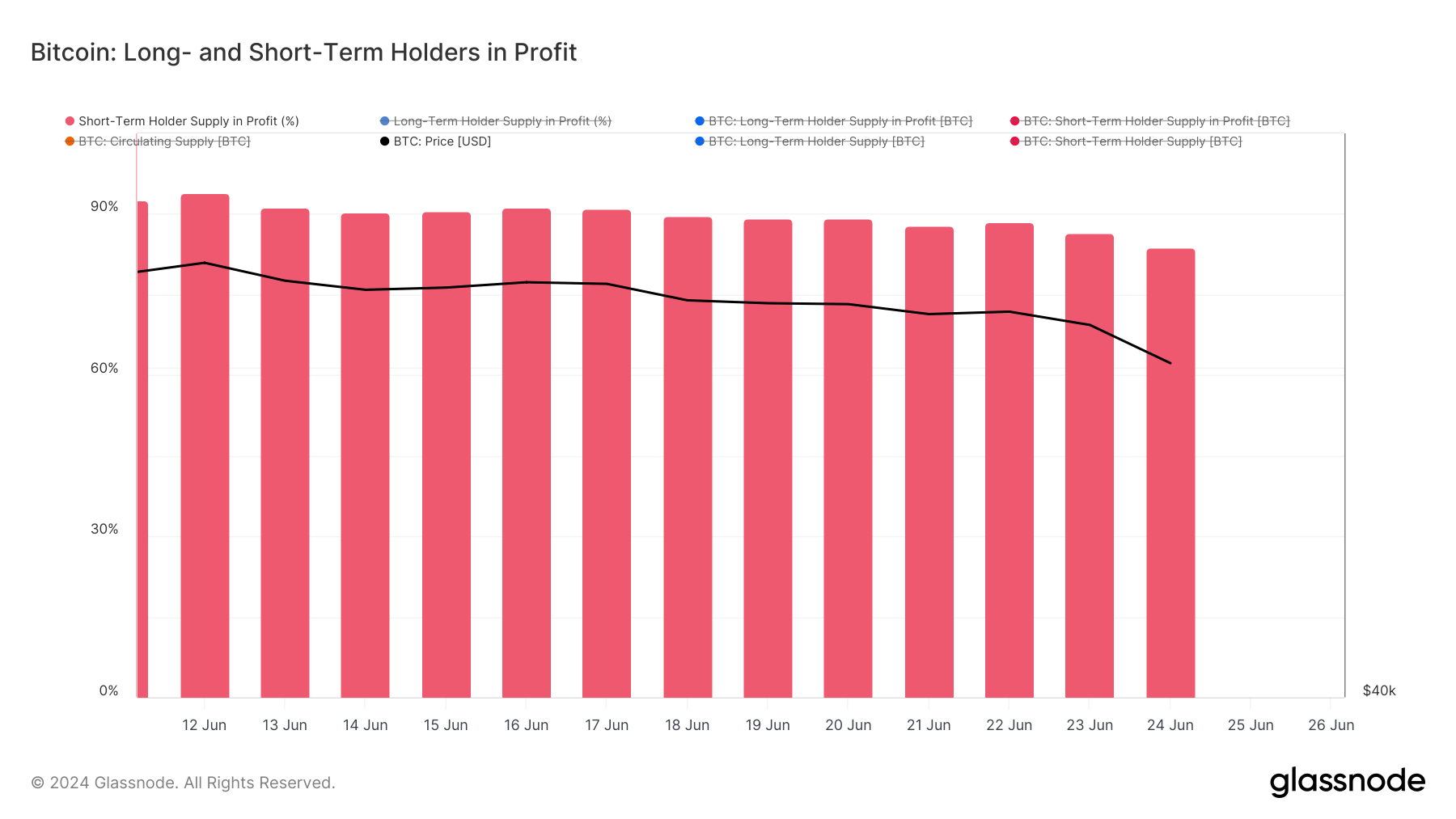

The standard of this sell-off is intelligibly disposable successful on-chain data. The percent of the STH proviso successful nett shows the proportionality of Bitcoin held by STHs presently valued higher than the acquisition price.

On June 22, 88.422% of the STH was successful profit, but this percent decreased arsenic Bitcoin’s terms dropped. It dropped to 83.854% connected June 24, showing that a increasing information of STHs are holding Bitcoin astatine a loss.

A driblet of astir 4% successful the percent of STH proviso successful nett implicit a abbreviated play is comparatively substantial. This alteration signifies a important measurement of Bitcoin moving from nett to loss, and the accelerated complaint of alteration shows the reactive quality of the cohort.

Chart showing the percent of STH proviso successful nett from June 12 to June 24, 2024 (Source: Glassnode)

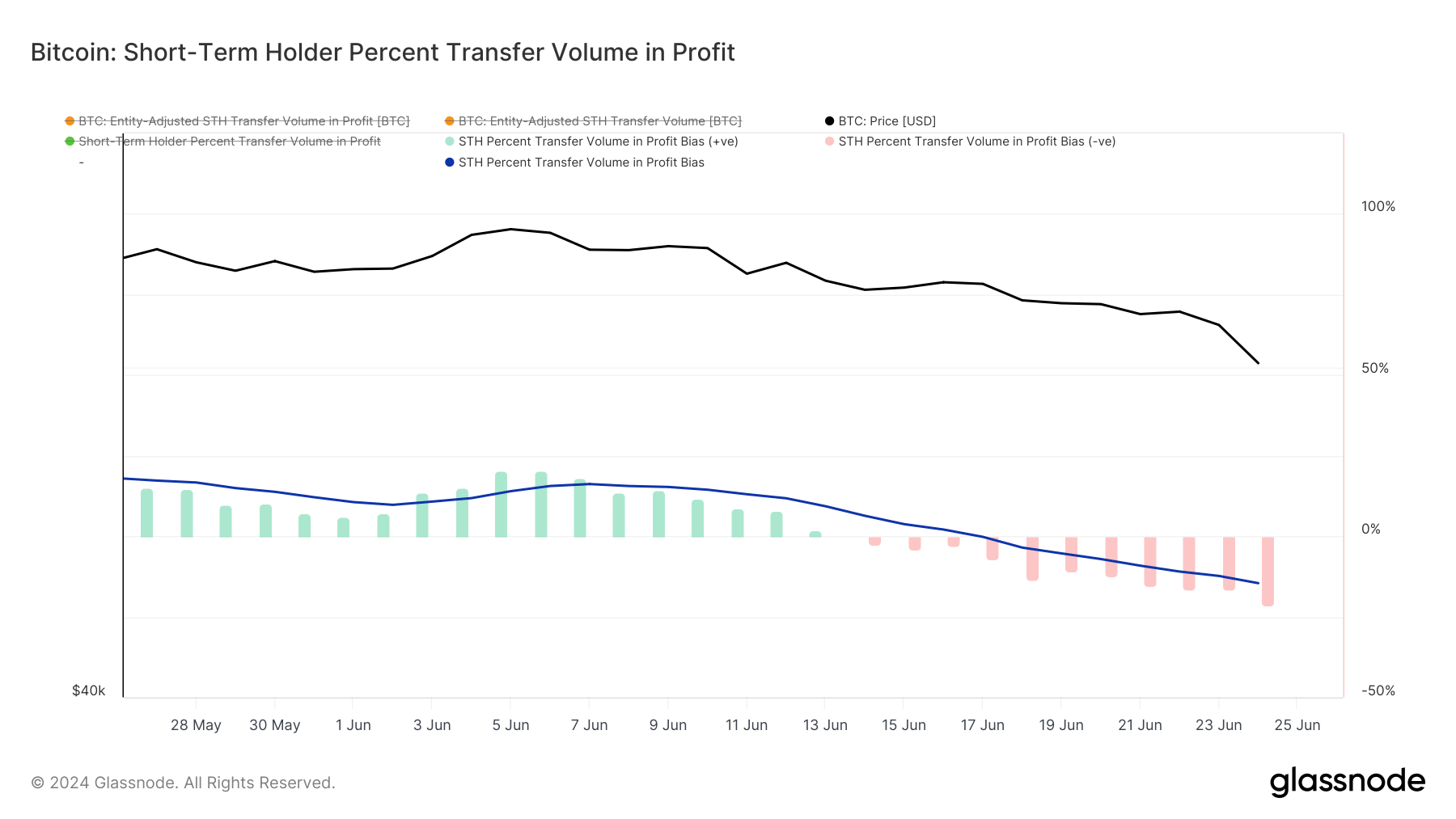

Chart showing the percent of STH proviso successful nett from June 12 to June 24, 2024 (Source: Glassnode)Most of the short-term holder transportation measurement has been successful nonaccomplishment since June 15. The antagonistic inclination worsened from -15.282% connected June 21 to -21.309% connected June 24, reaching its lowest level since September past year. This shows that the accrued selling unit among STHs persisted earlier the terms driblet and that the driblet beneath $61,000 further exacerbated this trend.

Graph showing the bias of STH on-chain worth settled successful nett (green) oregon nonaccomplishment (red) from May 27 to June 24, 2024 (Source: Glassnode)

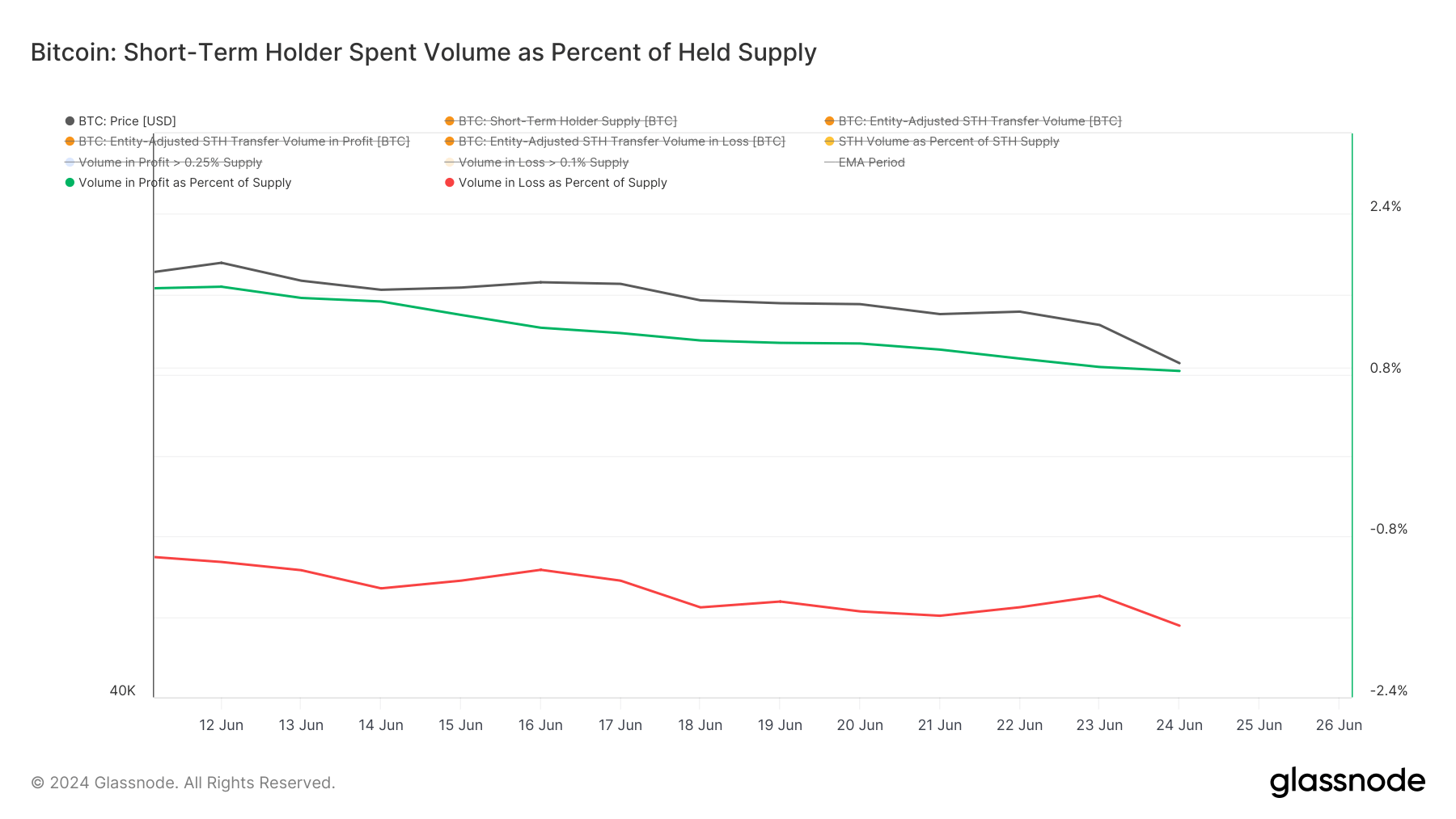

Graph showing the bias of STH on-chain worth settled successful nett (green) oregon nonaccomplishment (red) from May 27 to June 24, 2024 (Source: Glassnode)Another metric that illustrates the standard of the sell-off is the short-term holder spent measurement successful nett and nonaccomplishment arsenic a percent of held supply. This metric from Glassnode helps show however overmuch of the STH proviso was spent, realizing gains and losses.

Between June 21 and June 24, determination has been a accordant alteration successful the STH measurement spent successful nett from 1.053% to 0.841%. Conversely, the STH measurement spent successful nonaccomplishment arsenic a percent of held proviso showed a flimsy uptick from -1.590% connected June 21 to -1.688% connected June 24.

The information aligns with the inclination of STHs becoming much inclined to merchantability and recognize their losses.

Graph showing the percent of STH on-chain transportation measurement successful nett (green) and nonaccomplishment (red) successful proportionality to the full proviso held by this cohort from June 12 to June 24, 2024 (Source: Glassnode)

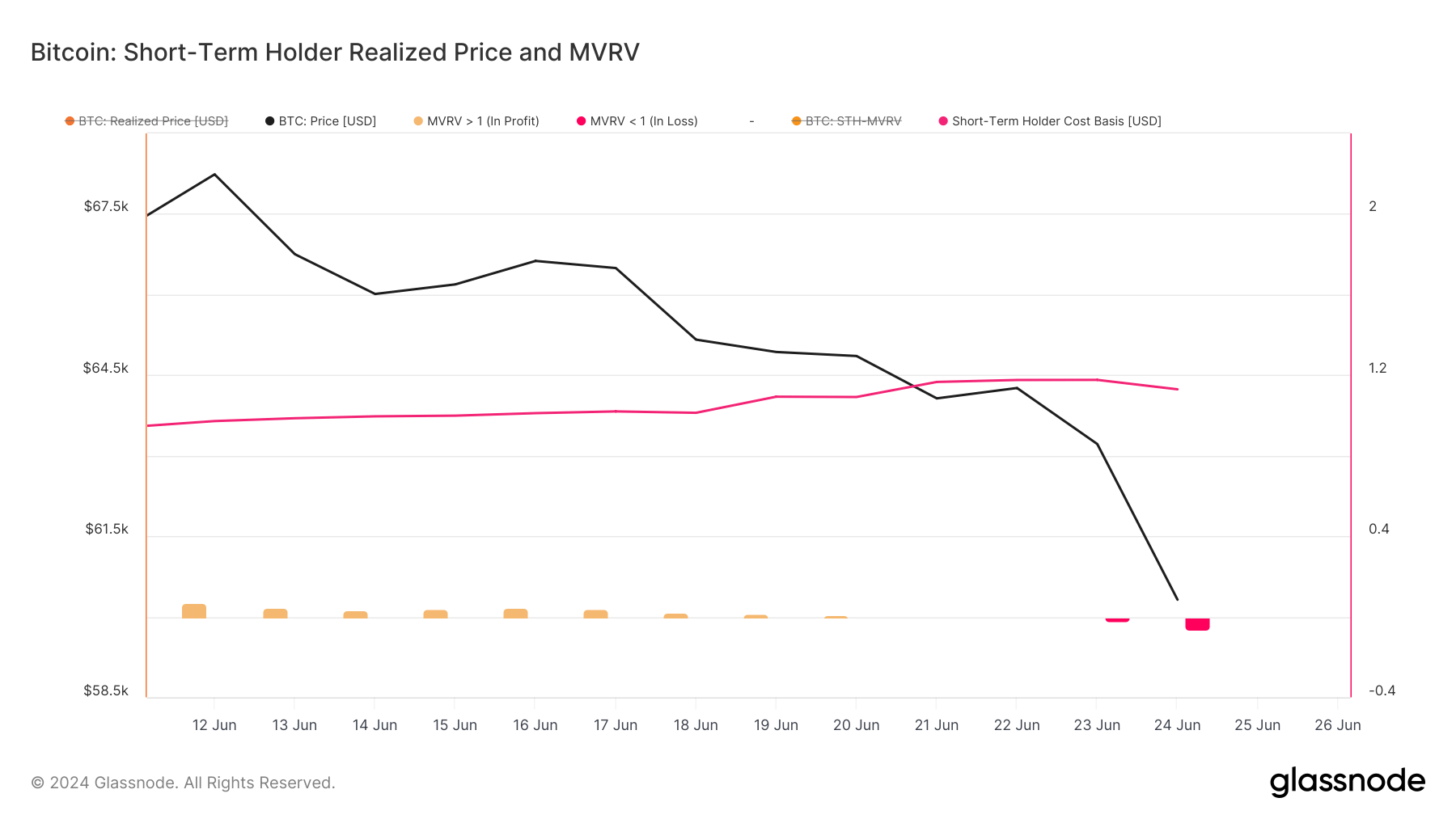

Graph showing the percent of STH on-chain transportation measurement successful nett (green) and nonaccomplishment (red) successful proportionality to the full proviso held by this cohort from June 12 to June 24, 2024 (Source: Glassnode)The realized terms and MVRV ratio for short-term holders further corroborate this. The realized price, the mean terms astatine which the existent STH proviso was acquired, remained comparatively unchangeable astatine astir $64,000 passim the weekend.

However, the MVRV ratio, which compares marketplace worth to realized value, turned negative. On June 21, the MVRV was -0.0047, dipping further to -0.0609 by June 24. A antagonistic MVRV ratio suggests that the marketplace worth is little than the realized value, indicating that the existent marketplace conditions are unfavorable for STHs — confirming that they are realizing losses upon selling.

Chart showing the realized terms and MVRV ratio for short-term holders from June 12 to June 24, 2024 (Source: Glassnode)

Chart showing the realized terms and MVRV ratio for short-term holders from June 12 to June 24, 2024 (Source: Glassnode)The decreasing percent of STH proviso successful profit, the antagonistic inclination successful transportation measurement successful profit, and the rising spent measurement successful nonaccomplishment collectively bespeak accrued selling unit and nonaccomplishment realization among STHs. The antagonistic MVRV ratio shows unfavorable marketplace conditions for STHs looking to profit. These metrics amusement a marketplace driven by highly reactive behavior, peculiarly among caller investors.

The station STHs faced important losses arsenic Bitcoin concisely fell beneath $60k appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)