Bitcoin's crisp terms declines person dominated quality headlines this week, but large firm BTC holder Strategy (MSTR) has been successful a downtrend for much than 3 months.

Trading astir the $250 level connected Wednesday, Strategy is little by astir 55% since peaking astatine $543 connected Nov. 21. Investors successful leveraged MSTR products person suffered adjacent greater losses. The Defiance Daily Target 2x Long MSTR ETF (MSTX) has plunged 90%, portion the T-REX ETF (MSTU) has declined 85%.

Despite the diminution successful bitcoin, Strategy's BTC acquisition remains profitable. Since initiating purchases successful August 2020, the institution is up 32% connected its holdings, with an mean outgo ground of $66,300 per BTC and an unrealized nett of $10.65 cardinal astatine bitcoin's existent terms of astir $87,000.

The forced income question

A person look astatine Strategy’s convertible indebtedness highlights imaginable “liquidation prices” oregon forced bitcoin sales. Notably, each of the company's 499,096 BTC stay unencumbered, meaning Strategy has not pledged immoderate bitcoin arsenic collateral. An earlier convertible enactment utilizing bitcoin arsenic collateral with Silvergate Bank was afloat repaid.

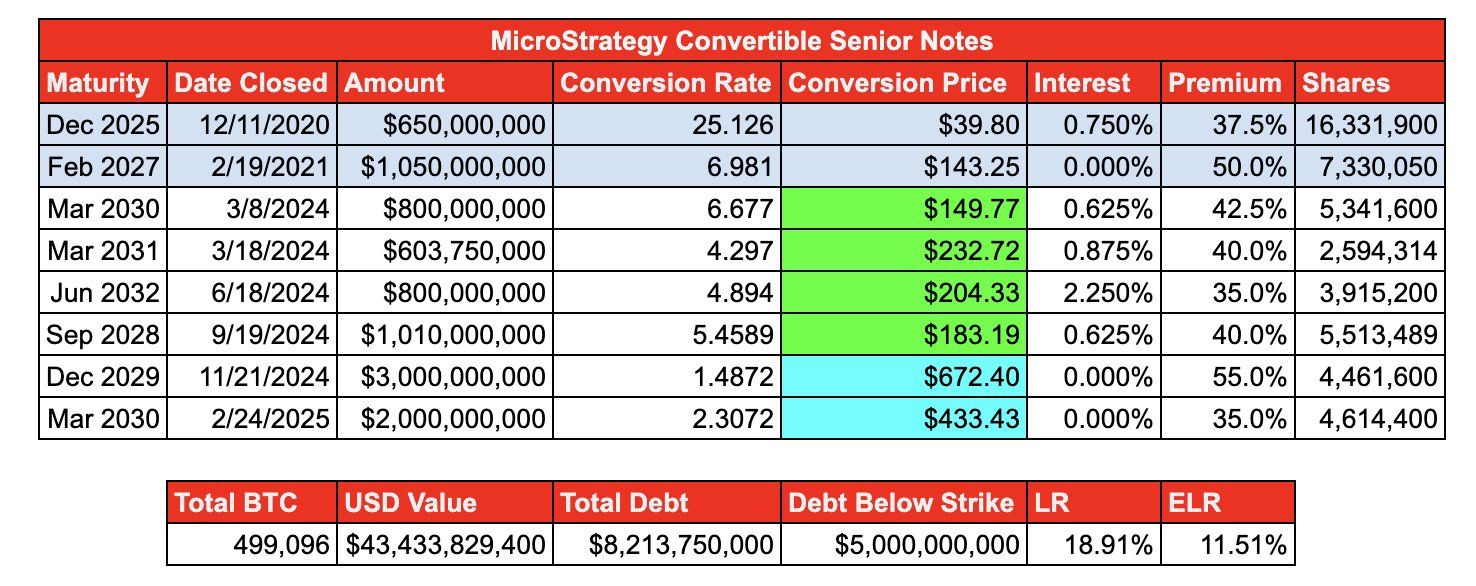

According to Bitcoin Overflow connected X, Strategy has $8.2 cardinal successful full outstanding debt, backed by 499,096 BTC, presently valued astatine $43.4 billion.

The abbreviated answer: As agelong arsenic the worth of Strategy's bitcoin exceeds its indebtedness levels, the institution would not request to merchantability immoderate of its BTC holdings. In different words, bitcoin would person to diminution each the mode to astir $16,500, oregon astir different 80% from existent levels.

Taking a much elaborate look, 2 of the six outstanding convertible bonds—the 2029 and 2030 issues—are beneath their conversion price. They're ample bonds, though, accounting for $5 cardinal retired of the $8.2 cardinal total. Even then, the indebtedness does not mature until 2029, allowing clip for recovery. And successful theory, Strategy could rotation implicit much paper, if that were to happen. If the worth of the company's bitcoin were to driblet beneath indebtedness levels astatine the clip the convertible bonds matured, and the MSTR banal terms was beneath the conversion terms (which would beryllium precise apt successful that scenario), Strategy — successful bid to forestall monolithic dilution successful its banal — would apt determine to merchantability bitcoin to repay the bonds successful currency alternatively than converting them into equity.

Read more: In Defense of the 'MicroStrategy Premium'

6 months ago

6 months ago

English (US)

English (US)