Disclaimer: The expert who wrote this study owns shares of Strategy (MSTR).

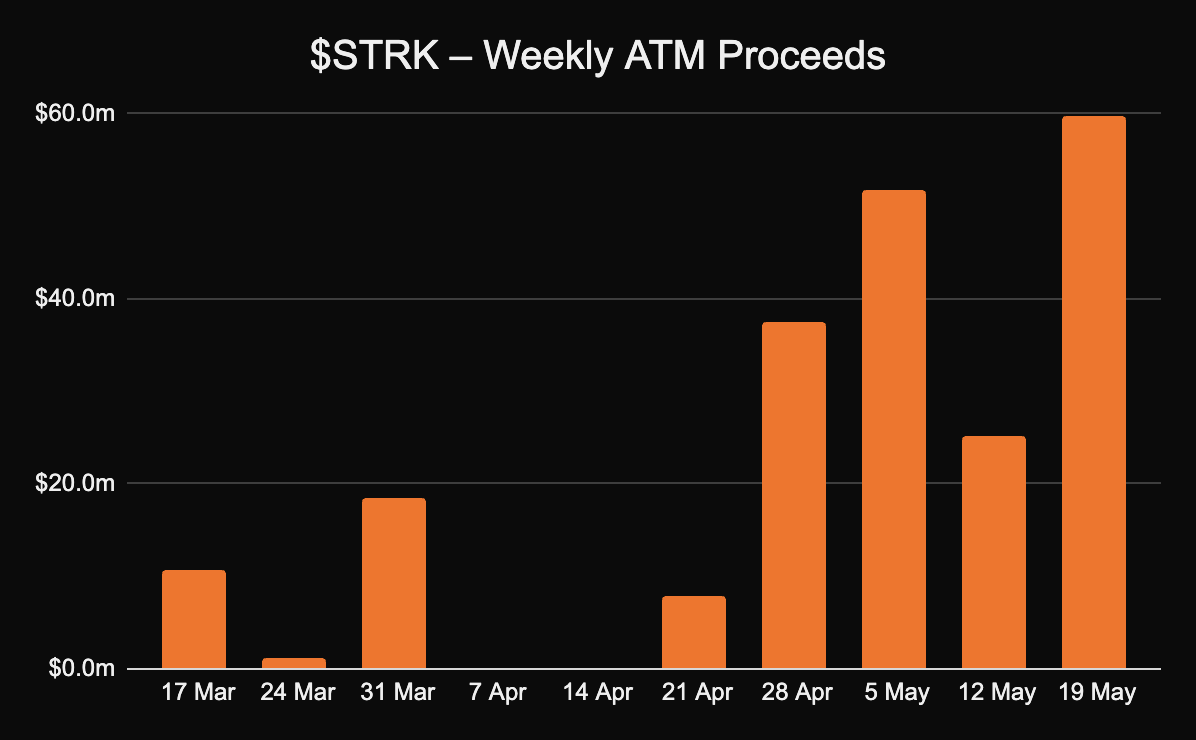

Strategy’s (MSTR) perpetual preferred stock, STRK, achieved the largest proceeds from its play at-the-market (ATM) issuance since the programme started successful February, according to X relationship DogCandles, raising $59.7 million that was utilized to bargain much bitcoin BTC, according to a Monday SEC filing.

That magnitude corresponds to the issuance of astir 621,555 STRK shares. Strategy has astir $20.79 cardinal inactive disposable successful the STRK ATM facility.

The institution led by Executive Chairman Michael Saylor is plowing up with its bitcoin-buying strategy adjacent arsenic the terms of the largest cryptocurrency holds supra $100,000, with an oculus connected its January grounds of $109,000. Strategy's Monday BTC purchase took its full holdings to 576,230 BTC.

This represents a 16.3% BTC yield, a cardinal show indicator (KPI) that reflects the year-to-date percent summation successful the ratio of MSTR’s bitcoin holdings to its assumed diluted shares outstanding, efficaciously measuring the maturation successful BTC vulnerability connected a per-share basis.

The caller STRK issuance represents conscionable nether 9% of the full proceeds generated from the ATM programme for the communal stock, which has raised $705.7 cardinal to date. This highlights the expanding relation STRK is playing successful Strategy’s bitcoin acquisition model.

STRK features a fixed 8% yearly dividend, which is based connected the $100 per stock liquidation preference, resulting successful an yearly payout of $8.00 per share.

That gives it an effectual yield, yearly dividend divided by STRK stock price, of 8.1%. Importantly, this output is inversely related to the stock price. As STRK trades higher, the output decreases, and vice versa.

Since its motorboat connected Feb. 10, STRK has risen by 16%, outperforming some bitcoin, which has added 10%, and the S&P 500, which has declined by 2% implicit the aforesaid period.

According to information from the Strategy dashboard, STRK exhibits the lowest correlation with MSTR communal stock, sitting astatine conscionable 44%. In contrast, STRK maintains comparatively higher correlations with broader marketplace benchmarks: 71% with bitcoin and 72% with the SPY exchange-traded fund.

This suggests that STRK trades with a unsocial profile, perchance appealing to investors seeking differentiated vulnerability owed to its hybrid quality arsenic a preferred equity instrumentality with bitcoin-tied superior deployment.

4 months ago

4 months ago

English (US)

English (US)