This is an sentiment editorial by Alex Gladstein, main strategy serviceman of the Human Rights Foundation and writer of “Check Your Financial Privilege.”

I. The Shrimp Fields

“Everything is gone.”

–Kolyani Mondal

Fifty-two years ago, Cyclone Bhola killed an estimated 1 cardinal radical successful coastal Bangladesh. It is, to this day, the deadliest tropical cyclone successful recorded history. Local and planetary authorities knew good the catastrophic risks of specified storms: successful the 1960s, determination officials had built a monolithic array of dikes to support the coastline and unfastened up much territory for farming. But successful the 1980s aft the assassination of independency person Sheikh Mujibur Rahman, overseas power pushed a caller autocratic Bangladeshi authorities to alteration course. Concern for quality beingness was dismissed and the public’s extortion against storms was weakened, each successful bid to boost exports to repay debt.

Instead of reinforcing the section mangrove forests which people protected the one-third of the colonisation that lived adjacent the coast, and alternatively of investing successful increasing nutrient to provender the rapidly increasing nation, the authorities took retired loans from the World Bank and International Monetary Fund successful bid to grow shrimp farming. The aquaculture process — controlled by a network of affluent elites linked to the authorities — progressive pushing farmers to instrumentality retired loans to “upgrade” their operations by drilling holes successful the dikes that protected their onshore from the ocean, filling their once-fertile fields with saltwater. Then, they would enactment back-breaking hours to hand-harvest young shrimp from the ocean, resistance them backmost to their stagnant ponds, and merchantability the mature ones to the section shrimp lords.

With financing from the World Bank and IMF, countless farms and their surrounding wetlands and mangrove forests were engineered into shrimp ponds known arsenic ghers. The area’s Ganges stream delta is an incredibly fertile place, location to the Sundarbans, the world’s biggest agelong of mangrove forest. But arsenic a effect of commercialized shrimp farming becoming the region’s main economical activity, 45% of the mangroves person been chopped away, leaving millions of radical exposed to the 10-meter waves that tin clang against the seashore during large cyclones. Arable onshore and stream beingness has been dilatory destroyed by excess salinity leaking successful from the sea. Entire forests person vanished arsenic shrimp farming has killed overmuch of the area’s vegetation, "rendering this erstwhile bountiful onshore into a watery desert,” according to Coastal Development Partnership.

A farm successful Khuna province, flooded to marque shrimp fields

The shrimp lords, however, person made a fortune, and shrimp (known arsenic “white gold”) has go the country’s second-largest export. As of 2014, much than 1.2 million Bangladeshis worked successful the shrimp industry, with 4.8 cardinal radical indirectly babelike connected it, astir fractional of the coastal poor. The shrimp collectors, who person the toughest job, marque up 50% of the labour unit but lone spot 6% of the profit. Thirty percent of them are girls and boys engaged successful kid labor, who enactment arsenic overmuch arsenic 9 hours a time successful the brackish water, for little than $1 per day, with galore giving up schoolhouse and remaining illiterate to bash so. Protests against the enlargement of shrimp farming person happened, lone to beryllium enactment down violently. In 1 salient case, a march was attacked with explosives from shrimp lords and their thugs, and a pistillate named Kuranamoyee Sardar was decapitated.

In a 2007 research paper, 102 Bangladeshi shrimp farms were surveyed, revealing that, retired of a outgo of accumulation of $1,084 per hectare, the nett income was $689. The nation’s export-driven profits came astatine the disbursal of the shrimp laborers, whose wages were deflated and whose situation was destroyed.

In a study by the Environmental Justice Foundation, a coastal husbandman named Kolyani Mondal said that she “used to workplace atom and support livestock and poultry,” but aft shrimp harvesting was imposed, “her cattle and goats developed diarrhea-type illness and unneurotic with her hens and ducks, each died.”

Now her fields are flooded with brackish water, and what remains is hardly productive: years agone her household could make “18-19 mon of atom per hectare,” but present they tin lone make one. She remembers shrimp farming successful her country opening successful the 1980s, erstwhile villagers were promised much income arsenic good arsenic tons of nutrient and crops, but present “everything is gone.” The shrimp farmers who usage her onshore promised to wage her $140 per year, but she says the champion she gets are “occasional installments of $8 present oregon there.” In the past, she says, “the household got astir of the things they needed from the land, but present determination are nary alternatives but going to the marketplace to bargain food.”

In Bangladesh, billions of dollars of World Bank and IMF “structural adjustment” loans — named for the mode they unit borrowing nations to modify their economies to favour exports astatine the disbursal of depletion — grew nationalist shrimp profits from $2.9 cardinal successful 1973 to $90 cardinal successful 1986 to $590 million successful 2012. As successful astir cases with processing countries, the gross was utilized to work overseas debt, make subject assets, and enactment the pockets of authorities officials. As for the shrimp serfs, they person been impoverished: little free, much babelike and little capable to provender themselves than before. To marque matters worse, studies amusement that “villages shielded from the tempest surge by mangrove forests acquisition importantly less deaths” than villages which had their protections removed oregon damaged.

Under nationalist unit successful 2013 the World Bank loaned Bangladesh $400 million to effort and reverse the ecological damage. In different words, the World Bank volition beryllium paid a interest successful the signifier of involvement to effort and hole the occupation it created successful the archetypal place. Meanwhile, the World Bank has loaned billions to countries everyplace from Ecuador to Morocco to India to regenerate accepted farming with shrimp production.

The World Bank claims that Bangladesh is “a singular communicative of poorness simplification and development.” On paper, triumph is declared: countries similar Bangladesh thin to amusement economical maturation implicit clip arsenic their exports emergence to conscionable their imports. But exports net travel mostly to the ruling elite and planetary creditors. After 10 structural adjustments, Bangladesh’s indebtedness heap has grown exponentially from $145 million successful 1972 to an all-time precocious of $95.9 billion successful 2022. The state is presently facing yet different equilibrium of payments crisis, and conscionable this period agreed to instrumentality its 11th indebtedness from the IMF, this clip a $4.5 billion bailout, successful speech for much adjustment. The Bank and the Fund assertion to privation to assistance mediocre countries, but the wide result aft much than 50 years of their policies is that nations similar Bangladesh are much babelike and indebted than ever before.

During the 1990s successful the aftermath of the Third World Debt Crisis, determination was a swell of planetary nationalist scrutiny connected the Bank and Fund: captious studies, thoroughfare protests, and a widespread, bipartisan content (even successful the halls of the U.S. Congress) that these institutions ranged from wasteful to destructive. But this sentiment and absorption has mostly faded. Today, the Bank and the Fund negociate to support a debased illustration successful the press. When they bash travel up, they thin to beryllium written disconnected arsenic progressively irrelevant, accepted arsenic problematic yet necessary, oregon adjacent welcomed arsenic helpful.

The world is that these organizations person impoverished and endangered millions of people; enriched dictators and kleptocrats; and formed quality rights speech to make a multi-trillion-dollar travel of food, earthy resources and inexpensive labour from mediocre countries to affluent ones. Their behaviour successful countries similar Bangladesh is nary mistake oregon exception: it is their preferred mode of doing business.

II. Inside The World Bank And IMF

“Let america retrieve that the main intent of assistance is not to assistance different nations but to assistance ourselves.”

The IMF is the world’s planetary lender of past resort, and the World Bank is the world’s largest improvement bank. Their enactment is carried retired connected behalf of their large creditors, which historically person been the United States, the United Kingdom, France, Germany and Japan.

The IMF and World Bank offices successful Washington, DC

The sister organizations — physically joined unneurotic astatine their office successful Washington, DC — were created astatine the Bretton Woods Conference successful New Hampshire successful 1944 arsenic 2 pillars of the caller U.S.-led planetary monetary order. Per tradition, the World Bank is headed by an American, and the IMF by a European.

Their archetypal intent was to assistance rebuild war-torn Europe and Japan, with the Bank to absorption connected circumstantial loans for improvement projects, and the Fund to code balance-of-payment issues via “bailouts” to support commercialized flowing adjacent if countries couldn’t spend much imports.

Nations are required to articulation the IMF successful bid to get entree to the “perks” of the World Bank. Today, determination are 190 subordinate states: each 1 deposited a premix of their ain currency positive “harder currency” (typically dollars, European currencies oregon gold) erstwhile they joined, creating a excavation of reserves.

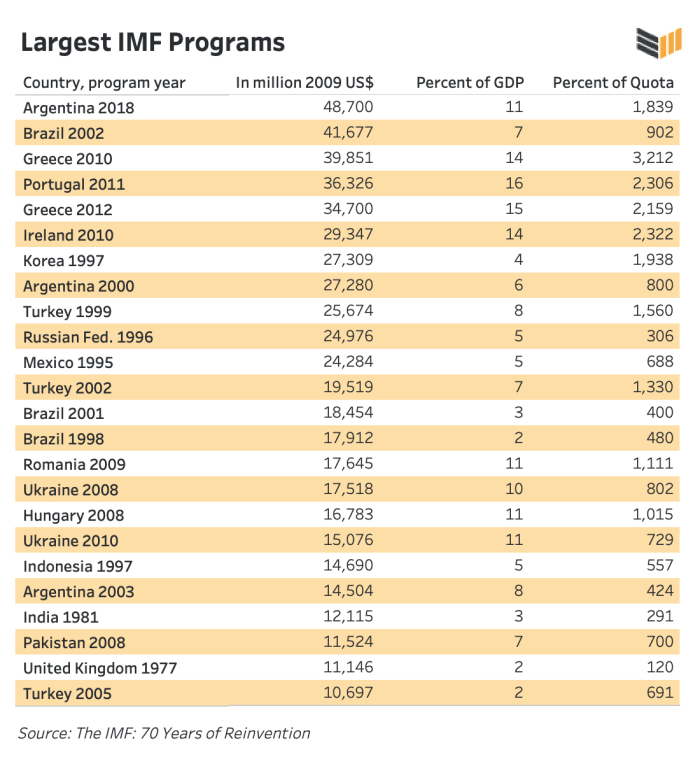

When members brushwood chronic balance-of-payments issues, and cannot marque indebtedness repayments, the Fund offers them recognition from the excavation astatine varying multiples of what they initially deposited, connected progressively costly terms.

The Fund is technically a supranational cardinal bank, arsenic since 1969 it has minted its ain currency: the peculiar drafting rights (SDR), whose worth is based connected a handbasket of the world’s apical currencies. Today, the SDR is backed by 45% dollars, 29% euros, 12% yuan, 7% yen and 7% pounds. The full lending capableness of the IMF contiguous stands astatine $1 trillion.

Between 1960 and 2008, the Fund mostly focused connected assisting processing countries with short-term, high-interest-rate loans. Because the currencies issued by processing countries are not freely convertible, they usually cannot beryllium redeemed for goods oregon services abroad. Developing states indispensable alternatively gain hard currency done exports. Unlike the U.S., which tin simply contented the planetary reserve currency, countries similar Sri Lanka and Mozambique often tally retired of money. At that point, astir governments — particularly authoritarian ones — similar the speedy hole of borrowing against their country’s aboriginal from the Fund.

As for the Bank, it states that its occupation is to supply recognition to processing countries to “reduce poverty, summation shared prosperity, and beforehand sustainable development.” The Bank itself is divided up into 5 parts, ranging from the International Bank for Reconstruction and Development (IBRD), which focuses connected much accepted “hard” loans to the larger processing countries (think Brazil oregon India) to the International Development Association (IDA), which focuses connected “soft” interest-free loans with agelong grace periods for the poorest countries. The IBRD makes wealth successful portion done the Cantillon effect: by borrowing connected favorable presumption from its creditors and backstage marketplace participants who person much nonstop entree to cheaper superior and past loaning retired those funds astatine higher presumption to mediocre countries who deficiency that access.

World Bank loans traditionally are project- oregon sector-specific, and person focused connected facilitating the earthy export of commodities (for example: financing the roads, tunnels, dams, and ports needed to get minerals retired of the crushed and into planetary markets) and connected transforming accepted depletion agriculture into concern agriculture oregon aquaculture truthful that countries could export much nutrient and goods to the West.

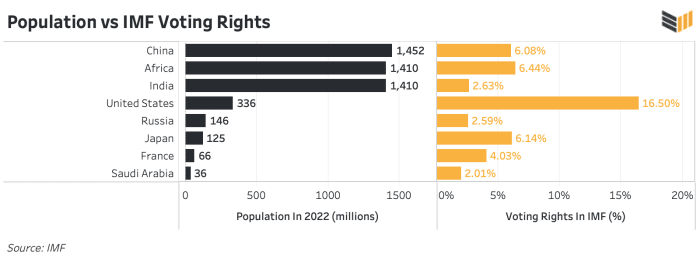

Bank and Fund subordinate states bash not person voting powerfulness based connected their population. Rather, power was crafted 7 decades agone to favour the U.S., Europe and Japan implicit the remainder of the world. That dominance has lone weakened mildly successful caller years.

Today the U.S. inactive owns acold and distant the largest ballot share, astatine 15.6% of the Bank and 16.5% of the Fund, capable to single-handedly veto immoderate large decision, which requires 85% of votes astatine either institution. Japan owns 7.35% of the votes astatine the Bank and 6.14% astatine the Fund; Germany 4.21% and 5.31%; France and the U.K. 3.87% and 4.03% each; and Italy 2.49% and 3.02%.

By contrast, India with its 1.4 cardinal radical lone has 3.04% of the Bank’s ballot and conscionable 2.63% astatine the Fund: little powerfulness than its erstwhile assemblage maestro contempt having a colonisation 20 times bigger. China’s 1.4 cardinal radical get 5.7% astatine the Bank and 6.08% astatine the fund, astir the aforesaid stock arsenic the Netherlands positive Canada and Australia. Brazil and Nigeria, the largest countries successful Latin America and Africa, person astir the aforesaid magnitude of sway arsenic Italy, a erstwhile imperial powerfulness successful afloat decline.

Tiny Switzerland with conscionable 8.6 cardinal radical has 1.47% of votes astatine the World Bank, and 1.17% of votes astatine the IMF: astir the aforesaid stock arsenic Pakistan, Indonesia, Bangladesh, and Ethiopia combined, contempt having 90 times less people.

These voting shares are expected to approximate each country’s stock of the satellite economy, but their imperial-era operation helps colour however decisions are made. Sixty-five years aft decolonization, the concern powers led by the U.S. proceed to person much oregon little full power implicit planetary commercialized and lending, portion the poorest countries person successful effect nary dependable astatine all.

The G-5 (the U.S., Japan, Germany, the U.K. and France) predominate the IMF enforcement board, adjacent though they marque up a comparatively tiny percent of the world’s population. The G-10 positive Ireland, Australia, and Korea marque up much than 50% of the votes, meaning that with a small unit connected its allies, the U.S. tin marque determinations adjacent connected circumstantial indebtedness decisions, which necessitate a majority.

To complement the IMF’s trillion-dollar lending power, the World Bank radical claims much than $350 billion successful outstanding loans crossed much than 150 countries. This recognition has spiked implicit the past 2 years, arsenic the sister organizations person lent hundreds of billions of dollars to governments who locked down their economies successful effect to the COVID-19 pandemic.

Over the past fewer months, the Bank and Fund began orchestrating billion-dollar deals to “save” governments endangered by the U.S. Federal Reserve’s assertive involvement complaint hikes. These clients are often quality rights violators who get without support from their citizens, who volition yet beryllium the ones liable for paying backmost main positive involvement connected the loans. The IMF is presently bailing retired Egyptian dictator Abdel Fattah El-Sisi — liable for the largest massacre of protestors since Tiananmen Square — for example, with $3 billion. Meanwhile, the World Bank was, during the past year, disbursing a $300 million indebtedness to an Ethiopian authorities that was committing genocide successful Tigray.

The cumulative effect of Bank and Fund policies is overmuch larger than the insubstantial magnitude of their loans, arsenic their lending drives bilateral assistance. It is estimated that “every dollar provided to the Third World by the IMF unlocks a further 4 to 7 dollars of caller loans and refinancing from commercialized banks and rich-country governments.” Similarly, if the Bank and Fund garbage to lend to a peculiar country, the remainder of the satellite typically follows suit.

It is hard to overstate the vast interaction the Bank and Fund person had crossed processing nations, particularly successful their formative decades aft World War II. By 1990 and the extremity of the Cold War, the IMF had extended recognition to 41 countries successful Africa, 28 countries successful Latin America, 20 countries successful Asia, 8 countries successful the Middle East and 5 countries successful Europe, affecting 3 cardinal people, oregon what was past two-thirds of the planetary population. The World Bank has extended loans to much than 160 countries. They stay the astir important planetary fiscal institutions connected the planet.

III. Structural Adjustment

“Adjustment is an ever caller and never-ending task”

–Otmar Emminger, erstwhile IMF manager and creator of SDR

Today, fiscal headlines are filled with stories astir IMF visits to countries similar Sri Lanka and Ghana. The result is that the Fund loans billions of dollars to countries successful situation successful speech for what is known arsenic structural adjustment.

In a structural-adjustment loan, borrowers not lone person to wage backmost main positive interest: they besides person to hold to change their economies according to Bank and Fund demands. These requirements astir ever stipulate that clients maximize exports astatine the disbursal of home consumption.

During probe for this essay, the writer learned overmuch from the enactment of the improvement student Cheryl Payer, who wrote landmark books and papers connected the power of the Bank and Fund successful the 1970s, 1980s and 1990s. This writer whitethorn disagree with Payer’s “solutions” — which, similar those of astir critics of the Bank and Fund, thin to beryllium socialist — but galore observations she makes astir the planetary system clasp existent careless of ideology.

“It is an explicit and basal purpose of IMF programs,” she wrote, “to discourage section depletion successful bid to escaped resources for export.”

This constituent cannot beryllium stressed enough.

The authoritative communicative is that the Bank and Fund were designed to “foster sustainable economical growth, beforehand higher standards of living, and trim poverty.” But the roads and dams the Bank builds are not designed to assistance amended transport and energy for locals, but alternatively to marque it casual for multinational corporations to extract wealth. And the bailouts the IMF provides aren’t to “save” a state from bankruptcy — which would astir apt beryllium the champion happening for it successful galore cases — but alternatively to let it to wage its indebtedness with adjacent much debt, truthful that the archetypal indebtedness doesn’t crook into a spread connected a Western bank’s equilibrium sheet.

In her books connected the Bank and Fund, Payer describes however the institutions assertion that their indebtedness conditionality enables borrowing countries “to execute a healthier equilibrium of commercialized and payments.” But the existent purpose, she says, is “to bribe the governments to forestall them from making the economical changes which would marque them much autarkic and self-supporting.” When countries wage backmost their structural accommodation loans, indebtedness work is prioritized, and home spending is to beryllium “adjusted” downwards.

IMF loans were often allocated done a mechanism called the “stand-by agreement,” a enactment of recognition that released funds lone arsenic the borrowing authorities claimed to execute definite objectives. From Jakarta to Lagos to Buenos Aires, IMF unit would alert successful (always archetypal oregon concern class) to conscionable undemocratic rulers and connection them millions oregon billions of dollars successful speech for pursuing their economical playbook.

Typical IMF demands would include:

- Currency devaluation

- Abolition oregon simplification of overseas speech and import controls

- Shrinking of home slope credit

- Higher involvement rates

- Increased taxes

- An extremity to user subsidies connected nutrient and energy

- Wage ceilings

- Restrictions connected authorities spending, particularly successful healthcare and education

- Favorable ineligible conditions and incentives for multinational corporations

- Selling disconnected authorities enterprises and claims connected earthy resources astatine occurrence merchantability prices

The World Bank had its ain playbook, too. Payer gives examples:

- The opening up of antecedently distant regions done proscription and telecommunications investments

- Aiding multinational corporations successful the mining sector

- Insisting connected accumulation for export

- Pressuring borrowers to amended ineligible privileges for the taxation liabilities of overseas investment

- Opposing minimum wage laws and commercialized national activity

- Ending protections for locally-owned businesses

- Financing projects that due land, h2o and forests from mediocre radical and manus them to multinational corporations

- Shrinking manufacturing and nutrient accumulation astatine the disbursal of the export of earthy resources and earthy goods

Third World governments person historically been forced to hold to a premix of these policies — sometimes known arsenic the “Washington Consensus” — successful bid to trigger the ongoing merchandise of Bank and Fund loans.

The erstwhile assemblage powers thin to absorption their “development” lending connected erstwhile colonies oregon areas of influence: France successful West Africa, Japan successful Indonesia, Britain successful East Africa and South Asia and the U.S. successful Latin America. A notable illustration is the CFA zone, wherever 180 cardinal radical successful 15 African countries are inactive forced to use a French assemblage currency. At the proposition of the IMF, successful 1994 France devalued the CFA by 50%, devastating the savings and purchasing powerfulness of tens of millions of radical surviving successful countries ranging from Senegal to Ivory Coast to Gabon, each to marque earthy goods exports more competitive.

The result of Bank and Fund policies connected the Third World has been remarkably akin to what was experienced nether accepted imperialism: wage deflation, a nonaccomplishment of autonomy and cultivation dependency. The large quality is that successful the caller system, the sword and the weapon person been replaced by weaponized debt.

Over the past 30 years, structural accommodation has intensified with respect to the mean fig of conditions successful loans extended by the Bank and Fund. Before 1980, the Bank did not mostly marque structural accommodation loans, astir everything was project- oregon sector-specific. But since then, “spend this nevertheless you want” bailout loans with economical quid pro quos person go a increasing portion of Bank policy. For the IMF, they are its lifeblood.

For example, erstwhile the IMF bailed out South Korea and Indonesia with $57 cardinal and $43 cardinal packages during the 1997 Asian Financial Crisis, it imposed dense conditionality. Borrowers had to motion agreements that “looked much similar Christmas trees than contracts, with anyplace from 50 to 80 elaborate conditions covering everything from the deregulation of ail monopolies to taxes connected cattle provender and caller biology laws,” according to governmental idiosyncratic Mark S. Copelvitch.

A 2014 analysis showed that the IMF had attached, connected average, 20 conditions to each indebtedness it gave retired successful the erstwhile 2 years, a historical increase. Countries similar Jamaica, Greece and Cyprus person borrowed successful caller years with an mean of 35 conditions each. It is worthy noting that Bank and Fund conditions person ne'er included protections connected escaped code oregon quality rights, oregon restrictions connected subject spending oregon constabulary violence.

An added twist of Bank and Fund argumentation is what is known arsenic the “double loan”: wealth is lent to build, for example, a hydroelectric dam, but astir if not each of the wealth gets paid to Western companies. So, the Third World payer is saddled with main and interest, and the North gets paid backmost double.

The discourse for the treble indebtedness is that ascendant states widen recognition done the Bank and Fund to erstwhile colonies, wherever section rulers often walk the caller currency straight backmost to multinational companies who nett from advising, operation oregon import services. The ensuing and required currency devaluation, wage controls and slope recognition tightening imposed by Bank and Fund structural accommodation disadvantage section entrepreneurs who are stuck successful a collapsing and isolated fiat system, and payment multinationals who are dollar, euro oregon yen native.

Another cardinal root for this writer has been the masterful publication “The Lords of Poverty” by historiographer Graham Hancock, written to bespeak connected the archetypal 5 decades of Bank and Fund argumentation and overseas assistance successful general.

“The World Bank,” Hancock writes, “is the archetypal to admit that retired of each $10 that it receives, astir $7 are successful information spent connected goods and services from the affluent industrialized countries.”

In the 1980s, erstwhile Bank backing was expanding rapidly astir the world, helium noted that “for each US taxation dollar contributed, 82 cents are instantly returned to American businesses successful the signifier of acquisition orders.” This dynamic applies not conscionable to loans but besides to aid. For example, erstwhile the U.S. oregon Germany sends a rescue level to a state successful crisis, the outgo of transport, food, medicine and unit salaries are added to what is known arsenic ODA, oregon “official improvement assistance.” On the books, it looks similar assistance and assistance. But astir of the wealth is paid close backmost to Western companies and not invested locally.

Reflecting connected the Third World Debt Crisis of the 1980s, Hancock noted that “70 cents retired of each dollar of American assistance ne'er really near the United States.” The U.K., for its part, spent a whopping 80% of its assistance during that clip straight connected British goods and services.

“One year,” Hancock writes, “British tax-payers provided multilateral assistance agencies with 495 cardinal pounds; successful the aforesaid year, however, British firms received contracts worthy 616 cardinal pounds.” Hancock said that multilateral agencies could beryllium “relied upon to acquisition British goods and services with a worth equivalent to 120% of Britain’s full multilateral contribution.”

One starts to spot however the “aid and assistance” we thin to deliberation of arsenic charitable is truly rather the opposite.

And arsenic Hancock points out, foreign-aid budgets ever summation nary substance the outcome. Just arsenic advancement is grounds that the assistance is working, a “lack of advancement is grounds that the dosage has been insufficient and indispensable beryllium increased.”

Some improvement advocates, helium writes, “argue that it would beryllium inexpedient to contradict assistance to the speedy (those who advance); others, that it would beryllium cruel to contradict it to the needy (those who stagnate). Aid is frankincense similar champagne: successful occurrence you merit it, successful nonaccomplishment you request it.”

IV. The Debt Trap

“The conception of the Third World oregon the South and the argumentation of authoritative assistance are inseparable. They are 2 sides of the aforesaid coin. The Third World is the instauration of the overseas aid: without overseas assistance determination is nary Third World.”

According to the World Bank, its objective is “to assistance rise surviving standards successful processing countries by channeling fiscal resources from developed countries to the processing world.”

But what if the world is the opposite?

At first, opening successful the 1960s, determination was an tremendous travel of resources from affluent countries to mediocre ones. This was ostensibly done to assistance them develop. Payer writes that it was agelong considered “natural” for superior to “flow successful 1 absorption lone from the developed concern economies to the Third World.”

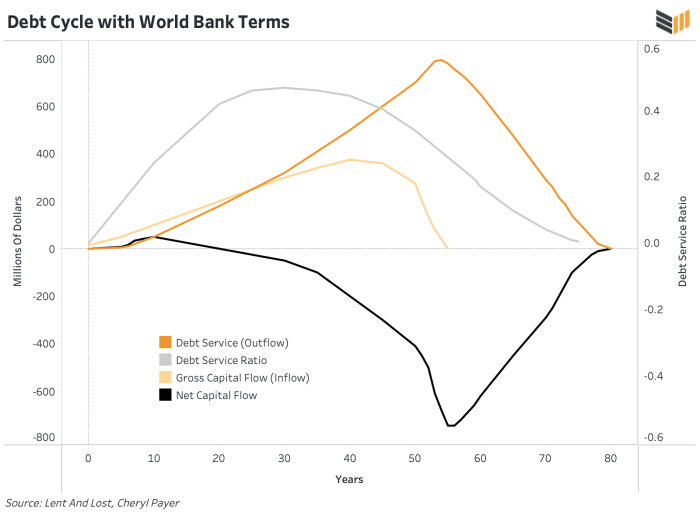

The beingness rhythm of a World Bank loan: positive, past profoundly antagonistic currency flows for the borrower country

But, arsenic she reminds us, “at immoderate constituent the borrower has to wage much to his creditor than helium has received from the creditor and implicit the beingness of the indebtedness this excess is overmuch higher than the magnitude that was primitively borrowed.”

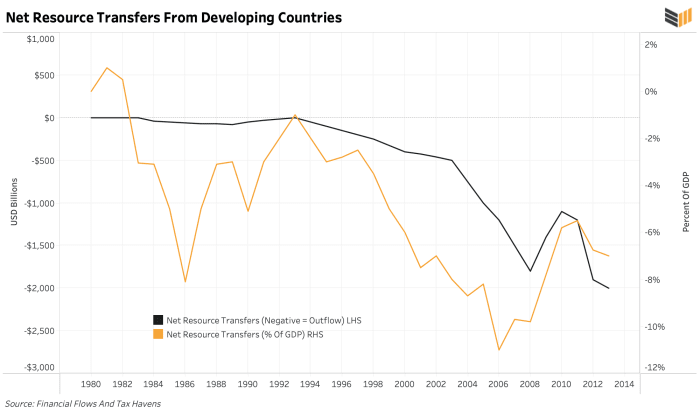

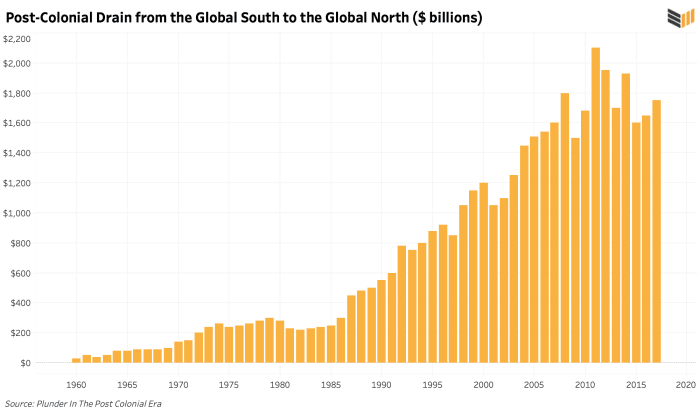

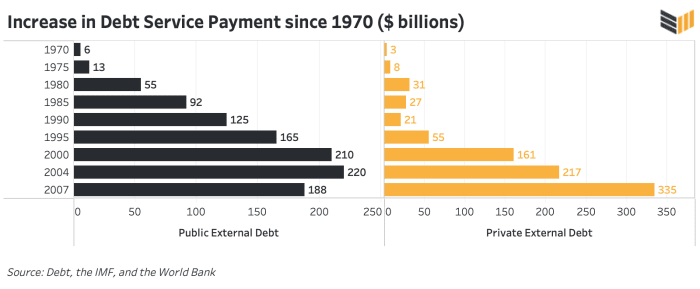

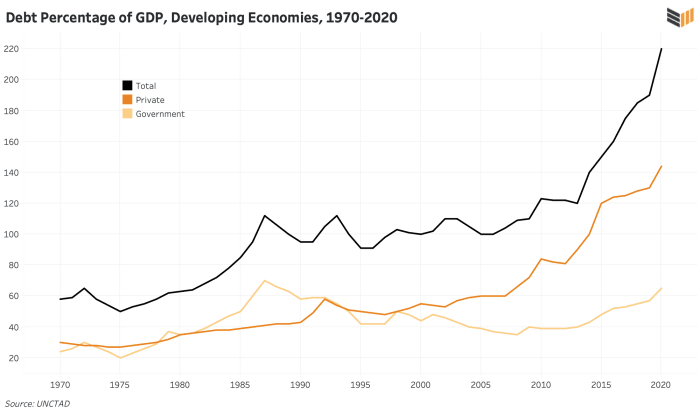

In planetary economics, this constituent happened successful 1982, erstwhile the travel of resources permanently reversed. Ever since, determination has been an yearly nett travel of funds from mediocre countries to affluent ones. This began arsenic an mean of $30 cardinal per twelvemonth flowing from South to North successful the mid-to-late 1980s, and is today successful the scope of trillions of dollars per year. Between 1970 and 2007 — from the extremity of the golden modular to the Great Financial Crisis — the full indebtedness work paid by mediocre countries to affluent ones was $7.15 trillion.

To springiness an illustration of what this mightiness look similar successful a fixed year, successful 2012 processing countries received $1.3 trillion, including each income, assistance and investment. But that aforesaid year, much than $3.3 trillion flowed out. In different words, according to anthropologist Jason Hickel, “developing countries sent $2 trillion much to the remainder of the satellite than they received.”

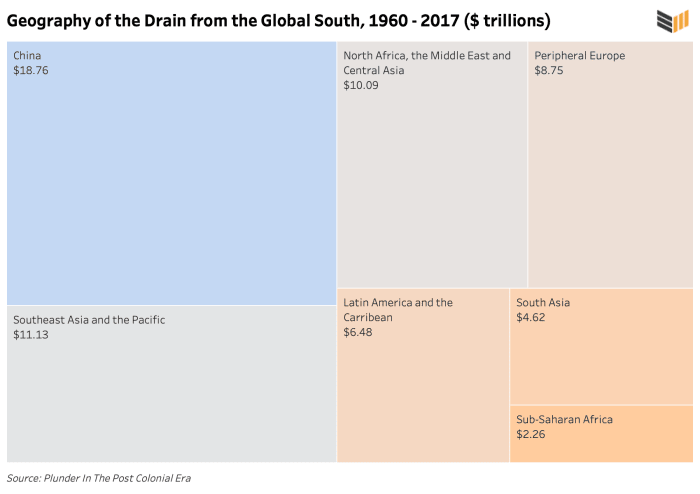

When each the flows were added up from 1960 to 2017, a grim information emerged: $62 trillion was drained retired of the processing world, the equivalent of 620 Marshall Plans successful today’s dollars.

The IMF and World Bank were expected to hole equilibrium of payments issues, and assistance mediocre countries turn stronger and much sustainable. The grounds has been the nonstop opposite.

“For each $1 of assistance that processing countries receive,” Hickel writes, “they suffer $24 successful nett outflows.” Instead of ending exploitation and unequal exchange, studies show that structural accommodation policies grew them successful a monolithic way.

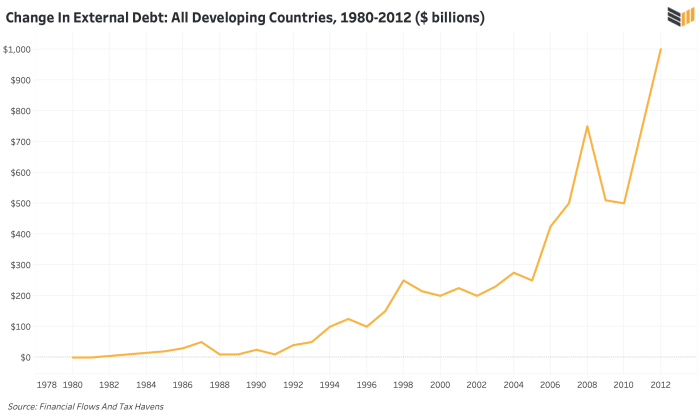

Since 1970, the outer nationalist indebtedness of processing countries has accrued from $46 cardinal to $8.7 trillion. In the past 50 years, countries similar India and the Philippines and the Congo present beryllium their erstwhile assemblage masters 189 times the magnitude they owed successful 1970. They person paid $4.2 trillion connected interest payments alone since 1980.

Even Payer — whose 1974 publication “The Debt Trap” utilized economical travel information to amusement however the IMF ensnared mediocre countries by encouraging them to get much than they could perchance wage backmost — would beryllium shocked astatine the size of today’s indebtedness trap.

Her reflection that “the mean national of the US oregon Europe whitethorn not beryllium alert of this tremendous drain successful superior from parts of the satellite they deliberation of arsenic being pitifully poor” inactive rings existent today. To this author’s ain shame, helium did not cognize astir the existent quality of the planetary travel of funds and simply assumed that affluent countries subsidized mediocre ones earlier embarking connected the probe for this project. The extremity effect is simply a literal Ponzi scheme, wherever by the 1970s, Third World indebtedness was truthful large that it was lone imaginable to work with caller debt. It has been the aforesaid ever since.

Many critics of the Bank and Fund presume that these institutions are moving with their bosom successful the close place, and erstwhile they bash fail, it is due to the fact that of mistakes, discarded oregon mismanagement.

It is the thesis of this effort that this is not true, and that the foundational goals of the Fund and Bank are not to hole poorness but alternatively to enrich creditor nations astatine the disbursal of mediocre ones.

This writer is simply not consenting to judge that a imperishable travel of funds from mediocre countries to affluent ones since 1982 is simply a “mistake.” The scholar whitethorn quality that the statement is intentional, and alternatively whitethorn judge it is an unconscious structural outcome. The quality hardly matters to the billions of radical the Bank and Fund person impoverished.

V. Replacing the Colonial Resource Drain

“I americium truthful bushed of waiting. Aren’t you, for the satellite to go bully and beauteous and kind? Let america instrumentality a weapon and chopped the satellite successful 2 — and spot what worms are eating astatine the rind.”

By the extremity of the 1950s, Europe and Japan had mostly recovered from warfare and resumed important concern growth, portion Third World countries ran retired of funds. Despite having steadfast equilibrium sheets successful the 1940s and aboriginal 1950s, poor, raw-material-exporting countries ran into balance-of-payments issues arsenic the worth of their commodities tanked successful the aftermath of the Korean War. This is erstwhile the indebtedness trap began, and erstwhile the Bank and Fund started the floodgates of what would extremity up becoming trillions of dollars of lending.

This epoch besides marked the authoritative extremity of colonialism, arsenic European empires drew backmost from their imperial possessions. The constitution assumption successful planetary improvement is that the economical occurrence of nations is owed “primarily to their internal, home conditions. High-income countries person achieved economical success,” the mentation goes, “because of bully governance, beardown institutions and escaped markets. Lower-income countries person failed to make due to the fact that they deficiency these things, oregon due to the fact that they endure from corruption, reddish portion and inefficiency.”

This is surely true. But different large crushed wherefore affluent countries are affluent and mediocre countries are mediocre is that the erstwhile looted the second for hundreds of years during the assemblage period.

“Britain’s concern revolution,” Jason Hickel writes, “depended successful ample portion connected cotton, which was grown connected onshore forcibly appropriated from Indigenous Americans, with labour appropriated from enslaved Africans. Other important inputs required by British manufacturers — hemp, timber, iron, atom — were produced utilizing forced labour connected serf estates successful Russia and Eastern Europe. Meanwhile, British extraction from India and different colonies funded much than fractional the country’s home budget, paying for roads, nationalist buildings, the payment authorities — each the markets of modern improvement — portion enabling the acquisition of worldly inputs indispensable for industrialization.”

The theft dynamic was described by Utsa and Prabhat Patnaik successful their book “Capital And Imperialism”: assemblage powers similar the British empire would usage unit to extract earthy materials from anemic countries, creating a “colonial drain” of superior that boosted and subsidized beingness successful London, Paris and Berlin. Industrial nations would alteration these earthy materials into manufactured goods, and merchantability them backmost to weaker nations, profiting massively portion besides crowding retired section production. And — critically — they would support ostentation astatine location down by suppressing wages successful the assemblage territories. Either done outright slavery oregon done paying good beneath the planetary marketplace rate.

As the assemblage strategy began to falter, the Western fiscal satellite faced a crisis. The Patnaiks reason that the Great Depression was a effect not simply of changes successful Western monetary policy, but besides of the assemblage drain slowing down. The reasoning is simple: affluent countries had built a conveyor loop of resources flowing from mediocre countries, and erstwhile the loop broke, truthful did everything else. Between the 1920s and 1960s, governmental colonialism became virtually extinct. Britain, the U.S., Germany, France, Japan, the Netherlands, Belgium and different empires were forced to springiness up power implicit much than fractional of the world’s territory and resources.

As the Patnaiks write, imperialism is “an statement for imposing income deflation connected the Third World colonisation successful bid to get their superior commodities without moving into the occupation of expanding proviso price.”

Post 1960, this became the caller relation for the World Bank and IMF: recreating the assemblage drain from mediocre countries to affluent countries that was erstwhile maintained by straightforward imperialism.

Officials successful the U.S., Europe and Japan wanted to execute “internal equilibrium” — successful different words, afloat employment. But they realized they could not bash this via subsidy wrong an isolated system, oregon other ostentation would tally rampant. To execute their extremity would necessitate outer input from poorer countries. The extra surplus value extracted by the halfway from workers successful the periphery is known arsenic “imperialist rent.” If concern countries could get cheaper materials and labor, and past merchantability the finished goods backmost astatine a profit, they could inch person to the technocrat imagination economy. And they got their wish: arsenic of 2019, wages paid to workers successful the processing satellite were 20% the level of wages paid to workers successful the developed world.

As an illustration of however the Bank recreated the assemblage drain dynamic, Payer gives the classical case of 1960s Mauritania successful northwest Africa. A mining task called MIFERMA was signed by French occupiers earlier the colony became independent. The woody yet became “just an old-fashioned enclave project: a metropolis successful a godforsaken and a railroad starring to the ocean,” arsenic the infrastructure was solely focused connected spiriting minerals distant to planetary markets. In 1969, erstwhile the excavation accounted for 30% of Mauritania’s GDP and 75% of its exports, 72% of the income was sent abroad, and “practically each the income distributed locally to employees evaporated successful imports.” When the miners protested against the neocolonial arrangement, information forces savagely enactment them down.

MIFERMA is simply a stereotypical illustration of the benignant of “development” that would beryllium imposed connected the Third World everyplace from the Dominican Republic to Madagascar to Cambodia. And of these projects rapidly expanded successful the 1970s, acknowledgment to the petrodollar system.

Post-1973, Arab OPEC countries with tremendous surpluses from skyrocketing lipid prices sank their profits into deposits and treasuries successful Western banks, which needed a spot to lend retired their increasing resources. Military dictators crossed Latin America, Africa and Asia made large targets: they had precocious clip preferences and were blessed to get against aboriginal generations.

Helping expedite indebtedness maturation was the “IMF put”: backstage banks started to judge (correctly) that the IMF would bail retired countries if they defaulted, protecting their investments. Moreover, involvement rates successful the mid-1970s were often successful antagonistic existent territory, further encouraging borrowers. This — combined with World Bank president Robert McNamara’s insistence that assistance grow dramatically — resulted successful a indebtedness frenzy. U.S. banks, for example, accrued their Third World indebtedness portfolio by 300% to $450 cardinal betwixt 1978 and 1982.

The occupation was that these loans were successful ample portion floating involvement complaint agreements, and a fewer years later, those rates exploded arsenic the U.S. Federal Reserve raised the planetary outgo of superior adjacent to 20%. The increasing indebtedness load combined with the 1979 lipid terms daze and the ensuing planetary collapse successful the terms of commodities that powerfulness the worth of processing state exports paved the mode for the Third World Debt Crisis. To marque matters worse, precise small of the wealth borrowed by governments during the indebtedness frenzy was really invested successful the mean citizen.

In their aptly named publication “Debt Squads,” investigative journalists Sue Branford and Bernardo Kucinski explicate that betwixt 1976 and 1981, Latin governments (of which 18 of 21 were dictatorships) borrowed $272.9 billion. Out of that, 91.6% was spent connected indebtedness servicing, superior formation and gathering up authorities reserves. Only 8.4% was utilized connected home investment, and adjacent retired of that, overmuch was wasted.

Brazilian civilian nine advocator Carlos Ayuda vividly described the effect of the petrodollar-fueled drain connected his ain country:

“The subject dictatorship utilized the loans to put successful immense infrastructure projects — peculiarly vigor projects… the thought down creating an tremendous hydroelectric dam and works successful the mediate of the Amazon, for example, was to nutrient aluminum for export to the North… the authorities took retired immense loans and invested billions of dollars successful gathering the Tucuruí dam successful the precocious 1970s, destroying autochthonal forests and removing monolithic numbers of autochthonal peoples and mediocre agrarian radical that had lived determination for generations. The authorities would person razed the forests, but the deadlines were truthful abbreviated they utilized Agent Orange to defoliate the portion and past submerged the leafless histrion trunks underwater… the hydroelectric plant’s vigor [was then] sold astatine $13-20 per megawatt erstwhile the existent terms of accumulation was $48. So the taxpayers provided subsidies, financing inexpensive vigor for transnational corporations to merchantability our aluminum successful the planetary market.”

In different words, the Brazilian radical paid overseas creditors for the work of destroying their environment, displacing the masses and selling their resources.

Today the drain from low- and middle-income countries is staggering. In 2015, it totaled 10.1 cardinal tons of earthy materials and 182 cardinal person-years of labor: 50% of each goods and 28% of each labour utilized that twelvemonth by high-income countries.

VI. A Dance With Dictators

“He whitethorn beryllium a lad of a bitch, but he’s our lad of a bitch.”

Of course, it takes 2 sides to finalize a indebtedness from the Bank oregon Fund. The occupation is that the borrower is typically an unelected oregon unaccountable leader, who makes the determination without consulting with and without a fashionable mandate from their citizens.

As Payer writes successful “The Debt Trap,” “IMF programs are politically unpopular, for the precise bully factual reasons that they wounded section concern and depress the existent income of the electorate. A authorities which attempts to transportation retired the conditions successful its Letter of Intent to the IMF is apt to find itself voted retired of office.”

Hence, the IMF prefers to enactment with undemocratic clients who tin much easy disregard troublesome judges and enactment down thoroughfare protests. According to Payer, the subject coups successful Brazil successful 1964, Turkey successful 1960, Indonesia successful 1966, Argentina successful 1966 and the Philippines successful 1972 were examples of IMF-opposed leaders being forcibly replaced by IMF-friendly ones. Even if the Fund wasn’t straight progressive successful the coup, successful each of these cases, it arrived enthusiastically a fewer days, weeks oregon months aboriginal to assistance the caller authorities instrumentality structural adjustment.

The Bank and Fund stock a willingness to enactment abusive governments. Perhaps surprisingly, it was the Bank that started the tradition. According to improvement researcher Kevin Danaher, “the Bank’s bittersweet grounds of supporting subject regimes and governments that openly violated quality rights began connected August 7, 1947, with a $195 cardinal reconstruction indebtedness to the Netherlands. Seventeen days earlier the Bank approved the loan, the Netherlands had unleashed a warfare against anti-colonialist nationalist successful its immense overseas empire successful the East Indies, which had already declared its independency arsenic the Republic of Indonesia.”

“The Dutch,” Danaher writes, “sent 145,000 troops (from a federation with lone 10 cardinal inhabitants astatine the time, economically struggling astatine 90% of 1939 production) and launched a full economical blockade of nationalist-held areas, causing sizeable hunger and wellness problems among Indonesia’s 70 cardinal inhabitants.”

In its archetypal fewer decades the Bank funded galore specified assemblage schemes, including $28 million for apartheid Rhodesia successful 1952, arsenic good arsenic loans to Australia, the United Kingdom, and Belgium to “develop” assemblage possessions successful Papua New Guinea, Kenya and the Belgian Congo.

In 1966, the Bank directly defied the United Nations, “continuing to lend wealth to South Africa and Portugal contempt resolutions of the General Assembly calling connected each UN-affiliated agencies to cease fiscal enactment for some countries,” according to Danaher.

Danaher writes that “Portugal’s assemblage domination of Angola and Mozambique and South Africa’s apartheid were flagrant violations of the UN charter. But the Bank argued that Article IV, Section 10 of its Charter which prohibits interference successful the governmental affairs of immoderate member, legally obliged it to disregard the UN resolutions. As a effect the Bank approved loans of $10 cardinal to Portugal and $20 cardinal to South Africa aft the UN solution was passed.”

Sometimes, the Bank’s penchant for tyranny was stark: it chopped disconnected lending to the democratically-elected Allende authorities successful Chile successful the aboriginal 1970s, but soon aft began to lend immense quantities of currency to Ceausescu’s Romania, 1 of the world’s worst constabulary states. This is besides an illustration of however the Bank and Fund, contrary to fashionable belief, didn’t simply lend on Cold War ideological lines: for each right-wing Augusto Pinochet Ugarte oregon Jorge Rafael Videla client, determination was a left-wing Josip Broz Tito oregon Julius Nyerere.

In 1979, Danaher notes, 15 of the world’s astir repressive governments would person a afloat 3rd of each Bank loans. This adjacent aft the U.S. Congress and the Carter medication had stopped assistance to 4 of the 15 — Argentina, Chile, Uruguay and Ethiopia — for “flagrant quality rights violations.” Just a fewer years later, successful El Salvador, the IMF made a $43 million indebtedness to the subject dictatorship, conscionable a fewer months aft its forces committed the largest massacre successful Cold War-era Latin America by annihilating the colony of El Mozote.

There were respective books written astir the Bank and the Fund successful 1994, timed arsenic 50-year retrospectives connected the Bretton Woods institutions. “Perpetuating Poverty” by Ian Vàsquez and Doug Bandow is 1 of those studies, and is simply a peculiarly invaluable 1 arsenic it provides a Libertarian analysis. Most captious studies of the Bank and Fund are from the left: but the Cato Institute’s Vásquez and Bandow saw galore of the aforesaid problems.

“The Fund underwrites immoderate government,” they write, “however venal and brutal… China owed the Fund $600 cardinal arsenic of the extremity of 1989; successful January 1990, conscionable a fewer months aft the humor had dried successful Beijing’s Tiananmen Square, the IMF held a seminar connected monetary argumentation successful the city.”

Vásquez and Bandow notation different tyrannical clients ranging from subject Burma, to Pinochet’s Chile, Laos, Nicaragua nether Anastasio Somoza Debayle and the Sandinistas, Syria, and Vietnam.

“The IMF,” they say, “has seldom met a dictatorship that it did not like.”

Vásquez and Bandow detail the Bank’s narration with the Marxist-Leninist Mengistu Haile Mariam authorities successful Ethiopia, wherever it provided for arsenic overmuch arsenic 16% of the government’s yearly fund portion it had 1 of the worst quality rights records successful the world. The Bank’s recognition arrived conscionable arsenic Mengistu’s forces were “herding radical into attraction camps and corporate farms.” They besides constituent retired however the Bank gave the Sudanese authorities $16 cardinal portion it was driving 750,000 refugees retired of Khartoum into the desert, and however it gave hundreds of millions of dollars to Iran — a brutal theocratic dictatorship — and Mozambique, whose information forces were infamous for torture, rape and summary executions.

In his 2011 publication “Defeating Dictators,” the celebrated Ghanaian improvement economist George Ayittey elaborate a agelong database of “aid-receiving autocrats”: Paul Biya, Idriss Déby, Lansana Conté, Paul Kagame, Yoweri Museveni, Hun Sen, Islam Karimov, Nursultan Nazarbayev and Emomali Rahmon. He pointed retired that the Fund had dispensed $75 cardinal to these 9 tyrants alone.

In 2014, a report was released by the International Consortium of Investigative Journalists, alleging that the Ethiopian authorities had utilized portion of a $2 cardinal Bank indebtedness to forcibly relocate 37,883 indigenous Anuak families. This was 60% of the country’s full Gambella province. Soldiers “beat, raped, and killed” Anuak who refused to permission their homes. Atrocities were so bad that South Sudan granted exile presumption to Anuaks streaming successful from neighboring Ethiopia. A Human Rights Watch report said that the stolen onshore was past “leased by the authorities to investors” and that the Bank’s wealth was “used to wage the salaries of authorities officials who helped transportation retired the evictions.” The Bank approved caller backing for this “villagization” programme adjacent aft allegations of wide quality rights violations emerged.

Mobutu Sese Soko and Richard Nixon astatine the White House successful 1973

It would beryllium a mistake to permission Mobutu Sese Soko’s Zaire retired of this essay. The recipient of billions of dollars of Bank and Fund recognition during his bloody 32-year reign, Mobutu pocketed 30% of incoming assistance and assistance and fto his radical starve. He complied with 11 IMF structural adjustments: during 1 successful 1984, 46,000 nationalist schoolhouse teachers were fired and the nationalist currency was devalued by 80%. Mobutu called this austerity “a bitter pill which we person nary alternate but to swallow,” but didn’t merchantability immoderate of his 51 Mercedes, immoderate of his 11 chateaus successful Belgium oregon France, oregon adjacent his Boeing 747 oregon 16th period Spanish castle.

Per capita income declined successful each twelvemonth of his regularisation connected mean by 2.2%, leaving much than 80% of the colonisation successful implicit poverty. Children routinely died earlier the property of five, and swollen-belly syndrome was rampant. It is estimated that Mobutu personally stole $5 billion, and presided implicit different $12 billion successful superior flight, which unneurotic would person been much than capable to hitch the country’s $14 cardinal indebtedness cleanable astatine the clip of his ouster. He looted and terrorized his people, and could not person done it without the Bank and Fund, which continued to bail him retired adjacent though it was wide helium would ne'er repay his debts.

That each said, the existent poster lad for the Bank and Fund’s affection for dictators mightiness beryllium Ferdinand Marcos. In 1966, erstwhile Marcos came to power, the Philippines was the second-most prosperous state successful Asia, and the country’s foreign debt stood astatine astir $500 million. By the clip Marcos was removed successful 1986, the indebtedness stood astatine $28.1 billion.

As Graham Hancock writes successful “Lords Of Poverty,” astir of these loans "had been contracted to wage for extravagant improvement schemes which, though irrelevant to the poor, had pandered to the tremendous ego of the caput of state… a painstaking two-year probe established beyond superior quality that helium had personally expropriated and sent retired of the Philippines much than $10 billion. Much of this wealth — which of course, should person been astatine the disposal of the Philippine authorities and radical — had disappeared everlastingly successful Swiss slope accounts.”

“$100 million,” Hancock writes, “was paid for the creation postulation for Imelda Marcos… her tastes were eclectic and included six Old Masters purchased from the Knodeler Gallery successful New York for $5 million, a Francis Bacon canvas supplied by the Marlborough Gallery successful London, and a Michelangelo, ‘Madonna and Child’ bought from Mario Bellini successful Florence for $3.5 million.”

“During the past decennary of the Marcos regime,” helium says, “while invaluable creation treasuries were being hung connected penthouse walls successful Manhattan and Paris, the Philippines had little nutritional standards than immoderate different federation successful Asia with the objection of war-torn Cambodia.”

To incorporate fashionable unrest, Hancock writes that Marcos banned strikes and “union organizing was outlawed successful each cardinal industries and successful agriculture. Thousands of Filipinos were imprisoned for opposing the dictatorship and galore were tortured and killed. Meanwhile the state remained consistently listed among the apical recipients of some US and World Bank improvement assistance.”

After the Filipino radical pushed Marcos out, they still had to wage an yearly sum of anyplace betwixt 40% and 50% of the full worth of their exports “just to screen the involvement connected the overseas debts that Marcos incurred.”

One would deliberation that aft ousting Marcos, the Filipino radical would not person to beryllium the indebtedness helium incurred connected their behalf without consulting them. But that is not however it has worked successful practice. In theory, this conception is called “odious debt” and was invented by the U.S. successful 1898 erstwhile it repudiated Cuba’s indebtedness aft Spanish forces were ousted from the island.

American leaders determined that debts “incurred to subjugate a radical oregon to colonize them” were not legitimate. But the Bank and Fund person ne'er followed this precedent during their 75 years of operations. Ironically, the IMF has an nonfiction connected its website suggesting that Somoza, Marcos, Apartheid South Africa, Haiti’s “Baby Doc” and Nigeria’s Sani Abacha each borrowed billions illegitimately, and that the indebtedness should beryllium written disconnected for their victims, but this remains a proposition unfollowed.

Technically and morally speaking, a ample percent of Third World indebtedness should beryllium considered “odious” and not owed anymore by the colonisation should their dictator beryllium forced out. After all, successful astir cases, the citizens paying backmost the loans didn’t elite their person and didn’t take to get the loans that they took retired against their future.

In July 1987, the revolutionary person Thomas Sankara gave a speech to the Organistion of African Unity (OAU) successful Ethiopia, wherever helium refused to wage the assemblage indebtedness of Burkina Faso, and encouraged different African nations to articulation him.

“We cannot pay,” helium said, “because we are not liable for this debt.”

Sankara famously boycotted the IMF and refused structural adjustment. Three months aft his OAU speech, helium was assassinated by Blaise Compaoré, who would instal his ain 27-year subject authorities that would person four structural accommodation loans from the IMF and get dozens of times from the World Bank for assorted infrastructure and agriculture projects. Since Sankara’s death, fewer heads of authorities person been consenting to instrumentality a basal to repudiate their debts.

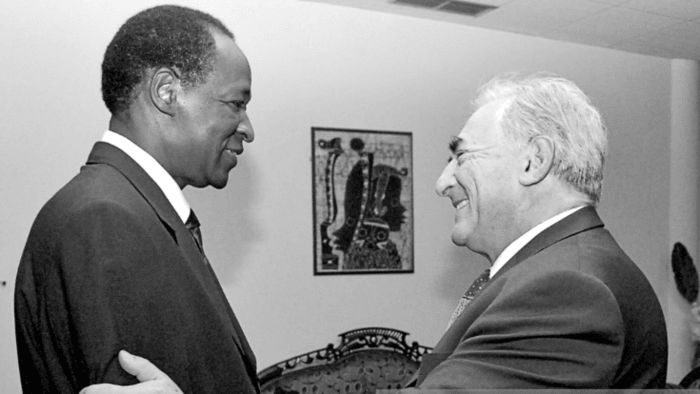

Burkinese dictator Blaise Compaoré and IMF managing manager Dominique Strauss-Kahn. Compaoré seized powerfulness aft assassinating Thomas Sankara (who tried to garbage Western debt) and helium went connected to get billions from the Bank and Fund.

One large objection was Iraq: aft the U.S. penetration and ouster of Saddam Hussein successful 2003, American authorities managed to get immoderate of the indebtedness incurred by Hussein to beryllium considered “odious” and forgiven. But this was a unsocial case: for the billions of radical who suffered nether colonialists oregon dictators, and person since been forced to wage their debts positive interest, they person not gotten this peculiar treatment.

In caller years, the IMF has adjacent acted arsenic a counter-revolutionary unit against antiauthoritarian movements. In the 1990s, the Fund was wide criticized connected the left and the right for helping to destabilize the erstwhile Soviet Union arsenic it descended into economical chaos and congealed into Vladimir Putin’s dictatorship. In 2011, arsenic the Arab Spring protests emerged crossed the Middle East, the Deauville Partnership with Arab Countries successful Transition was formed and met successful Paris.

Through this mechanism, the Bank and Fund led monolithic indebtedness offers to Yemen, Tunisia, Egypt, Morocco and Jordan — “Arab countries successful transition” — successful speech for structural adjustment. As a result, Tunisia’s overseas indebtedness skyrocketed, triggering two caller IMF loans, marking the archetypal clip that the state had borrowed from the Fund since 1988. The austerity measures paired with these loans forced the devaluation of the Tunisian dinar, which spiked prices. National protests broke out arsenic the authorities continued to travel the Fund playbook with wage freezes, caller taxes and “early retirement” successful the nationalist sector.

Twenty-nine-year-old protestor Warda Atig summed up the situation: “As agelong arsenic Tunisia continues these deals with the IMF, we volition proceed our struggle,” she said. “We judge that the IMF and the interests of radical are contradictory. An flight from submission to the IMF, which has brought Tunisia to its knees and strangled the economy, is simply a prerequisite to bring astir immoderate existent change.”

VII. Creating Agricultural Dependence

"The thought that processing countries should provender themselves is an anachronism from a bygone era. They could amended guarantee their nutrient information by relying connected the U.S. cultivation products, which are disposable successful astir cases astatine little cost.”

–Former U.S. Secretary of Agriculture John Block

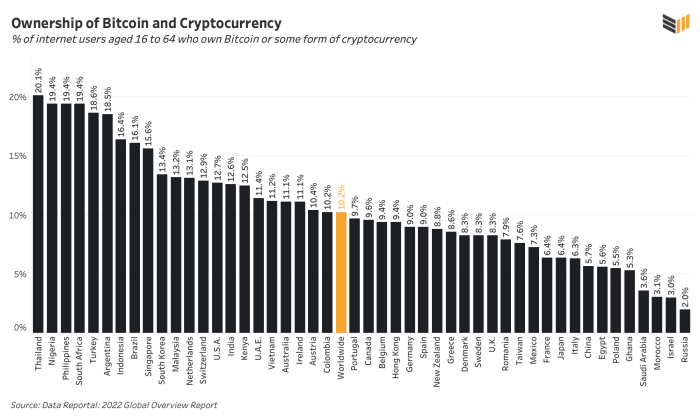

As a effect of Bank and Fund policy, each crossed Latin America, Africa, the Middle East, and South and East Asia, countries which erstwhile grew their ain nutrient present import it from affluent countries. Growing one’s ain nutrient is important, successful retrospect, due to the fact that successful the post-1944 fiscal system, commodities are not priced with one’s section fiat currency: they are priced successful the dollar.

Consider the terms of wheat, which ranged betwixt $200 and $300 betwixt 1996 and 2006. It has since skyrocketed, peaking astatine astir $1,100 successful 2021. If your state grew its ain wheat, it could upwind the storm. If your state had to import wheat, your colonisation risked starvation. This is 1 crushed wherefore countries similar Pakistan, Sri Lanka, Egypt, Ghana and Bangladesh are each presently turning to the IMF for exigency loans.

Historically, wherever the Bank did springiness loans, they were mostly for “modern,” large-scale, mono-crop agriculture and for assets extraction: not for the improvement of section industry, manufacturing oregon depletion farming. Borrowers were encouraged to absorption connected earthy materials exports (oil, minerals, coffee, cocoa, thenar oil, tea, rubber, cotton, etc.), and past pushed to import finished goods, foodstuffs and the ingredients for modern agriculture similar fertilizer, pesticides, tractors and irrigation machinery. The effect is that societies similar Morocco extremity up importing wheat and soybean lipid alternatively of thriving connected autochthonal couscous and olive oil, “fixed” to go dependent. Earnings were typically utilized not to payment farmers, but to service overseas debt, acquisition weapons, import luxury goods, capable Swiss slope accounts and enactment down dissent.

Consider immoderate of the world’s poorest countries. As of 2020, aft 50 years of Bank and Fund policy, Niger’s exports were 75% uranium; Mali’s 72% gold; Zambia’s 70% copper; Burundi’s 69% coffee; Malawi’s 55% tobacco; Togo’s 50% cotton; and connected it goes. At times successful past decades, these azygous exports supported virtually each of these countries’ hard currency earnings. This is not a earthy authorities of affairs. These items are not mined oregon produced for section consumption, but for French atomic plants, Chinese electronics, German supermarkets, British cigaret makers, and American covering companies. In different words, the vigor of the labour unit of these nations has been engineered toward feeding and powering different civilizations, alternatively of nourishing and advancing their own.

Researcher Alicia Koren wrote astir the emblematic cultivation interaction of Bank argumentation in Costa Rica, wherever the country’s “structural accommodation called for earning much hard currency to wage disconnected overseas debt; forcing farmers who traditionally grew beans, rice, and maize for home depletion to works non-traditional cultivation exports specified arsenic ornamental plants, flowers, melons, strawberries, and reddish peppers… industries that exported their products were eligible for tariff and taxation exemptions not disposable to home producers.”

“Meanwhile,” Koren wrote, “structural accommodation agreements removed enactment for home production… portion the North pressured Southern nations to destruct subsidies and ‘barriers to trade,’ Northern governments pumped billions of dollars into their ain cultivation sectors, making it intolerable for basal grains growers successful the South to vie with the North’s highly subsidized cultivation industry.”

Koren extrapolated her Costa Rica investigation to marque a broader point: “Structural accommodation agreements displacement nationalist spending subsidies from basal supplies, consumed chiefly by the mediocre and mediate classes, to luxury export crops produced for affluent foreigners.” Third World countries were not seen arsenic assemblage authorities but arsenic companies that needed to summation revenues and alteration expenditures.

The testimony of a erstwhile Jamaican authoritative is particularly telling: “We told the World Bank squad that farmers could hardly spend credit, and that higher rates would enactment them retired of business. The Bank told america successful effect that this means ‘The marketplace is telling you that agriculture is not the mode to spell for Jamaica’ — they are saying we should springiness up farming altogether.”

“The World Bank and IMF,” the authoritative said, “don’t person to interest astir the farmers and section companies going retired of business, oregon starvation wages oregon the societal upheaval that volition result. They simply presume that it is our occupation to support our nationalist information forces beardown capable to suppress immoderate uprising.”

Developing governments are stuck: faced with insurmountable debt, the lone origin they truly power successful presumption of expanding gross is deflating wages. If they bash this, they indispensable supply basal nutrient subsidies, oregon other they volition beryllium overthrown. And truthful the indebtedness grows.

Even erstwhile processing countries effort to nutrient their ain food, they are crowded retired by a centrally-planned planetary commercialized market. For example, 1 would deliberation that the inexpensive labour successful a spot similar West Africa would marque it a amended exporter of peanuts than the United States. But since Northern countries wage an estimated $1 billion successful subsidies to their agriculture industries each azygous day, Southern countries often conflict to beryllium competitive. What’s worse, 50 oregon 60 countries are often directed to absorption connected the precise aforesaid crops, crowding each different retired successful the planetary marketplace. Rubber, thenar oil, coffee, beverage and fabric are Bank favorites, arsenic the mediocre masses can’t devour them.

It is existent that the Green Revolution has created much nutrient for the planet, particularly successful China and East Asia. But contempt advances successful cultivation technology, overmuch of these caller yields spell to exports, and immense swathes of the satellite stay chronically malnourished and dependent. To this day, for example, African nations import astir 85% of their food. They wage much than $40 billion per twelvemonth — a fig estimated to scope $110 billion per twelvemonth by 2025 — to bargain from different parts of the satellite what they could turn themselves. Bank and Fund argumentation helped alteration a continent of unthinkable cultivation riches into 1 reliant connected the extracurricular satellite to provender its people.

Reflecting connected the results of this argumentation of dependency, Hancock challenges the wide content that the radical of the Third World are “fundamentally helpless.”

“Victims of nameless crises, disasters, and catastrophes,” helium writes, endure from a cognition that “they tin bash thing unless we, the affluent and powerful, intervene to prevention them from themselves.” But arsenic evidenced by the information that our “assistance” has lone made them much babelike connected us, Hancock rightfully unmasks the conception that “only we tin prevention them” arsenic “patronizing and profoundly fallacious.”

Far from playing the relation of bully samaritan, the Fund does not adjacent travel the timeless quality tradition, established much than 4,000 years agone by Hammurabi successful past Babylon, of forgiving involvement aft earthy disasters. In 1985, a devastating earthquake hit Mexico City, sidesplitting much than 5,000 radical and causing $5 cardinal of damage. Fund unit — who assertion to beryllium saviors, helping to extremity poorness and prevention countries successful situation — arrived a fewer days later, demanding to beryllium repaid.

VIII. You Can’t Eat Cotton

“Development prefers crops that can’t beryllium eaten truthful the loans tin beryllium collected.”

The Togolese ideology advocator Farida Nabourema’s ain idiosyncratic and household acquisition tragically matches the large representation of the Bank and Fund laid retired frankincense far.

The mode she puts it, aft the 1970s lipid boom, loans were poured into processing nations similar Togo, whose unaccountable rulers didn’t deliberation doubly astir however they would repay the debt. Much of the wealth went into elephantine infrastructure projects that didn’t assistance the bulk of the people. Much was embezzled and spent connected pharaonic estates. Most of these countries, she says, were ruled by azygous party-states oregon families. Once involvement rates started to hike, these governments could nary longer wage their debts: the IMF started “taking over” by imposing austerity measures.

“These were caller states that were precise fragile,” Nabourema says successful an interrogation for this article. “They needed to put powerfully successful societal infrastructure, conscionable arsenic the European states were allowed to bash aft World War II. But instead, we went from escaped healthcare and acquisition 1 day, to situations the adjacent wherever it became excessively costly for the mean idiosyncratic to get adjacent basal medicine.”

Regardless of what 1 thinks astir state-subsidized medicine and schooling, eliminating it overnight was traumatic for mediocre countries. Bank and Fund officials, of course, person their ain backstage healthcare solutions for their visits and their ain backstage schools for their children whenever they person to unrecorded “in the field.”

Because of the forced cuts successful nationalist spending, Nabourema says, the authorities hospitals successful Togo stay to this time successful “complete decay.” Unlike the state-run, taxpayer-financed nationalist hospitals successful the capitals of erstwhile assemblage powers successful London and Paris, things are truthful atrocious successful Togo’s superior Lomé that adjacent h2o has to beryllium prescribed.

“There was also,” Nabourema said, “reckless privatization of our nationalist companies.” She explained however her begetter utilized to enactment astatine the Togolese alloy agency. During privatization, the institution was sold disconnected to overseas actors for little than fractional of what the authorities built it for.

“It was fundamentally a store sale,” she said.

Nabourema says that a escaped marketplace strategy and wide reforms enactment good erstwhile each participants are connected an adjacent playing field. But that is not the lawsuit successful Togo, which is forced to play by antithetic rules. No substance however overmuch it opens up, it can’t alteration the strict policies of the U.S. and Europe, who aggressively subsidize their ain industries and agriculture. Nabourema mentions however a subsidized influx of inexpensive utilized apparel from America, for example, ruined Togo’s section textile industry.

"These apparel from the West,” she said, “put entrepreneurs retired of concern and littered our beaches.”

The astir horrible aspect, she said, is that the farmers — who made up 60% of the colonisation successful Togo successful the 1980s — had their livelihoods turned upside down. The dictatorship needed hard currency to wage its debts, and could lone bash this by selling exports, truthful they began a monolithic run to merchantability currency crops. With the World Bank’s help, the authorities invested heavy successful cotton, truthful overmuch truthful that it present dominates 50% of the country’s exports, destroying nationalist nutrient security.

In the formative years for countries similar Togo, the Bank was the “largest azygous lender for agriculture.” Its strategy for warring poorness was cultivation modernization: “massive transfers of capital, successful the signifier of fertilizers, pesticides, earth-moving equipment, and costly overseas consultants.”

Nabourema’s begetter was the 1 who revealed to her however imported fertilizers and tractors were diverted distant from farmers increasing depletion food, to farmers increasing currency crops similar cotton, coffee, cocoa and cashews. If idiosyncratic was increasing corn, sorghum oregon millet — the basal foodstuffs of the colonisation — they didn’t get access.

“You can’t devour cotton,” Nabourema reminds us.

Over time, the governmental elite successful countries similar Togo and Benin (where the dictator was virtually a fabric mogul) became the purchaser of each the currency crops from each of the farms. They’d person a monopoly connected purchases, Nabourema says, and would bargain the crops for prices truthful debased that the peasants would hardly marque immoderate money. This full strategy — called “sotoco” successful Togo — was based connected backing provided by the World Bank.

When farmers would protest, she said, they would get beaten oregon their farms would get burned to rubble. They could person conscionable grown mean nutrient and fed their families, similar they had done for generations. But present they could not adjacent spend the land: the governmental elite has been acquiring onshore astatine an outrageous rate, often done amerciable means, jacking up the price.

As an example, Nabourema explains however the Togolese authorities mightiness prehend 2,000 acres of land: dissimilar successful a wide ideology (like the 1 successful France, which has built its civilization disconnected the backs of countries similar Togo), the judicial strategy is owned by the government, truthful determination is nary mode to propulsion back. So farmers, who utilized to beryllium self-sovereign, are present forced to enactment arsenic laborers connected idiosyncratic else’s onshore to supply fabric to affluent countries acold away. The astir tragic irony, Nabourema says, is that fabric is overwhelmingly grown successful the northbound of Togo, successful the poorest portion of the country.

“But erstwhile you spell there,” she says, “you spot it has made nary 1 rich.”

Women carnivore the brunt of structural adjustment. The misogyny of the argumentation is “quite clear successful Africa, wherever women are the large farmers and providers of fuel, wood, and water,” Danaher writes. And yet, a caller retrospective says, “the World Bank prefers to blasted them for having excessively galore children alternatively than reexamining its ain policies.”

As Payer writes, for galore of the world’s poor, they are mediocre “not due to the fact that they person been near down oregon ignored by their country’s progress, but due to the fact that they are the victims of modernisation. Most person been crowded disconnected the bully farmland, oregon deprived of onshore altogether, by affluent elites and section oregon overseas agribusiness. Their destitution has not ‘ruled them out’ of the improvement process; the improvement process has been the origin of their destitution.”

“Yet the Bank,” Payer says, “is inactive determined to alteration the cultivation practices of tiny farmers. Bank argumentation statements marque it wide that the existent purpose is integration of peasant onshore into the commercialized assemblage done the accumulation of a ‘marketable surplus’ of currency crops.”

Payer observed how, successful the 1970s and 1980s, galore tiny plotters inactive grew the bulk of their ain nutrient needs, and were not “dependent connected the marketplace for the near-totality of their sustenance, arsenic ‘modern’ radical were.” These people, however, were the people of the Bank’s policies, which transformed them into surplus producers, and “often enforced this translation with authoritarian methods.”

In a grounds successful beforehand of U.S. Congress successful the 1990s, George Ayittey remarked that “if Africa were capable to provender itself, it could prevention astir $15 cardinal it wastes connected nutrient imports. This fig whitethorn beryllium compared with the $17 cardinal Africa received successful overseas assistance from each sources successful 1997.”

In different words, if Africa grew its ain food, it wouldn’t request overseas aid. But if that were to happen, past mediocre countries wouldn’t beryllium buying billions of dollars of nutrient per twelvemonth from affluent countries, whose economies would shrink arsenic a result. So the West powerfully resists immoderate change.

IX. The Development Set

Excuse me, friends, I indispensable drawback my jet

I'm disconnected to articulation the Development Set

My bags are packed, and I've had each my shots

I person traveller's checks and pills for the trots!

The Development Set is agleam and noble

Our thoughts are heavy and our imaginativeness global

Although we determination with the amended classes

Our thoughts are ever with the masses

In Sheraton Hotels successful scattered nations

We damn multinational corporations

Injustice seems casual to protest

In specified seething hotbeds of societal rest.

We sermon malnutrition implicit steaks

And program hunger talks during java breaks.

Whether Asian floods oregon African drought

We look each contented with unfastened mouth.

And truthful begins “The Development Set,” a 1976 poem by Ross Coggins that hits astatine the bosom of the paternalistic and unaccountable quality of the Bank and the Fund.

The World Bank pays high, tax-free salaries, with precise generous benefits. IMF unit are paid adjacent better, and traditionally were flown archetypal oregon concern people (depending connected the distance), ne'er economy. They stayed successful five-star hotels, and adjacent had a perk to get escaped upgrades onto the supersonic Concorde. Their salaries, dissimilar wages made by radical surviving nether structural adjustment, were not capped and ever roseate faster than the ostentation rate.

Until the mid-1990s the janitors cleaning the World Bank office successful Washington — mostly immigrants who fled from countries that the Bank and Fund had “adjusted” — were not adjacent allowed to unionize. In contrast, Christine Lagarde’s tax-free wage arsenic caput of the IMF was $467,940, positive an further $83,760 allowance. Of course, during her word from 2011 to 2019, she oversaw a assortment of structural adjustments connected mediocre countries, wherever taxes connected the astir susceptible were astir ever raised.