The support of a spot ethereum exchange-traded money (ETF) by the U.S. Securities and Exchange Commission (SEC) could beryllium the crypto asset’s “strongest narrative,” according to a Kaiko Research analysis. The Kaiko Research squad believes that ethereum’s rally post-bitcoin ETF approvals amusement that investors are betting connected the regulator’s support of ether-based ETFs.

ETH Outperforms ETH Beta Tokens

According to an investigation carried retired by Kaiko Research, the imaginable support of a spot-based ethereum (ETH) exchange-traded money (ETF) is apt to beryllium the crypto asset’s existent “strongest narrative.” To enactment this assertion, the investigation points to bitcoin’s show earlier the SEC approved a spot bitcoin ETF.

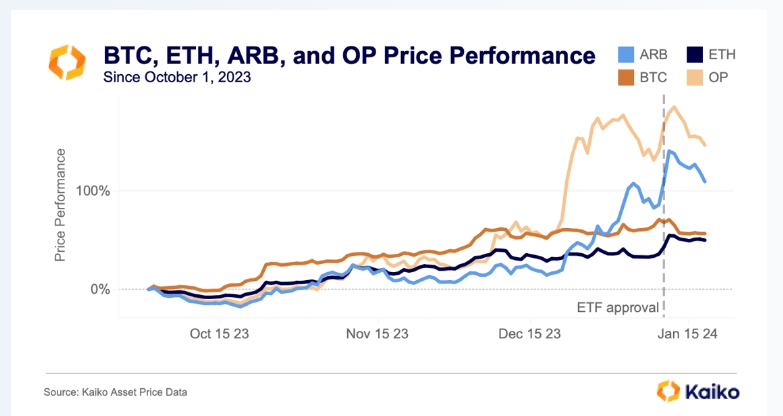

As per Kaiko data, successful the 365 days earlier the ETF approval, bitcoin’s instrumentality of 100% easy outpaced ETH’s 60%. Indeed, successful the weeks and days starring up to the approvals, BTC surged past $48,000, and immoderate predicted the crypto asset’s USD worth to spell beyond $50,000 aft the spot ETFs approvals.

However, since the SEC’s approval of 11 spot bitcoin ETFs, the terms of BTC has trended downwards, portion that of ETH has rallied. The Kaiko squad implied that this whitethorn bespeak investors are “building connected the hype that ETH could beryllium adjacent successful line.” Another metric highlighted by the Kaiko Research investigation relates to investors’ penchant for tokens related to ETH but with higher volatility besides known arsenic ETH beta.

According to the analysis, involvement successful ETH beta post-approval has faded, portion that of ETH “has outperformed by falling the least.” During the 2nd week of January, ETH spot measurement connected centralized exchanges touched its highest level since the FTX collapse. In fact, successful that week, ETH notched its 3 highest spot measurement days since the commencement of 2023.

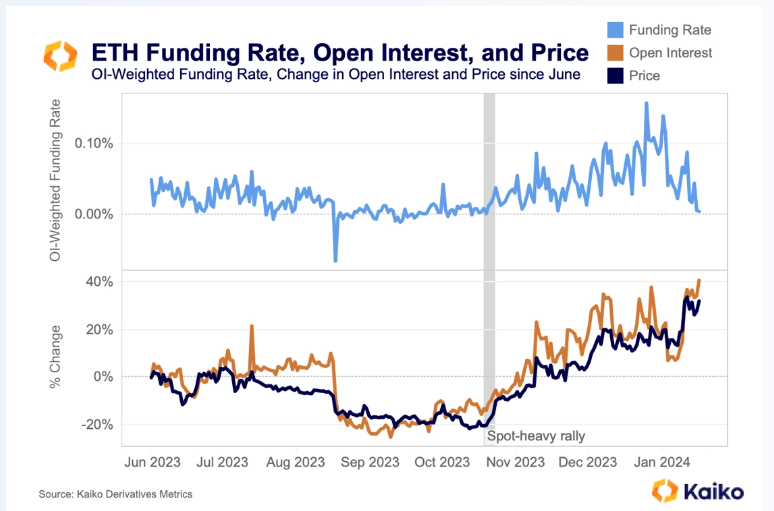

Meanwhile, Kaiko’s derivatives information amusement that ETH’s caller performances were chiefly fueled by spot volumes and not perpetual futures. The study added:

September and October marked a debased constituent successful futures markets, with aggregated unfastened involvement (in USD) falling much than 20% from its summertime levels. At this time, determination was small terms question and backing rates were neutral.

In their conclusion, the Kaiko squad stated that portion the ETF communicative is much apt to rekindle involvement successful ether, inactive if this were to fail, different narratives specified arsenic caller furniture twos (L2s) oregon the occurrence of Eigenn Layer and restaking” could beryllium the catalysts for the crypto asset’s adjacent rally.

What are your thoughts connected this story? Let america cognize what you deliberation successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)