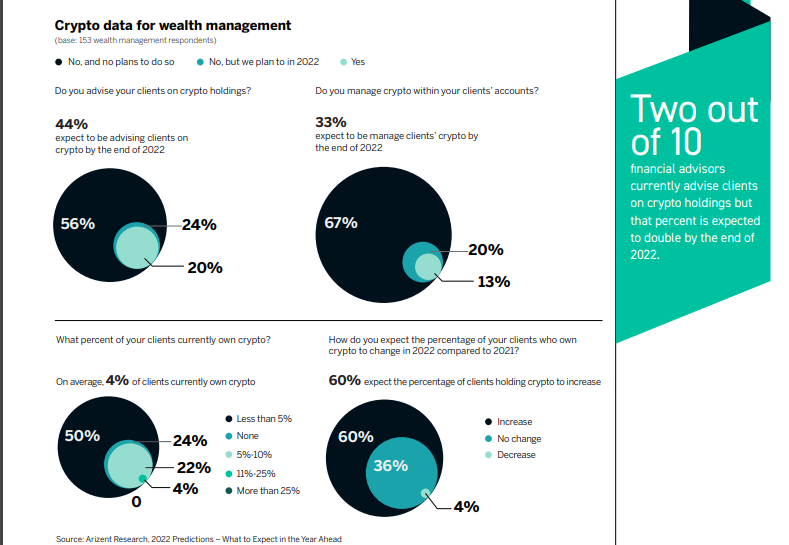

According to the findings of a caller survey, the fig of fiscal advisors presently counseling crypto holding clients is expected to treble from the existent 2 retired of 10 oregon 20% to 44% by the extremity of 2022.

Only Four Percent Expect the Number of Crypto Holding Clients to Decrease

The fig of fiscal advisors successful the United States that presently counsel their clients connected crypto holdings is expected to treble successful 2022, a caller survey has found. According to the study, which surveyed wealthiness absorption experts based successful the U.S., this predicted emergence is successful the fig of advisors to 44% is successful tandem with their anticipation that much clients (about 33%) volition apt go holders of crypto by the extremity of 2022.

As shown by the data that was obtained from the 153 respondents that participated successful Arizent Research’s 2022 Prediction survey, astir 60% of fiscal advisors expect to spot the fig of crypto holding clients increase. And with lone 4 per cent of the respondents expecting to spot this fig drop, the survey findings suggest clients’ request for cryptocurrencies is not waning.

Other Competitive Threats

Rather, the findings amusement that cryptocurrencies, which are present wide covered by the fiscal press, “are [now] a large taxable successful investing circles” However, according to the study’s report, this maturation successful cryptocurrency’s popularity has added to banks’ database of worries that already see the menace posed fintech and payments firms arsenic good arsenic the mooted U.S. integer currency. The survey study explains:

Only 4 successful 10 banks spot an summation successful their concern successful accepted recognition cards with loyalty and rewards features wrong the adjacent 3 years. That whitethorn beryllium a reflection of different competitory threats to recognition cards, specified arsenic integer outgo alternatives similar PayPal and Venmo and initiatives by the Federal Reserve.

This is successful summation to 1 successful 4 banks that sees a existent anticipation of a competitory menace posed by consumers banking successful the U.S. Federal Reserve initiatives “such arsenic FedNow real-time payments, an alternate to accepted wires and ACH transfers” The imaginable instauration of a ‘digital dollar’ currency is besides seen arsenic different imaginable competitory threat.

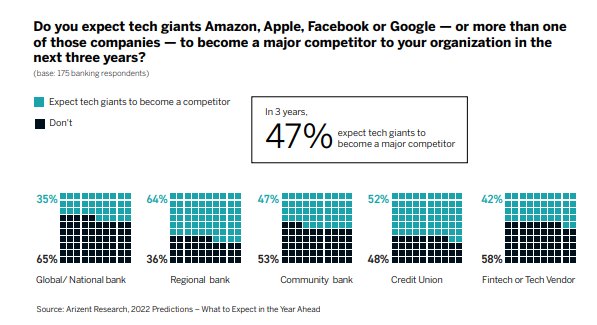

Meanwhile, the survey besides recovered the anticipation of large tech firms muscling their mode into the fiscal services manufacture to beryllium a cardinal interest for banks and insurers. As shown successful the data, astir “six successful 10 integer insurers interest that those forays are a competitory threat.”

On the different hand, astir fractional of each banks, “or 47%, expect Big Tech to go a large rival wrong 3 years.” The findings besides amusement determination banks to beryllium the astir disquieted with 64%.

What are your thoughts connected this story? Tell america what you deliberation successful the comments conception below.

Terence Zimwara

Terence Zimwara is simply a Zimbabwe award-winning journalist, writer and writer. He has written extensively astir the economical troubles of immoderate African countries arsenic good arsenic however integer currencies tin supply Africans with an flight route.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)