In 2023, the apical 10 Web3 projects collectively raised $1.78 cardinal successful funding, a fig which is 70% little than the $5.87 cardinal raised successful the erstwhile year, the findings of a caller survey person shown. The findings besides amusement that Web3 projects were capable to pull $9 cardinal successful superior with infrastructure projects accounting for 36.5% of the total.

Most Capital Raised successful the Latter Half of 2023

According to a survey conducted by the crypto speech Binance, task superior investments successful the apical 10 Web3 projects saw a important downturn successful 2023, with lone $1.78 cardinal raised. This full is 70% little than the $5.87 cardinal raised successful 2022.

As explained successful the study report, the fundraising fortunes of the apical 10 projects are a reflection of the bearish marketplace conditions that prevailed successful overmuch of 2023. Despite this crisp driblet successful superior flows, each the apical 10 Web3 projects were inactive capable to rise much than $100 million.

“Notably, astir of the important backing occurred successful the second fractional of the year, with six retired of the 10 largest fundraises happening successful this period. Among these, Phoenix Group, a Bitcoin mining work provider, and Ramp, a non-custodial outgo infrastructure company, led the battalion with US$370 cardinal and US$300 cardinal successful the magnitude raised, respectively,” the survey study said.

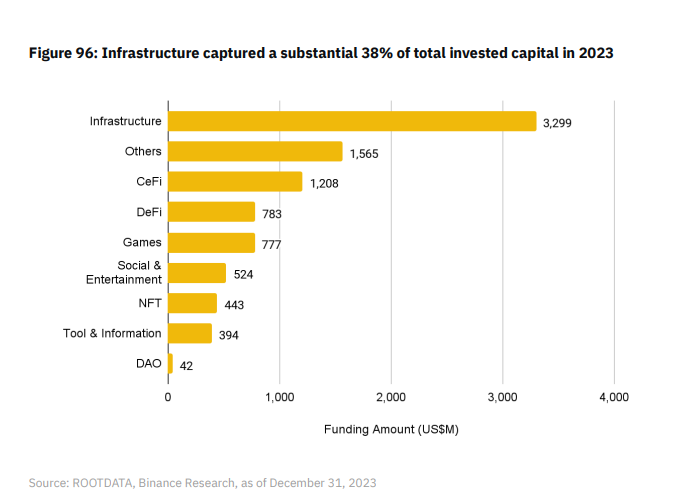

Infrastructure Projects Account for Just Over a Third of Capital Raised

Meanwhile, the survey findings amusement that Web3 projects attracted investments totaling $9 billion, with infrastructure projects accounting for 36.5%, portion centralized concern (cefi) and decentralized concern (defi) platforms accounted for 13.3% and 8.6%, respectively. Decentralized autonomous organizations (DAOs) saw the slightest magnitude of superior investment, with a stock of lone 0.47% of the total.

As noted successful the report, task superior (VC) firms’ sentiment towards Web3 projects remained mostly antagonistic until the extremity of Q3. However, aft reports of organization investors’ involvement successful spot Bitcoin exchange-traded funds (ETF) surfaced, this sentiment turned bullish.

Since then, the crypto marketplace has rallied with bitcoin touching prices past seen astir 2 years ago. This rally has successful crook laid the instauration for accrued VC investments successful 2024. Commenting connected this apt scenario, the study said:

“Moving into 2024, it would not beryllium astonishing to spot an uptick successful concern activities. This anticipated maturation is not lone owed to the debased basal play from the erstwhile twelvemonth but besides driven by the progressively bullish sentiment permeating the market.”

What are your thoughts connected this story? Let america cognize what you deliberation successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)