Bitcoin’s futures marketplace is showcasing signs that person historically signalled bullish sentiment. Analysts are turning their attraction to the Bitcoin futures basis—a metric representing the differential betwixt the futures terms of Bitcoin and its spot price.

Recent information has revealed that this ground has escalated to unprecedented levels since Bitcoin’s all-time precocious of $69,000 successful November 2021.

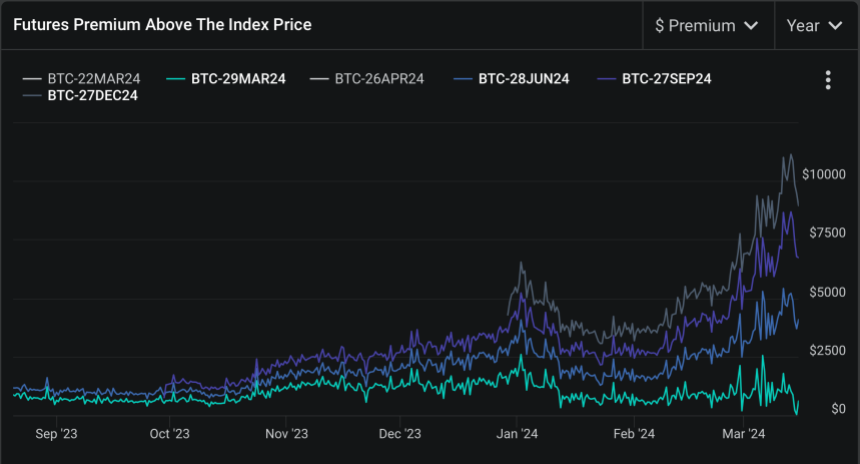

Bullish Indications From Bitcoin Futures

Deribit’s Chief Commercial Officer, Luuk Strijers, has highlighted the existent authorities of the Bitcoin futures basis, which ranges betwixt 18% to 25% annually, a complaint reminiscent of the marketplace conditions successful 2021.

According to Strijers’s comment, this elevated ground is not conscionable a fig but a lucrative accidental for derivatives traders.

Bitcoin Futures Premium Above The Index Price. | Source: Deribit

Bitcoin Futures Premium Above The Index Price. | Source: DeribitBy engaging successful trades that impact buying Bitcoin successful the spot marketplace and simultaneously selling futures contracts astatine a premium, traders tin unafraid a “dollar gain” that volition materialize astatine the contract’s expiry, irrespective of Bitcoin’s terms volatility.

Strijers further noted that this strategy is peculiarly appealing successful the existent climate, fueled by the influx of caller investments pursuing the support of Bitcoin ETFs and anticipation surrounding the Bitcoin halving event.

The value of the heightened futures ground extends beyond the mechanics of derivatives trading. It further reflects broader marketplace optimism, “bolstered” by caller regulatory approvals and macroeconomic factors influencing cryptocurrency.

The disparity betwixt Bitcoin’s spot and futures prices suggests a assured marketplace outlook, propelled by the anticipation of continued concern inflows and the interaction of the upcoming Bitcoin halving.

Such conditions make a fertile crushed for Bitcoin’s worth to surge, arsenic humanities precedents person often linked bullish futures ground rates with periods of important terms appreciation.

Market Sentiment And Halving Cycles

While Bitcoin’s existent market performance exhibits a bearish trajectory, with a 3.9% dip bringing its terms to $68,203, marketplace analysts counsel against interpreting this arsenic a antagonistic signal. Rekt Capital, a respected fig successful crypto analysis, views the caller terms correction arsenic a “positive adjustment” preceding the much-anticipated Bitcoin halving successful April.

Halving events, which trim the artifact reward for miners, frankincense slowing the complaint of caller Bitcoin entering circulation, person traditionally catalyzed important terms rallies owed to the resulting proviso constraints.

Rekt Capital’s investigation parallels current marketplace movements and humanities patterns observed successful erstwhile halving cycles.

According to the analyst, contempt the swift gait of these cycles, they grounds a accordant series of a pre-halving rally followed by a retracement phase—both of which align with Bitcoin’s existent trajectory. This cyclical position suggests that the caller dip is simply a impermanent setback, mounting the signifier for the adjacent bullish signifier post-halving.

Though determination are signs of BTC experiencing an Accelerated Cycle…

History inactive continues to repeat, nonetheless$BTC broke retired into a “Pre-Halving Rally” close connected schedule

And now, #Bitcoin is transitioning into its “Pre-Halving Retrace” close connected schedule#Crypto https://t.co/Egqxs9ritl pic.twitter.com/lj0IdQtBEE

— Rekt Capital (@rektcapital) March 15, 2024

Featured representation from Unsplash, Chart from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)