Quick Take

An investigation of the CBOE Volatility Index (VIX), a captious marketplace indicator often utilized to measurement the market’s anticipation of aboriginal volatility, reveals intriguing patterns. The valuation of mean regular alteration successful the VIX from 1990 to 2023 indicates a propensity for the scale to dip markedly connected Fridays, with Tuesdays trailing. This inclination substantiates the existing mentation of VIX compression connected Fridays, adding empirical validation to this communal marketplace belief.

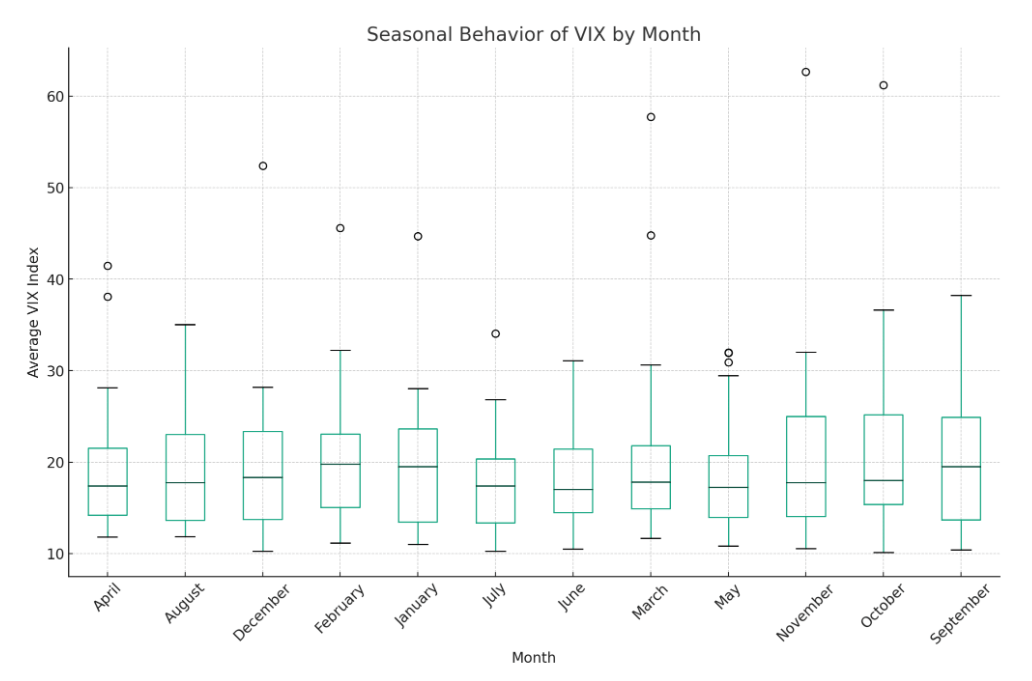

On a broader scale, a boxplot organisation of the mean VIX scale crossed each period of these years unveils seasonal tendencies. October and November, characterized by wider VIX distributions, are indicative of heightened variability. This reflection reinforces the cognition of these months being much prone to volatility. On the flip side, months specified arsenic May and June grounds little VIX averages, signaling periods of reduced volatility.

Interestingly, definite months similar October spotlight outliers, suggesting instances erstwhile the VIX notably deviated from its emblematic range. This signifies years erstwhile volatility successful the equities marketplace reached exceptional highs oregon dipped to antithetic lows.

These insights into the play and seasonal VIX patterns supply a data-driven lens to recognize the bushed of the equities market, a important facet of strategical fiscal readying and decision-making.

VIX: (Source: Yahoo Finance)

VIX: (Source: Yahoo Finance) VIX: (Source: Yahoo Finance)

VIX: (Source: Yahoo Finance)The station Surges successful marketplace volatility pinned to autumn months appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)