Bitcoin Custodians Facing Liquidity Crisis As Price Falls

This is an sentiment editorial by Josef Tětek, the Trezor marque ambassador for SatoshiLabs.

Bear markets tin beryllium scary, with bitcoin dropping to unthinkable levels, leverage positions being liquidated and custodians failing connected their promises. When FUD replaces FOMO, fortunes are easy lost. Keeping your caput chill and your bitcoin successful acold retention is imperative to past successful this unpredictable environment.

“Banks indispensable beryllium trusted to clasp our wealth and transportation it electronically, but they lend it retired successful waves of recognition bubbles with hardly a fraction successful reserve.”

The existent concern that immoderate of the bitcoin exchanges and custodians are facing reeks of solvency issues, colloquially known arsenic “bank runs.”

Bank runs are thing new. There are well-documented slope runs dating backmost implicit 200 years; the first American slope run happened conscionable a fewer decades aft the Declaration of Independence, successful 1819 (for funny readers, I urge Murray Rothbard’s “The Panic Of 1819”). Bank runs are a effect of the age-old communicative of greed and antagonistic to the conception of “getting distant with it.” Bankers person ever lent retired immoderate of their customers’ deposits to make revenue, but doing truthful increases their risks of going bust erstwhile depositors privation their wealth backmost en masse.

In a fiat economy, slope runs are prevented successful a emblematic statist fashion: the signifier of fractional reserve banking that leads to slope runs is sanctified, and inevitable losses are mitigated by printing much money. And portion this signifier has been mostly hidden from the nationalist oculus for the astir portion of the 20th century, it became rather evident aft 2008: Banks that were expected to neglect were simply bailed out with taxpayers’ wealth and via a zero-interest complaint policy, which yet led to ostentation levels not seen since the 1980s.

But still, slope runs are mostly a happening of the past successful the fiat economy, though they are inactive precise overmuch a anticipation successful the “crypto” economy.

In Bitcoin, Shysters Face The Music

In galore aspects, Bitcoin is the nonstop other of fiat. The fixed issuance of 21 cardinal coins is wide cited, but the information that determination are nary leaders and nary bailouts is nary little captious for Bitcoin’s semipermanent success. However, this doesn’t halt definite risk-prone characters from recreating fiat institutions. The “crypto lending” shops specified arsenic Celsius are fractional reserve banks successful principle; nevertheless this clip determination is nary “lender of past resort” successful the signifier of a cardinal slope to bail retired the founders and their clients erstwhile things crook sour.

Let’s marque 1 happening clear: a output ever has to travel from somewhere. To make a affirmative output connected a scarce plus specified arsenic bitcoin, the instauration offering said output has to leverage the clients’ deposits successful assorted ways. And whereas banks look beardown regulatory requirements arsenic to what they tin bash with the lawsuit deposits (such arsenic bargain treasuries, facilitate owe loans etc.), cryptocurrency lending companies look nary specified regulatory requirements, truthful they fundamentally spell and enactment their customers’ deposits into casinos of assorted kinds — DeFi output farming, staking, speculating connected obscure altcoins.

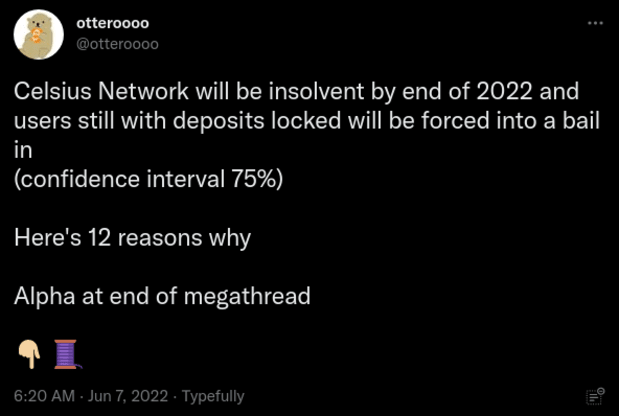

As Twitter idiosyncratic Otterooo recently mapped out, Celsius frankincense mislaid hundreds of millions dollars successful idiosyncratic deposits connected assorted badly-placed bets:

Source

Source

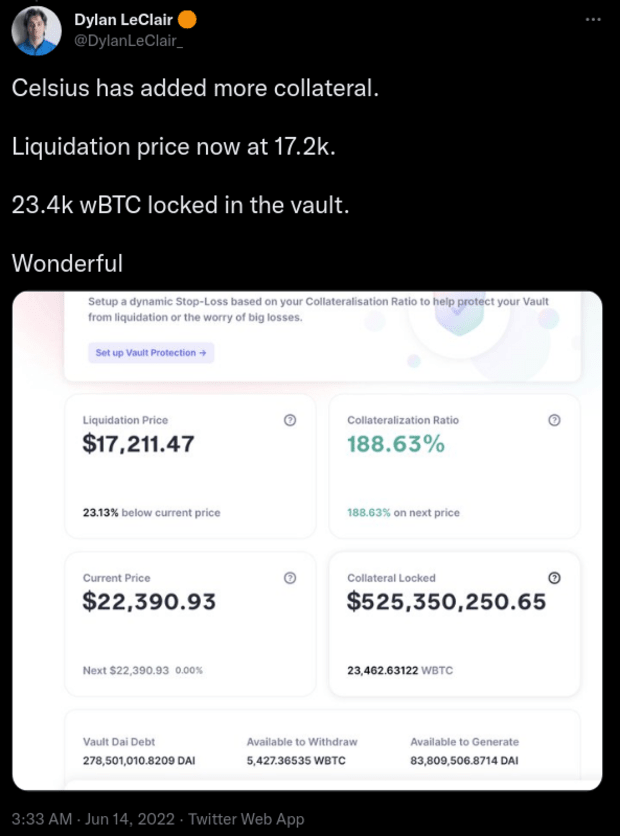

As of the clip of this writing, Celsius has stopped each idiosyncratic withdrawals and seems to beryllium having a superior solvency issue. With nary bailout incoming, each the hapless users tin bash is drawback immoderate popcorn and ticker the Celsius squad combat for its half-billion leveraged position, the liquidation of which could mean the evaporation of astir of its users’ funds:

Source

Source

Celsius Is Not The Only One

“You ne'er cognize who's swimming bare until the tide goes out.”

It’s rather frustrating to witnesser radical suffer funds successful fundamentally the aforesaid mode arsenic Mt. Gox users did successful 2013. Exchanges and custodians autumn for the aforesaid temptation that bankers did for centuries: leveraging idiosyncratic deposits to compression retired much than what they would gain from the work fees. It’s rather paradoxical that bitcoin (and astir altcoins) connection a straightforward mode to connection a impervious of self-audit via a cryptographic signature of addresses with capable balances, yet nary exchange, prevention for a fewer exceptions, performs specified proofs of reserves.

It whitethorn precise good beryllium that each the exchanges are perfectly solvent, but the contented is we person to spot them connected that. As the “Oracle of Omaha” famously quipped, we’ll ne'er cognize who’s bare until the tide goes out. So, erstwhile Binance, 1 of the world’s largest exchanges, halts bitcoin withdrawals, we ne'er cognize if it’s truly lone a impermanent method hiccup, oregon a overmuch much sinister liquidity issue.

Source

Source

How Can We Protect Our Coins?

While we tin collectively telephone for exchanges to connection proofs of reserves, the lone existent mitigation of the counterparty hazard that exchanges airs is to instrumentality possession of our coins. The lone mode to beryllium truly definite that thing shady is happening with our coins is to clasp the backstage keys ourselves. Bitcoin is unsocial successful the mode it makes administering one’s ain wealthiness easy, and ever since the archetypal hardware wallet successful the signifier of Trezor was introduced successful 2014, determination are nary excuses not to clasp your ain keys.

Buying bitcoin successful a peer-to-peer manner is preferable from the privateness standpoint, truthful if you tin find a reliable seller — usually done Bitcoin meetups — making regular purchases done the aforesaid transmission and stacking consecutive into a hardware wallet is the mode to go. ATMs besides tin let for purchasing amounts of bitcoin up to $1,000 with bully privacy. But, if for immoderate crushed you similar buying done exchanges, determination is nary crushed to permission your coins disconnected of your ain wallet.

And if you’re keeping your coins connected an speech close now, it’s a bully thought to see withdrawing into your ain wallet. Even if you gain a output connected your coins, the semipermanent risks of losing 100% of your coins simply isn’t worthy it.

Hardware Wallet Manufacturers Do Not And Cannot Gamble With Your Wealth

Surprisingly, a batch of radical misunderstand the quality of hardware wallet devices and the concern models down them. Some radical judge that hardware wallet manufacturers are really successful possession of users’ coins and tin retrieve the coins successful lawsuit the idiosyncratic loses their betterment effect oregon passphrase — this couldn’t beryllium further from the truth! It’s the wallet users that are ever successful the sole and exclusive possession of their coins. The manufacturer’s concern is to merchantability devices; not to lend retired oregon different leverage the coins of their users!

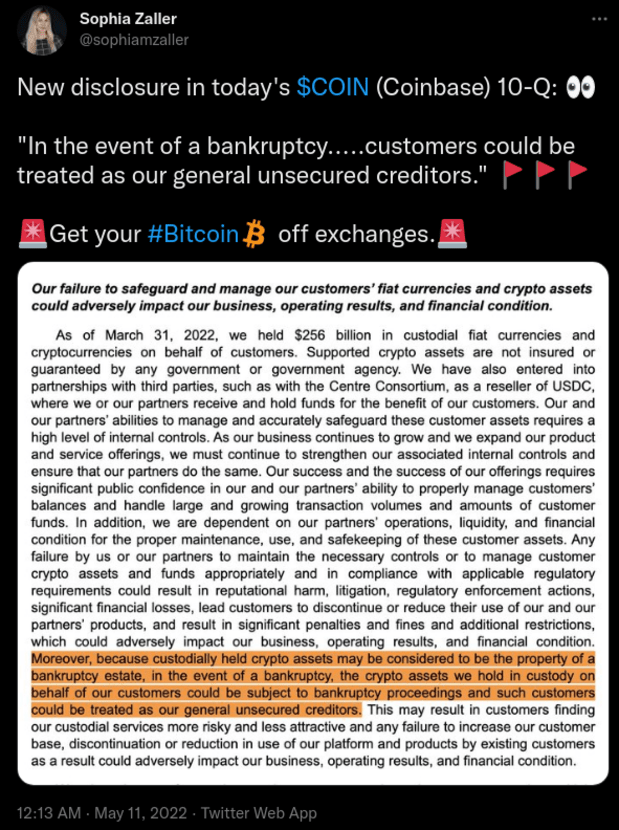

Contrary to exchanges and different custodians, determination is nary counterparty hazard with utilizing a hardware wallet. If Trezor oregon immoderate of the different manufacturers went bankrupt tomorrow, users would beryllium unaffected, due to the fact that they are the sole owners of their coins. Compare this information with the disclaimers of the large bitcoin exchanges, which can authorities that, successful the lawsuit of bankruptcy, users’ coins are fundamentally confiscated.

Source

Source

Nightmare For Some, Lifetime Opportunity For Others

The find of the fractional reserve practices being undertaken by immoderate of the foremost custodians successful the abstraction mightiness beryllium an unpleasant astonishment for galore newcomers, who were seduced by the imaginativeness of earning output connected their different “unproductive” assets. The further find of determination being nary bailouts mightiness crook into a nightmare. Yet that is the quality of Bitcoin: successful a stark opposition to the fiat system, Bitcoin rewards the prudent and punishes the frivolous. And done that mechanism, Bitcoin helps physique a much liable world.

Source

Source

This is simply a impermanent station by Josef Tětek. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)