UST and LUNA successful escaped autumn arsenic the full crypto marketplace watches the capitulation owed to a realization of the cardinal risks

Cover art/illustration via CryptoSlate

The Swiss-based crypto exchange, SwissBorg, has released a study connected the risks surrounding Terra’s stablecoin, UST. The token is presently undergoing utmost volatility, trading astatine conscionable $0.59 astatine writing. SwissBorg issued a hazard informing to users connected May 10 and paused withdrawals of UST connected the aforesaid day, hours earlier Binance followed suit. The study was completed successful April, and astir each of the risks they identified are presently playing out.

Risks of TerraUSD (UST)

Unlike different stablecoins specified arsenic USDT oregon USDC, backed by fiat collateral and different liquid assets, UST is an algorithmically baked token. CryptoSlate has obtained a study from SwissBorg’s DFi squad connected UST risks. The study explained, “at immoderate time, users connected Terra tin pain $1 of LUNA to mint 1 UST, oregon pain 1 UST to redeem $1 worthy of LUNA. Therefore, the destiny of UST and LUNA are intimately linked, and truthful are the risks involved.” Importantly. It highlighted 4 cardinal areas of risk;

- A decease spiral of UST-TerraLuna

- Anchor Protocol risks

- UST nonaccomplishment of peg

- A structured exemplary for default.

Death spiral of UST-TerraLuna

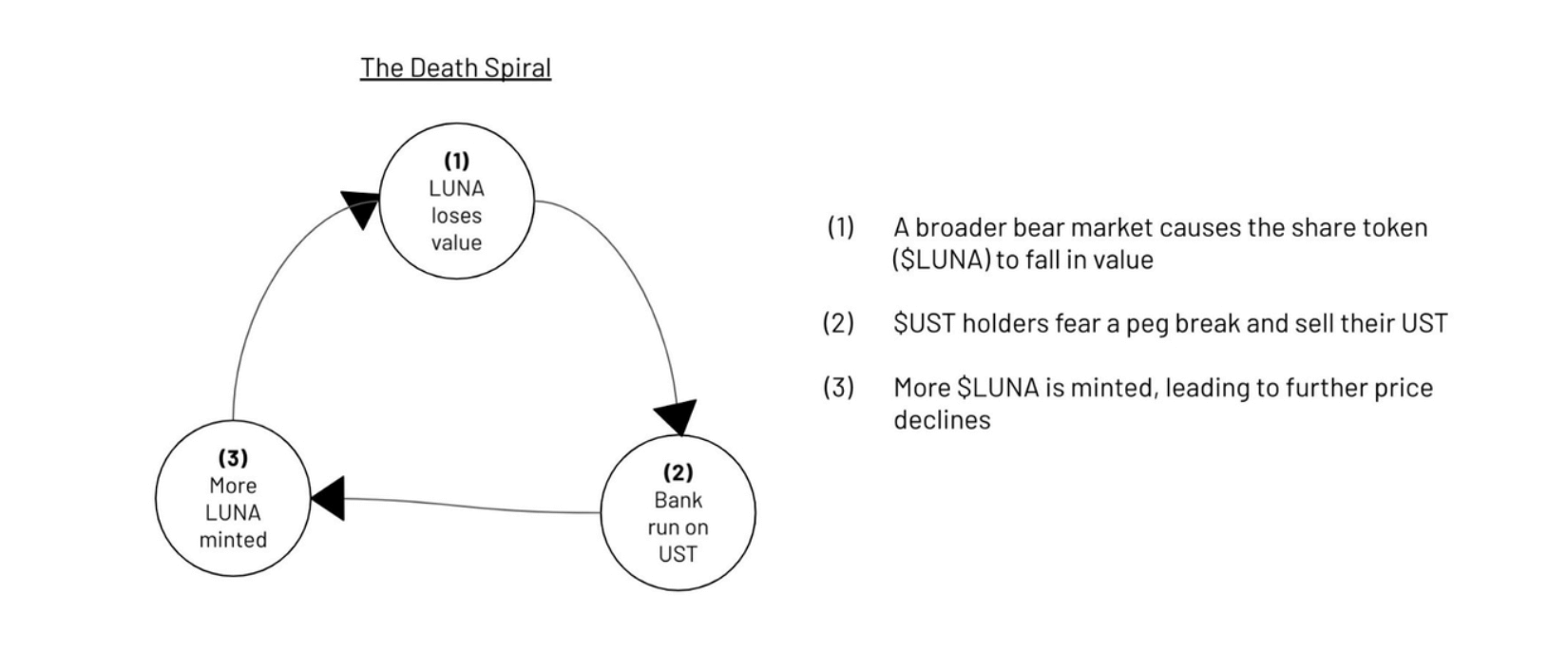

SwissBorg recounted a imaginable “death spiral” betwixt TerraLuna and UST which would origin LUNA to clang and further stress a slope tally connected UST. LUNA is presently trading down 90% since May 9, indicating that this script is present playing retired with UST besides down 30%. The study explains the decease spiral successful detail.

“If LUNA’s terms is nether pressure, UST holders could beryllium fearing that the UST peg is astatine hazard and determine to redeem their UST positions. In bid to bash so, UST is burnt and LUNA is minted and sold connected the market. This would exacerbate further the diminution of LUNA’s price, pushing much UST holders to merchantability their UST. This vicious rhythm is cognize and ‘bank run’ oregon ‘death spiral’

Source: SwissBorg UST Risk Report

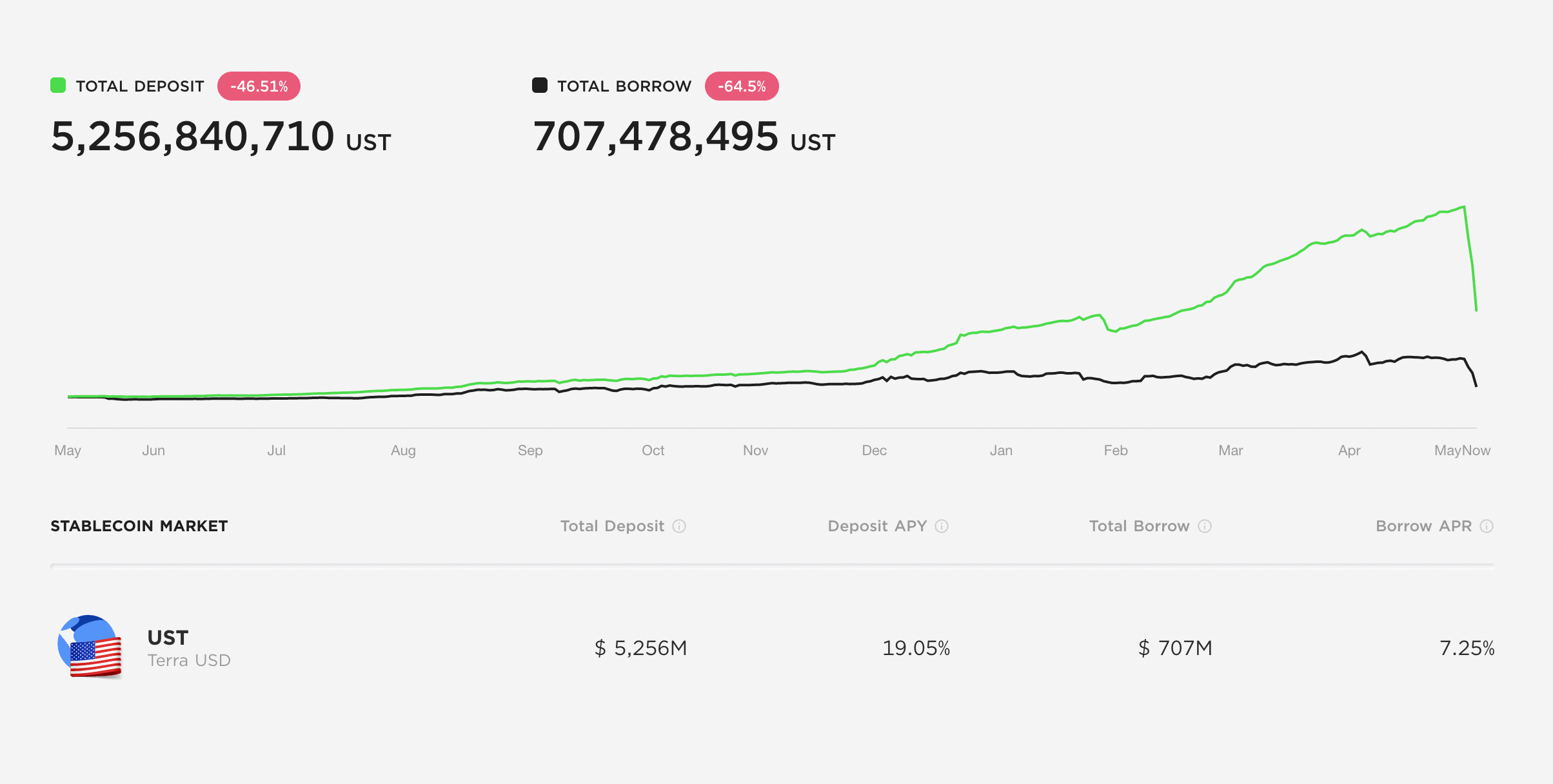

Source: SwissBorg UST Risk ReportAnchor Protocol Risk

Anchor Protocol is the Terra ecosystem level that offers precocious involvement successful UST staking. The level has offered up to 19% successful caller weeks with a highest TVL of astir $15 billion. The TVL has plummeted implicit the past fewer days, with some deposit and get values escaped falling.

Source: Anchor Protocol

Source: Anchor ProtocolSwissBorg identified the hazard present arsenic “if the terms of LUNA (and bLUNA) falls, this could trigger a liquidation of the LUNA collateral positions. UST would past beryllium burned backmost into LUNA, further exacerbating the LUNA terms decrease.”

Via reports from users connected Twitter, galore investors person been incapable to entree their Terra Station wallets owed to web congestion starring to liquidations.

An inability to entree wallets has caused users to beryllium incapable to deposit funds to alteration their LTV, forcing liquidation. This appears to beryllium partially liable for the steep diminution successful LUNA’s terms implicit the past week. SwissBorg specifically stated successful their study that “any contented with Anchor would apt origin a cascade of UST redemptions with each the consequences antecedently mentioned.”

UST nonaccomplishment of peg

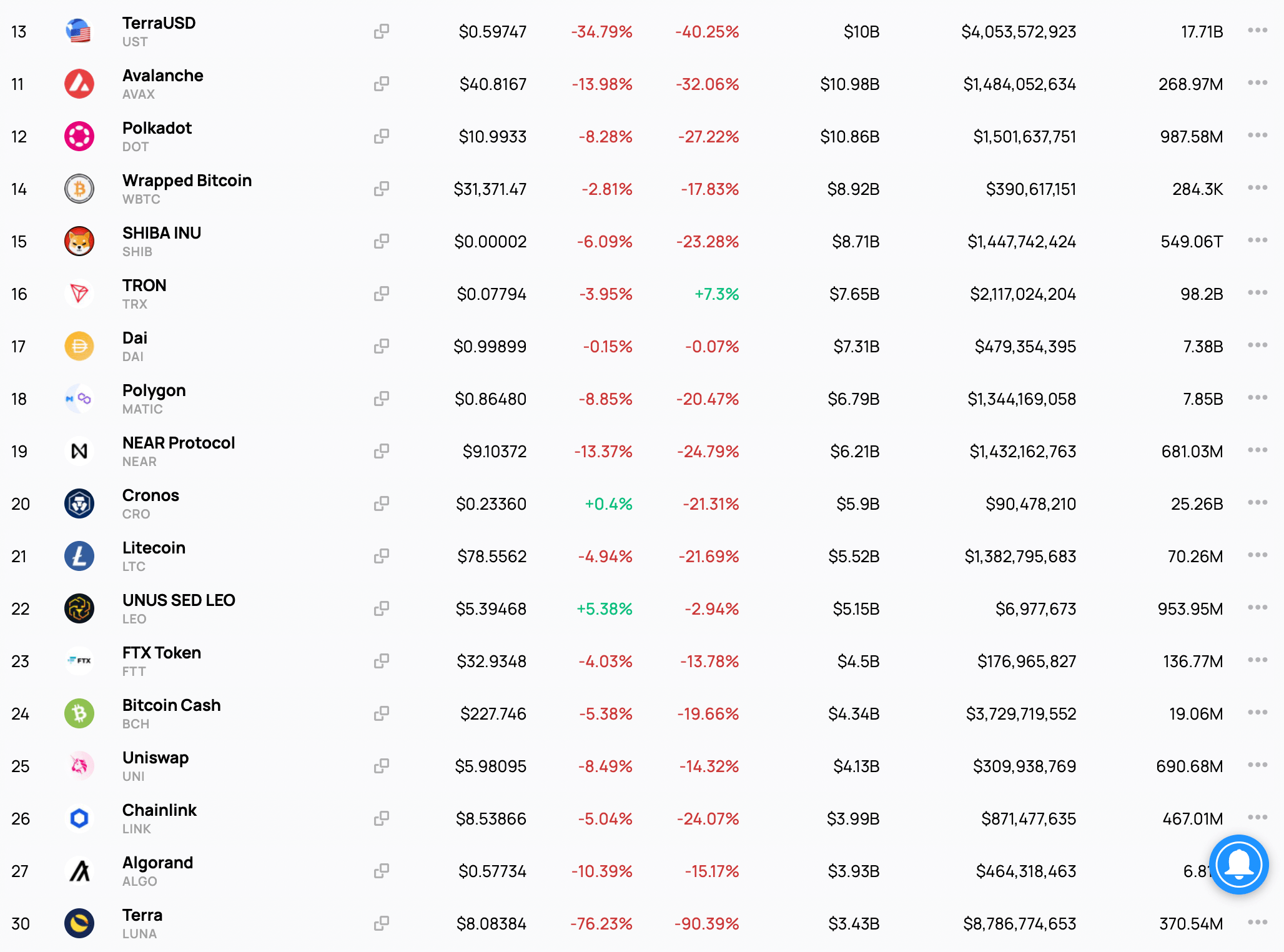

Swissborg outlined a imaginable script whereby “a decease spiral on with a cascade of liquidations successful Anchor could origin the marketplace capitalization of LUNA to autumn beneath the marketplace capitalization of the circulating UST.” As seen connected the CryptoSlate coin tracker, this has present played out, with LUNA dropping to conscionable $370M successful marketplace cap.

Source: CryptoSlate

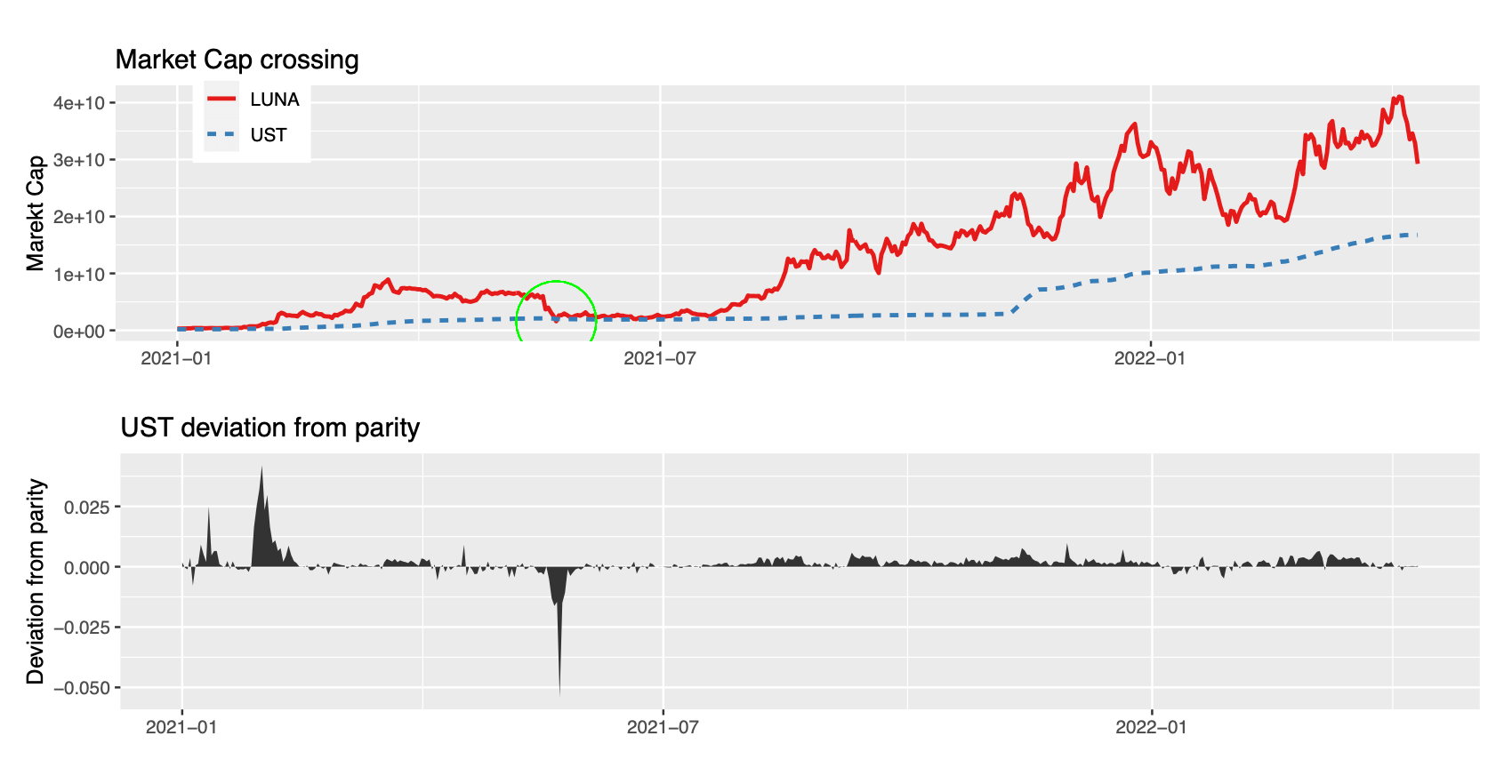

Source: CryptoSlateSwissBorg identified this concern unsocial arsenic being highly correlated with a hazard of UST de-pegging. The existent authorities of play has this arsenic conscionable 1 of the factors affecting the Terra ecosystem. The beneath graph shows an lawsuit successful May 2021 wherever the marketplace headdress crossed for a little play and its effect connected the UST peg.

Source: SwissBorg UST Risk Report

Source: SwissBorg UST Risk ReportStructured exemplary for default

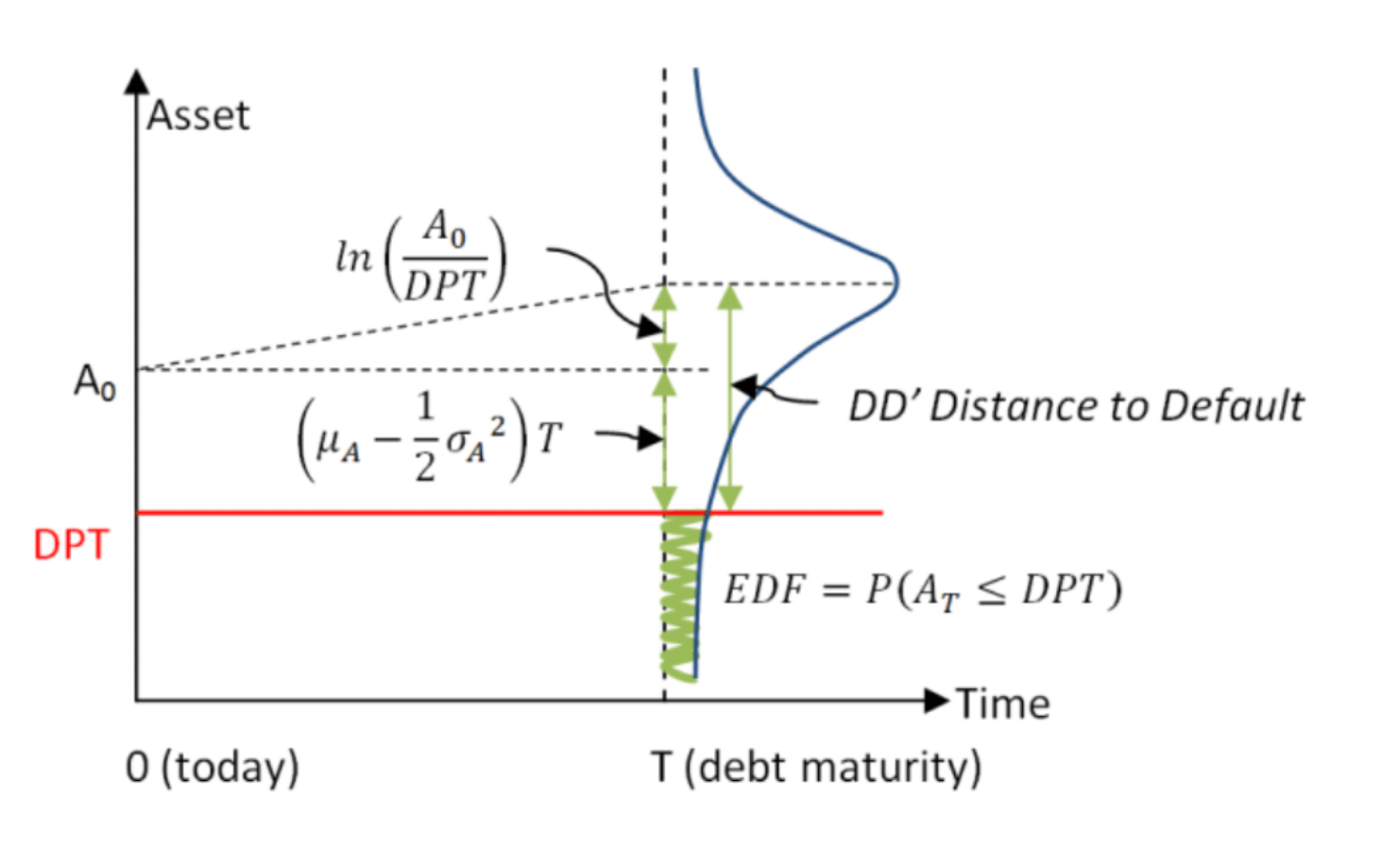

SwissBorg identified the Merton exemplary for assessing the hazard of default arsenic applying to an appraisal of the risks associated with UST.

“The Merton exemplary uses the Black-Scholes-Merton enactment pricing methods and is structural due to the fact that it provides a narration betwixt the default hazard and the plus (capital) operation of the firm.”

The study illustrated however the analyzable look utilized successful the Merton exemplary analyses the hazard of an plus falling beneath its liability threshold, arsenic shown below.

Source: SwissBorg UST hazard report

Source: SwissBorg UST hazard reportConcerning the Terra ecosystem, the study determined the probability of UST losing its peg.

• Asset worth A is represented by the marketplace capitalization of LUNA

• Liabilities worth L is represented by the marketplace capitalization of UST

• if astatine a fixed clip skyline T the marketplace headdress of Luna is smaller than that of UST, the UST peg is lost

The supra information was charted to amusement the probability of UST losing its peg daily. In May 2021, the hazard roseate to conscionable nether 100% earlier falling backmost to 20% successful November. The menace had been steadily rising to 60% arsenic of April 2022. At present, UST, trading astatine $0.59, has definitively mislaid its peg.

Risk conclusions

SwissBorg concluded that “the destiny (and risks) of UST are strictly linked to that of LUNA. Any convergence successful the marketplace capitalization of LUNA toward that of UST poses superior risks of losing the peg.” Their proposal was to show the presumption of UST with LUNA closely, ticker the TVL of Anchor Protocol for a decline, way marketplace volumes for LUNA to guarantee liquidity, and show for a alteration successful request for Terra stablecoins.

At present, each of these conditions are true. LUNA has dropped 90%, UST is down 30%, Anchor Protocol TVL is down 60%, and request for Terra stablecoins is flatlining. Further, a driblet successful the full marketplace headdress of crypto arsenic a full has created a cleanable tempest for a achromatic swan lawsuit successful regards to the Terra ecosystem. Will Terra past this storm, oregon are tens of billions of dollars worthy of tokens astir to beryllium wiped from the look of the earth?

Regardless of whether Terra tin recover, determination are plentifulness of investors who volition not beryllium capable to owed to Anchor Protocol liquidations.

And it’s not a tiny amount, $133k.. was each I had man, earnestly this crap is beauteous overmuch wiped maine retired too a fewer k successful savings. I’m fucked 10 ways to sunday

— Wicklidation (@Joe_Cool_Bitmex) May 11, 2022

3 years ago

3 years ago

English (US)

English (US)