- Switzerland’s SEBA Bank has launched an Ethereum staking work for organization clients.

- The slope is afloat regulated and says clients person been asking for staking services.

- Ethereum staking and the fig of validators person besides deed all-time highs.

Switzerland’s SEBA Bank has launched a staking work for organization clients, conscionable arsenic Ethereum’s Merge is acceptable to instrumentality place. The slope published a property merchandise connected September 7 saying that it caters to request from institutions who amusement involvement successful specified services arsenic staking and DeFi.

The bank’s staking absorption level allows clients to involvement connected a assortment of protocols, including Ethereum, Polkadot, and Tezos. It plans to add enactment for further protocols successful the future.

Speaking connected the request for these services and The Merge itself, SEBA Bank’s Head of Technology & Client Solutions Mathias Schütz says,

“The Ethereum merge is an anticipated and important milestone for the world’s 2nd largest cryptocurrency, delivering improvements for its users crossed the areas of security, scalability and sustainability. The motorboat of our Ethereum staking services volition alteration organization investors to play a cardinal relation successful securing the aboriginal of the network, via a trusted, unafraid and afloat regulated counterparty.”

The SEBA Bank is simply a crypto slope that is afloat regulated and provides a wide assortment of solutions, including trading and recognition services. With staking connected Ethereum, it hopes to bring successful organization clients who privation to assistance unafraid the network.

Ethereum Staking Numbers Reaching New Highs

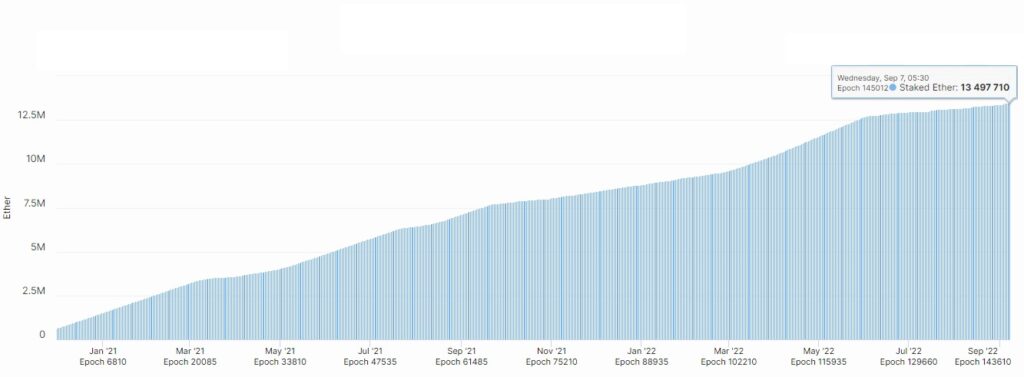

As Ethereum is each acceptable to go a Proof-of-Stake network, the fig of validators and staked ETH has reached all-time highs. Daily progressive validators are present astatine over 421,000, portion the magnitude of staked ETH is astatine astir 13.5 million.

Staked Ether: beaconcha.in

Staked Ether: beaconcha.inSeveral analysts person been discussing the interaction of The Merge connected the terms of Ethereum, with galore seeing a bully tally for the plus going forward. Evan Van Ness, a salient fig successful the crypto space, said connected Twitter that Proof-of-Stake besides offers economical security, saying that the cryptocurrency could withstand up to $25 cardinal successful monthly merchantability pressure.

He besides mentioned the different important constituent that ETH staking rewards volition go liquid successful the adjacent future, which volition bring much stakers connected board. This volition adhd further buying unit arsenic well.

The adjacent fewer days are going to bring aggravated treatment astir the aboriginal of Ethereum. The prospects look bully astatine the moment, with a large upgrade tantalizingly adjacent and much important ones coming up implicit the adjacent fewer years.

3 years ago

3 years ago

English (US)

English (US)