Attending ETHDenver this past play allowed maine to summation penetration into the frontline of DeFi, NFTs, DAOs and each the breathtaking parts of Ethereum that the manufacture loves. And it was besides astonishing to get a accidental to spot however developers were tackling problems astatine the core infrastructure level of Ethereum and its modulation to proof-of-stake.

This nonfiction primitively appeared successful Valid Points, CoinDesk’s play newsletter breaking down Ethereum 2.0 and its sweeping interaction connected crypto markets. Subscribe to Valid Points here.

Running an Ethereum validator

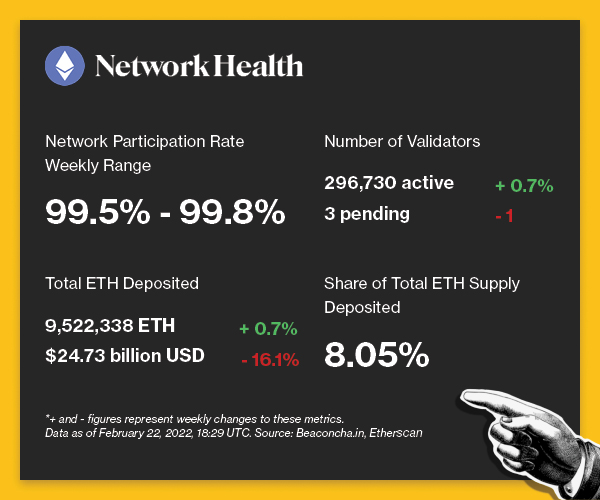

Running an Ethereum validator is not a household enactment for most. The upfront outgo of 32 ETH is present astir $85,000, and it peaked astatine implicit $150,000 astatine the apical of past year’s cycle. Furthermore, validators person to fastener their ether for an chartless magnitude of time, adding further uncertainty to a alternatively ample investment. This is not to accidental that cipher is funny successful staking ether, arsenic determination are astir 300,000 progressive validators locking 8% of the ether supply.

In bid to further the efforts successful decentralization and security, Carl Beekhuizen, a subordinate of the Ethereum Foundation’s probe and improvement team, hosted a chat astatine ETHDenver to speech astir the existent scenery of Ethereum staking.

A important chunk of validators are tally by staking services that are hosted by crypto exchanges Coinbase and Kraken and by staking work supplier Lido. While it's a unsmooth estimate, 29.7% of validators were controlled oregon outsourced by Kraken and Lido alone. That statistic whitethorn not beryllium overly concerning astatine the moment, but it would beryllium mostly affirmative for idiosyncratic stakers to turn successful size and instrumentality a larger marketplace share. The displacement to idiosyncratic staking would payment Ethereum by strengthening the web against regulatory pressures, improving client diversity and ensuring nary ample actors tin collude to onslaught the network.

It’s pugnacious to blasted those utilizing a staking work oregon adjacent staking services themselves. Users get astir of the incentives of staking (ETH rewards and securing the network) without the upfront disbursal of 32 ether. Meanwhile, staking services supply the method cognition needed for progressive validator management, and sometimes they adjacent supply liquid staking done tokenized deposits. So however does the web promote staking connected the idiosyncratic front?

What’s new? “Staking with friends”

Continued innovation astir the Ethereum ecosystem has improved the staking experience, minimizing the drawbacks of self-staking without sacrificing decentralization. This is simply a antithetic attack than the built-in disincentives that effort to marque outsized, large-scale staking not worthy the underlying risk.

Beekhuizen took the stage this past play to dive into distributed validators and the imaginable for solutions similar Secret Shared Validator Network and Obol. Distributed pools tin interruption a validation cardinal crossed respective participants, and truthful each subordinate successful a radical of four, for example, could clasp a portion of the cardinal that is useless without the remainder of the group. Using this model, the radical tin make parameters for however galore of the 4 stakeholders it would instrumentality to hold connected attestations and artifact proposals, each portion moving the validator locally connected antithetic client software.

Running a distributed validator with aggregate clients hedges against downtime and lawsuit bug risk, making the acquisition not lone much accessible but besides safer. The operation of harsher punishment for ample staking providers and expanding accessibility for idiosyncratic stakers could reverse existent validation trends, but the idiosyncratic acquisition indispensable proceed to amended until Ethereum staking makes consciousness for everyone successful the ecosystem.

The pursuing is an overview of web enactment connected the Ethereum Beacon Chain implicit the past week. For much accusation astir the metrics featured successful this section, cheque retired our 101 explainer connected Eth 2.0 metrics.

Beaconcha.in, Etherscan

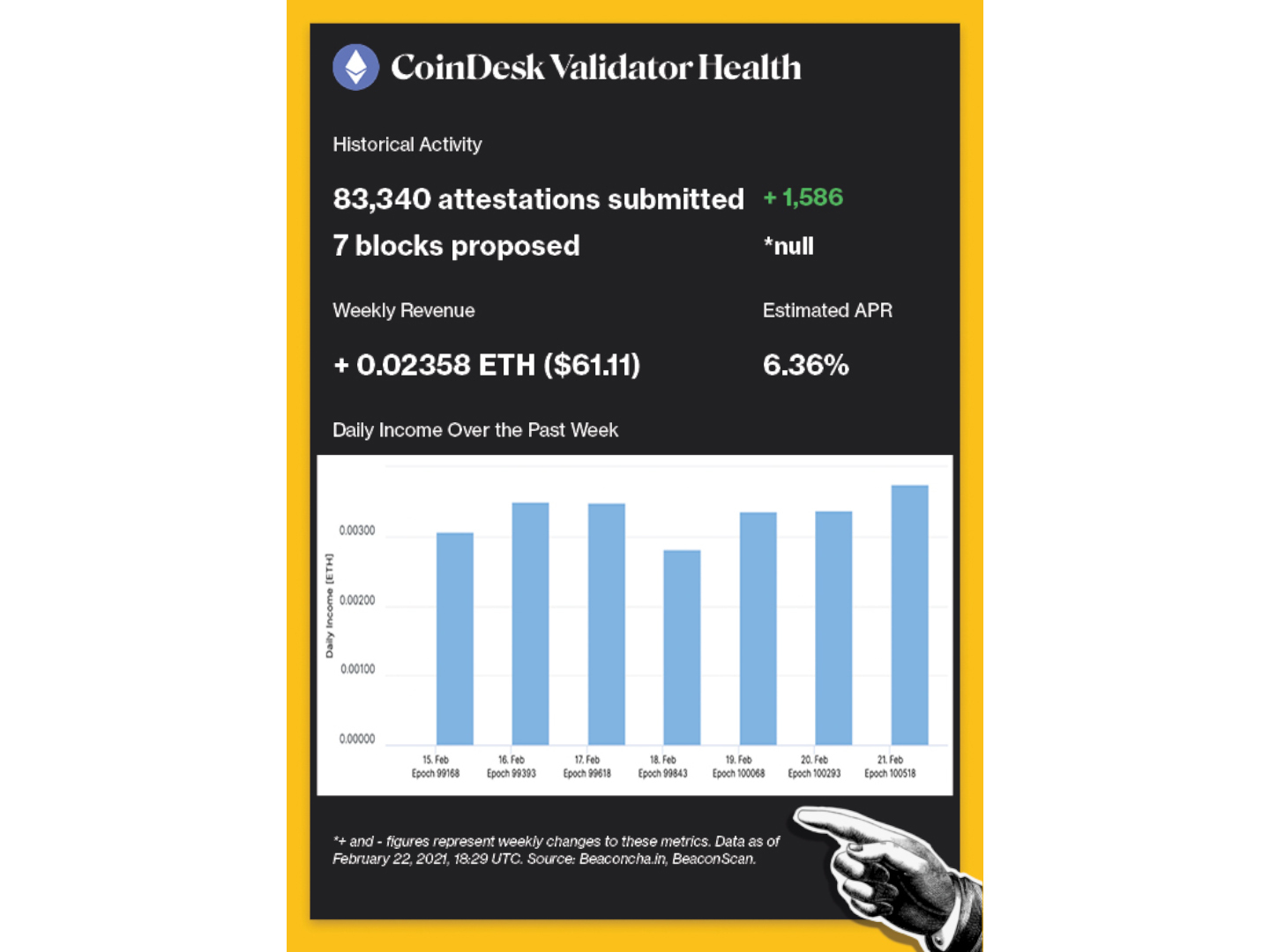

Beaconcha.in, Beaconscan

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking task volition beryllium donated to a foundation of the company’s choosing erstwhile transfers are enabled connected the network.

Seventeen OpenSea users were affected by a mass phishing email that drained wallets of the ERC-721 tokens representing their NFTs. BACKGROUND: Several owners of non-fungible tokens received a fake OpenSea email encouraging them to migrate their tokens to the V2 contract, which, erstwhile approved, gave the attacker an accidental to bargain the NFTs for free. The contented had nary nexus to OpenSea’s existent contracts and frankincense appears to beryllium much of a custody hack than an exploit.

Frax Finance is launching a decentralized CPI-tracking stablecoin to make an ostentation resistant asset. BACKGROUND: Frax is known for its archetypal dollar-pegged stablecoin, which present has implicit $2.6 cardinal successful circulation. The “Frax Price Index” volition way a handbasket of assets, which tin aboriginal beryllium voted connected by governance token holders for inclusion and weighting.

A erstwhile Bored Ape Yacht Club proprietor is suing OpenSea for the accidental merchantability of his NFT. BACKGROUND: A bug allowed attackers to acquisition NFTs utilizing outdated listings that were not unrecorded connected the marketplace, forcing users to merchantability NFTs for little than marketplace value. While the suit contains a fewer errors, lawyers acquainted with the exertion judge a negligence suit whitethorn beryllium possible.

Factoid of the Week

Valid Points incorporates accusation and information astir CoinDesk’s ain Eth 2.0 validator successful play analysis. All profits made from this staking task volition beryllium donated to a foundation of our choosing erstwhile transfers are enabled connected the network. For a afloat overview of the project, cheque retired our announcement post.

You tin verify the enactment of the CoinDesk Eth 2.0 validator successful existent clip done our nationalist validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it connected immoderate Eth 2.0 artifact explorer site.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Shows, amusement newsletter promo.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)