Purchasing crypto with fiat oregon immoderate “unrealized appreciation” are not taxable events according to Thomas Shea, an EY crypto taxation executive.

While galore notation to crypto arsenic the “Wild West,” immoderate judge that this whitethorn lone proceed for a small longer.

Thomas Shea, crypto taxation person astatine EY Financial Services, told Cointelegraph that taxation for crypto is an evolving country and caller regulations whitethorn beryllium implemented soon. “There is caller authorities that volition necessitate reporting for astatine slightest immoderate crypto transactions and erstwhile those rules spell into effect determination volition beryllium important changes,” says Shea.

The EY enforcement notes that with the accrued popularity of crypto, lawmakers are continuously exploring however to make gross by taxing and regulating integer assets.

“We’re seeing definite jurisdictions make regimes, rates, and reporting unsocial to integer assets. In the U.S., we’re seeing integer assets being taxable to rules and reporting typically constricted to securities (and not property).”While not galore whitethorn admit the taxation of their crypto assets, knowing the changing taxation impacts associated with crypto is important according to Shea. The taxation adept notes that marketplace participants request to beryllium alert of the "scope of their transactions that perchance trigger a taxable lawsuit and the associated reporting requirements.”

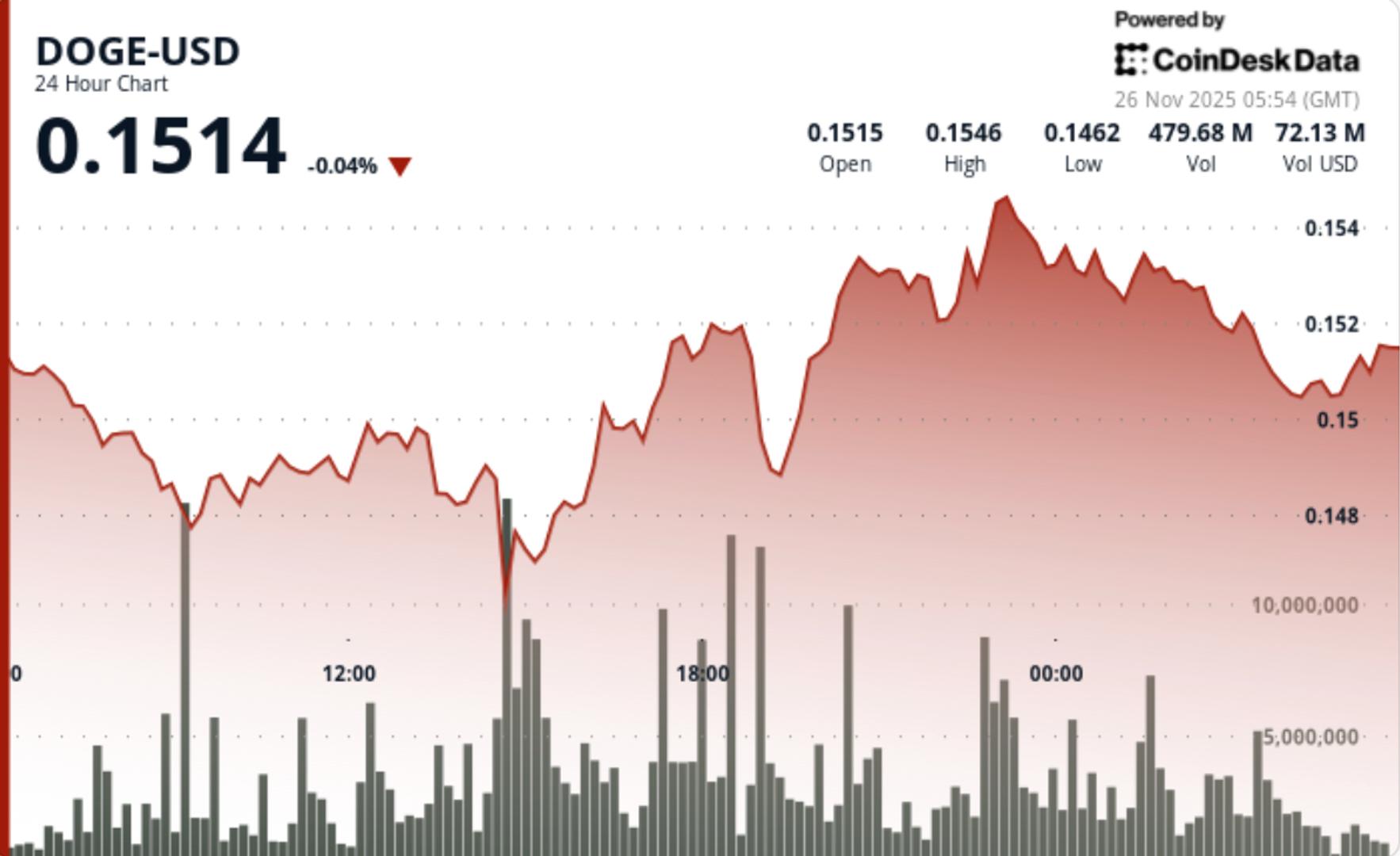

According to Shea, buying oregon selling crypto influences whether it's taxable oregon not. Purchasing crypto with fiat and immoderate unrealized appreciation are not taxable events. However, the taxation enforcement notes that selling your crypto is simply a taxable event. He explains that “the summation oregon nonaccomplishment is mostly superior successful nature” and this could beryllium taxed.

Even if a holder exchanges their crypto for different assets similar Bitcoin (BTC) oregon Ethereum (ETH), the EY enforcement notes that this gives users a “taxable lawsuit and are required to study summation oregon nonaccomplishment connected the disposed crypto.”

The aforesaid applies to nonfungible tokens (NFTs). “If you purchased an NFT with fiat, nary taxable event,” says Shea. However, purchasing NFTs with crypto is treated precise likewise to a crypto-for-crypto exchange. “The gross proceeds little your taxation ground successful the asset, mostly including immoderate associated fees/costs,” says the crypto taxation expert.

The EY enforcement besides urges radical to question the counsel of due advisors erstwhile they are alert of their taxation obligations.

“In an manufacture successful which exertion serves arsenic the architectural framework, having an advisor that has an accompanying exertion solution and understands your goals, volition alteration you to marque the champion decisions imaginable to minimize your taxation burden.”Related: How are cryptocurrency taxes reported?

Meanwhile, successful Thailand, crypto traders are reportedly exempt from the 7% VAT connected authorized exchanges. Traders wrong the state volition besides beryllium capable to offset losses against gains annually.

Back successful February, the Indian authorities projected a 30% income taxation connected crypto revenue. However, many opposed the proposal arsenic a 30% crypto taxation is astir treble compared to firm taxation rates hovering astatine 16%.

3 years ago

3 years ago

English (US)

English (US)